IL DoR IL-505-I 2022 free printable template

Show details

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of RevenueIL505IAutomatic Extension Payment

for Individuals Filing Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR IL-505-I

Edit your IL DoR IL-505-I form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR IL-505-I form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR IL-505-I online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL DoR IL-505-I. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-505-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR IL-505-I

How to fill out IL DoR IL-505-I

01

Start by downloading the IL DoR IL-505-I form from the Illinois Department of Revenue website.

02

Carefully read the instructions provided with the form to understand the requirements.

03

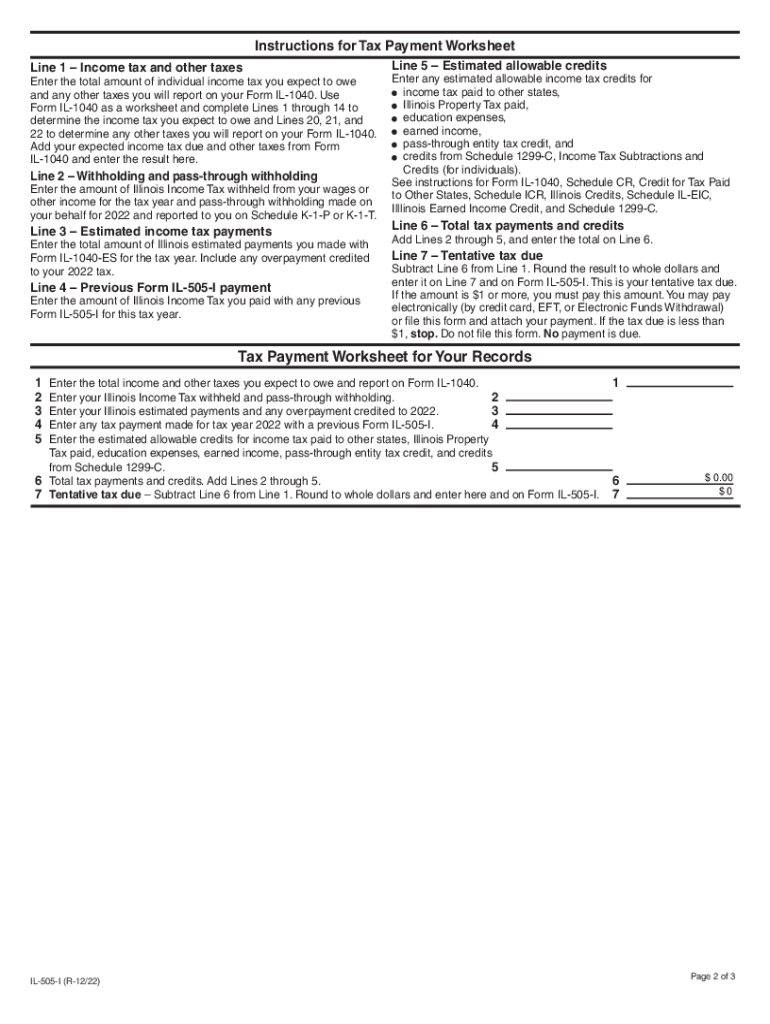

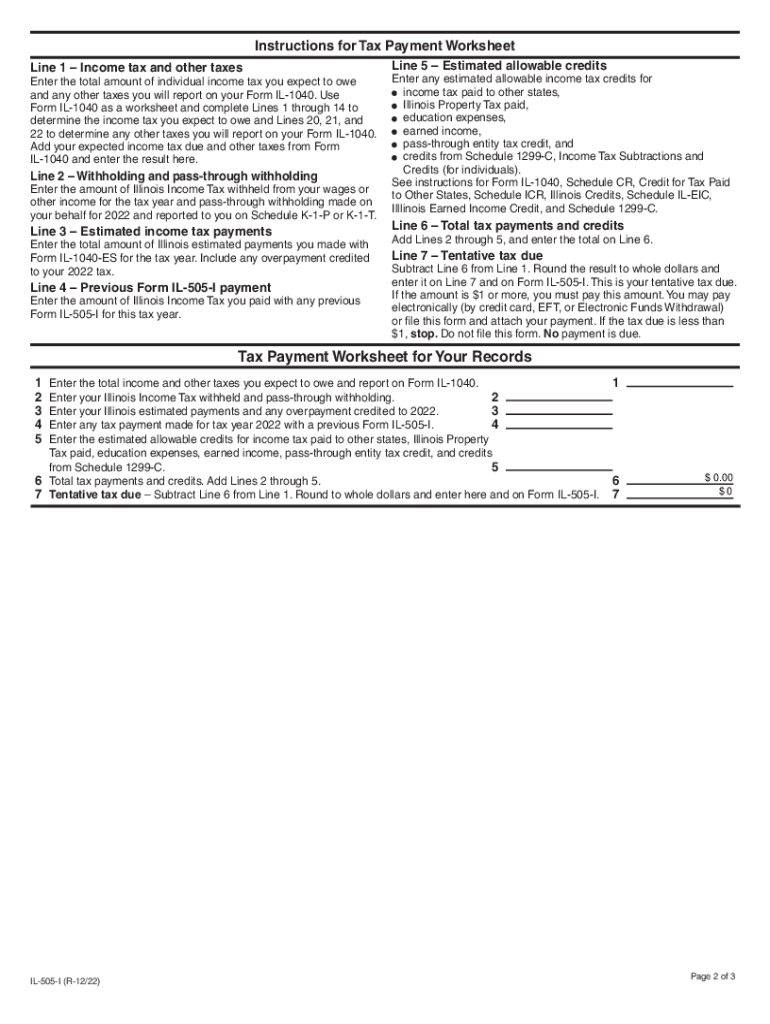

Fill out the taxpayer identification information at the top of the form, including your name, address, and Social Security Number or Employer Identification Number.

