Get the free Credit Card IQ

Show details

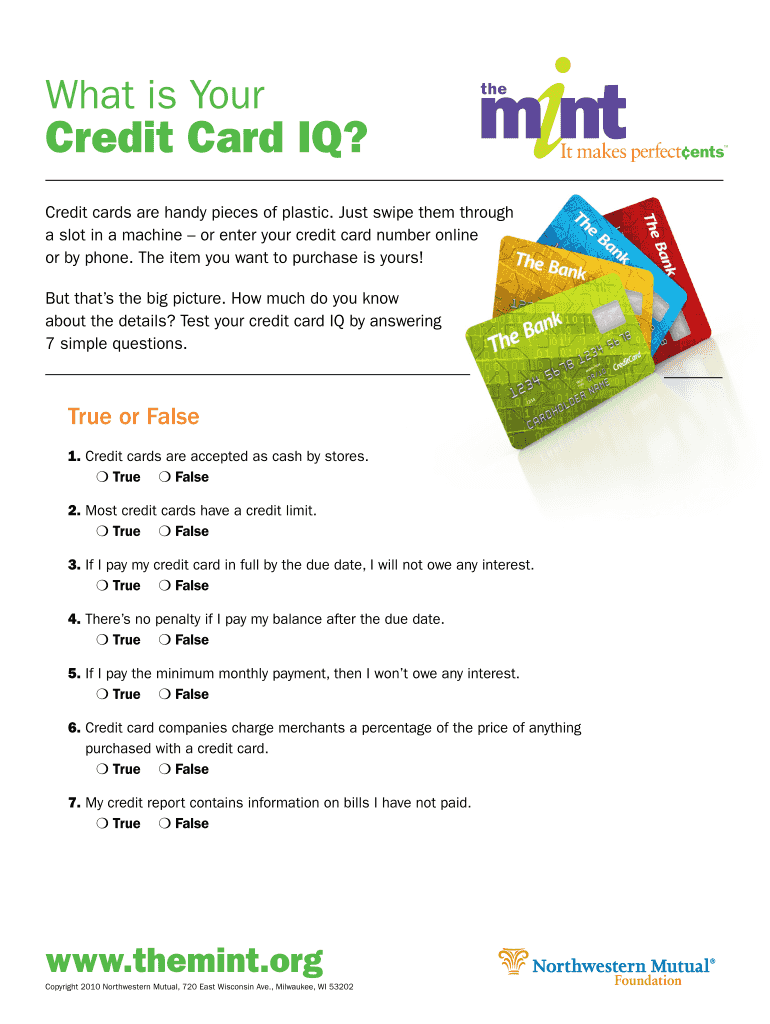

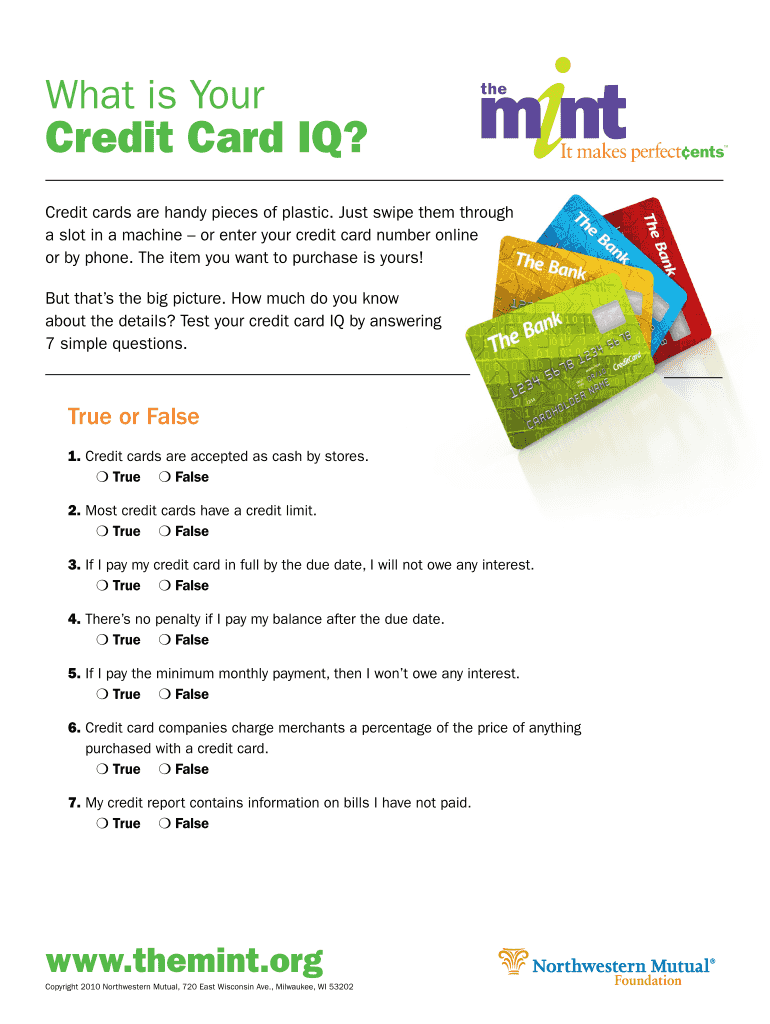

What is Noncredit Card IQ? Credit cards are handy pieces of plastic. Just swipe them through a slot in a machine or enter your credit card number online or by phone. The item you want to purchase

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card iq

Edit your credit card iq form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card iq form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit card iq online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit card iq. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card iq

How to fill out credit card IQ:

01

Gather required information: Before starting the application process for a credit card IQ, make sure you have all the necessary information at hand. This includes your personal details, contact information, social security number, and financial information such as income and employment details.

02

Research options: Explore different credit card IQ options available from various financial institutions. Look for features that align with your needs, such as low interest rates, rewards programs, or specific benefits that match your spending habits.

03

Compare terms and conditions: Once you have narrowed down your options, carefully review the terms and conditions of each credit card IQ. Pay attention to fees, interest rates, annual charges, and any additional fine print. Understanding these details will help you make an informed decision and avoid any surprises later.

04

Start the application process: After selecting the credit card IQ that suits you best, visit the provider's website or call their customer service to initiate the application process. Follow the instructions provided and provide the necessary information accurately and honestly.

05

Complete the application: Fill out all the required fields in the credit card IQ application form. Ensure that you double-check the information for accuracy and completeness before submitting it. In some cases, you may need to provide supporting documents, such as proof of income or identification, so be prepared to upload or send those as well.

06

Review and submit: Take a few moments to review your application before hitting the final submit button. Check for any errors, missing information, or discrepancies. Once you are satisfied, submit your credit card IQ application.

