IL DoR IL-505-I 2023-2025 free printable template

Show details

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.Illinois Department of RevenueIL505IAutomatic Extension Payment

for Individuals Filing Form

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign il 505 i form

Edit your illinois dor payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il 505 i payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit il 505 i online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit illinois automatic extension form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR IL-505-I Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out illinois automatic form

How to fill out IL DoR IL-505-I

01

Obtain the IL DoR IL-505-I form from the Illinois Department of Revenue website or local office.

02

Start by entering your name and Social Security number in the appropriate sections.

03

Provide your address, ensuring accuracy for mail correspondence.

04

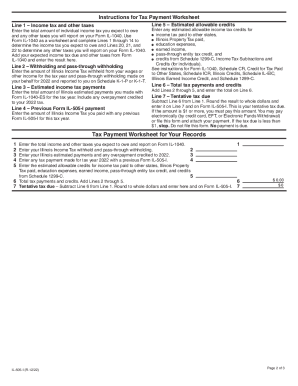

Fill out the income sections, reporting all income and any adjustments.

05

Complete the deductions section, including any applicable credits.

06

Review the tax calculation section and ensure all numbers are accurate.

07

Sign and date the form, certifying that all information provided is true and correct.

08

Submit the completed form by the specified deadline, either electronically or by mail.

Who needs IL DoR IL-505-I?

01

Individuals filing income tax returns in Illinois who need to report their income, exemptions, and deductions.

02

Taxpayers who are required to adjust their taxable income based on the specific guidelines set by the Illinois Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

Which states accept a federal extension?

16498: States That Accept Federal Extension StateReturn TypeMississippi1040, 1120, 1120S, 1065, 1041Missouri1040, 1120, 1120S, 1065, 1041Nebraska1040, 1120, 1120S, 1065, 1041New Jersey1040, 1065, 104124 more rows

How do I get automatic extension?

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

Do you automatically get a tax extension?

You can obtain a tax extension for any reason; the IRS grants them automatically as long as you complete the proper form on time. Check your state tax laws; some states accept IRS extensions while others require you to file a separate state extension form.

Is there an automatic tax extension?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022.

How long is the IRS automatic extension?

If you are not able to file your return by the due date, you generally can get an automatic 6-month extension of time to file (but not of time to pay). To get this automatic extension, you must file a paper Form 4868 or use IRS efile (electronic filing).

Can I file an Illinois extension online?

You can find Illinois mailing addresses here. If you filed a tax extension, you can e-File your Taxes until October 16, 2023 without a late filing penalty. However, if you owe Taxes and don't pay on time, you might face late tax payment penalties.

Do you get an automatic extension on taxes?

We give you an automatic 6-month extension to file your return. You must file by the deadline to avoid a late filing penalty. The deadline is October 17, 2022. An extension to file your tax return is not an extension to pay.

Does everyone have to file an extension?

Free File: Everyone Can File an Extension for Free If you have a balance due, the deadline to pay is still April 18, 2022.

How do I file a tax extension in 2022 Illinois?

You should file Form IL-505-I, Automatic Extension Payment for Individuals, to pay any tax you owe in order to avoid penalty and interest on tax not paid by the original due date of your return, even if you plan to file your return after the original due date and during the automatic extension period.

How do I file an extension for 2022 electronically?

You can get an automatic extension of time to file your tax return by filing Form 4868 electronically. You'll receive an electronic acknowledgment once you complete the transaction. Keep it with your records. Don't mail in Form 4868 if you file electronically, unless you're making a payment with a check or money order.

What is Illinois extension?

Illinois Extension is the flagship outreach effort of the University of Illinois at Urbana-Champaign (@illinois1867). linktr.ee/ilextension. Floral Care. Communication.

Do I need to file for an extension for 2022 taxes?

If you find yourself unable to complete your 2022 federal tax return by the tax deadline, you'll first need to file an extension with the IRS to avoid potential late-filing penalties. Filing an extension will allow you to push your deadline to October 16, 2023.

Does Illinois grant automatic extension?

We grant an automatic six-month extension of time to file your return. If you receive a federal extension of more than six months, you are automatically allowed that extension for Illinois.

Is there an automatic tax extension for 2022?

File and Pay Extension Taxpayers will have until April 18, 2022 to file and pay income taxes. California grants you an automatic extension to file your state tax return. No form is required. You must file by October 17, 2022.

What is the deadline for tax extension 2022?

October 16, 2023 - Deadline to file your extended 2022 tax return. If you chose to file an extension request on your tax return, this is the due date for filing your tax return.

Which states automatically extend with federal extension?

16498: States That Accept Federal Extension StateReturn TypeAlaska1120, 1120S, 1065Arizona1040, 1120, 1120S, 1065, 1041, 990Arkansas1040, 1120, 1120S, 1065, 1041Delaware1120, 1120S, 106524 more rows

Do extensions have to be filed in Illinois?

Automatic Illinois six-month extension You are not required to file Form IL-505-I to obtain this automatic extension. However, you must pay any tentative tax due by the original due date of your return in order to avoid any late-payment penalty and interest on unpaid tax.

Is Illinois an automatic extension State?

We grant an automatic six-month extension of time to file your return. If you receive a federal extension of more than six months, you are automatically allowed that extension for Illinois.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete illinois extension payment 2023-2025 online?

pdfFiller has made filling out and eSigning illinois extension payment 2023-2025 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in illinois extension payment 2023-2025 without leaving Chrome?

illinois extension payment 2023-2025 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit illinois extension payment 2023-2025 straight from my smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing illinois extension payment 2023-2025, you need to install and log in to the app.

What is IL DoR IL-505-I?

IL DoR IL-505-I is a form used by the Illinois Department of Revenue for reporting income and calculating tax liability for individuals, particularly for those who are not required to file a full income tax return.

Who is required to file IL DoR IL-505-I?

Individuals who have income that is not subject to full income tax reporting may be required to file IL DoR IL-505-I, especially if they meet certain income thresholds or conditions set by the Illinois Department of Revenue.

How to fill out IL DoR IL-505-I?

To fill out IL DoR IL-505-I, individuals should provide personal information, report all income sources, calculate total income, and apply any applicable deductions or credits as outlined in the form instructions.

What is the purpose of IL DoR IL-505-I?

The purpose of IL DoR IL-505-I is to allow taxpayers to report income and determine their state tax liability in a simplified manner, facilitating compliance with Illinois tax laws.

What information must be reported on IL DoR IL-505-I?

The information that must be reported on IL DoR IL-505-I includes personal identification details, types and amounts of income received, adjustments to income, and any credits or deductions that the filer is eligible for.

Fill out your illinois extension payment 2023-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois Extension Payment 2023-2025 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.