04

Indicate the type of return you are filing by checking the appropriate box.

05

Complete all required sections, including income, deductions, and credits as applicable.

06

Review the calculations for accuracy, ensuring all figures are correct.

07

Sign and date the form, indicating that the information provided is true and complete.

08

Submit the completed form by the specified deadline, either electronically or by mail.

Who needs IL DoR IL-505-I?

01

Individuals or businesses who need to file their Illinois tax returns should complete the IL DoR IL-505-I form.

02

Taxpayers who are non-residents or part-year residents of Illinois and have income that is subject to state tax.

03

Anyone who has received a notice from the Illinois Department of Revenue requiring them to file.

Fill

form

: Try Risk Free

People Also Ask about

Which states accept a federal extension?

16498: States That Accept Federal Extension StateReturn TypeMississippi1040, 1120, 1120S, 1065, 1041Missouri1040, 1120, 1120S, 1065, 1041Nebraska1040, 1120, 1120S, 1065, 1041New Jersey1040, 1065, 104124 more rows

How do I get automatic extension?

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

Do you automatically get a tax extension?

You can obtain a tax extension for any reason; the IRS grants them automatically as long as you complete the proper form on time. Check your state tax laws; some states accept IRS extensions while others require you to file a separate state extension form.

Is there an automatic tax extension?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022.

How long is the IRS automatic extension?

If you are not able to file your return by the due date, you generally can get an automatic 6-month extension of time to file (but not of time to pay). To get this automatic extension, you must file a paper Form 4868 or use IRS efile (electronic filing).

Can I file an Illinois extension online?

You can find Illinois mailing addresses here. If you filed a tax extension, you can e-File your Taxes until October 16, 2023 without a late filing penalty. However, if you owe Taxes and don't pay on time, you might face late tax payment penalties.

Do you get an automatic extension on taxes?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022. An extension to file your tax return is not an extension to pay.

Does everyone have to file an extension?

Free File: Everyone Can File an Extension for Free If you have a balance due, the deadline to pay is still April 18, 2022.

How do I file a tax extension in 2022 Illinois?

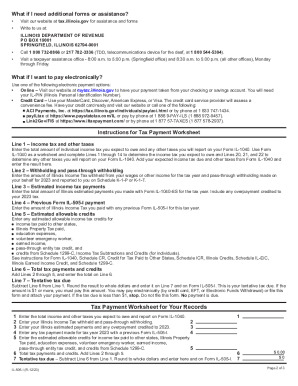

You should file Form IL-505-I, Automatic Extension Payment for Individuals, to pay any tax you owe in order to avoid penalty and interest on tax not paid by the original due date of your return, even if you plan to file your return after the original due date and during the automatic extension period.

How do I file an extension for 2022 electronically?

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

What is Illinois extension?

Illinois Extension is the flagship outreach effort of the University of Illinois at Urbana-Champaign (@illinois1867). linktr.ee/ilextension. Floral Care. Communication.

Do I need to file for an extension for 2022 taxes?

If you find yourself unable to complete your 2022 federal tax return by the tax deadline, you'll first need to file an extension with the IRS to avoid potential late-filing penalties. Filing an extension will allow you to push your deadline to October 16, 2023.

Does Illinois grant automatic extension?

We grant an automatic six-month extension of time to file your return. If you receive a federal extension of more than six months, you are automatically allowed that extension for Illinois.

Is there an automatic tax extension for 2022?

File and Pay Extension Taxpayers will have until April 18, 2022 to file and pay income taxes. California grants you an automatic extension to file your state tax return. No form is required. You must file by October 17, 2022.

What is the deadline for tax extension 2022?

October 16, 2023 - Deadline to file your extended 2022 tax return. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

Which states automatically extend with federal extension?

16498: States That Accept Federal Extension StateReturn TypeAlaska1120, 1120S, 1065Arizona1040, 1120, 1120S, 1065, 1041, 990Arkansas1040, 1120, 1120S, 1065, 1041Delaware1120, 1120S, 106524 more rows

Do extensions have to be filed in Illinois?

Automatic Illinois six-month extension You are not required to file Form IL-505-I to obtain this automatic extension. However, you must pay any tentative tax due by the original due date of your return in order to avoid any late-payment penalty and interest on unpaid tax.

Is Illinois an automatic extension State?

We grant an automatic six-month extension of time to file your return. If you receive a federal extension of more than six months, you are automatically allowed that extension for Illinois.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my IL DoR IL-505-I directly from Gmail?

IL DoR IL-505-I and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

Where do I find IL DoR IL-505-I?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the IL DoR IL-505-I in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the IL DoR IL-505-I in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your IL DoR IL-505-I and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

What is IL DoR IL-505-I?

IL DoR IL-505-I is a form used by taxpayers in Illinois to report information regarding their income tax and any applicable adjustments.

Who is required to file IL DoR IL-505-I?

Taxpayers who have income that requires adjustments, such as partnerships, S corporations, or other entity types that pass through income, are required to file IL DoR IL-505-I.

How to fill out IL DoR IL-505-I?

To fill out IL DoR IL-505-I, gather necessary income information, complete each section by entering the required data, and ensure all relevant adjustments are included before submitting.

What is the purpose of IL DoR IL-505-I?

The purpose of IL DoR IL-505-I is to provide a detailed account of income earned and any applicable adjustments needed for accurately calculating Illinois state taxes.

What information must be reported on IL DoR IL-505-I?

IL DoR IL-505-I must report total income, adjustments to income, deductions, and any other necessary financial information relevant to the taxpayer's situation.

Fill out your IL DoR IL-505-I online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR IL-505-I is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.