Who needs credit card IQ:

01

Individuals seeking better financial management: Credit card IQ can be beneficial for individuals who want to take control of their finances. It offers insights, tools, and resources to track spending, manage budgets, and improve overall financial health.

02

Consumers looking for rewards and benefits: Credit card IQ often comes with rewards programs, such as cashback, travel miles, or points that can be redeemed for various goods and services. If you regularly use a credit card and can take advantage of these rewards, credit card IQ may be suitable for you.

03

Those in need of credit-building solutions: If you have a limited credit history or need to improve your credit score, credit card IQ can provide educational resources and guidance on how to build credit responsibly. It can be a useful tool for establishing or rebuilding credit.

Overall, credit card IQ caters to a diverse range of individuals who want to optimize their financial management, enjoy rewards, and improve their creditworthiness.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit card iq to be eSigned by others?

Once your credit card iq is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get credit card iq?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the credit card iq in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I edit credit card iq on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as credit card iq. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is credit card iq?

Credit card iq is a report that provides insights into a person's credit card usage and behaviors.

Who is required to file credit card iq?

Anyone who has a credit card account is required to file credit card iq.

How to fill out credit card iq?

You can fill out credit card iq by providing accurate information about your credit card usage and behaviors.

What is the purpose of credit card iq?

The purpose of credit card iq is to track and analyze individuals' credit card habits and trends.

What information must be reported on credit card iq?

Information such as credit card spending, payment history, and credit limits must be reported on credit card iq.

Fill out your credit card iq online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Iq is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.