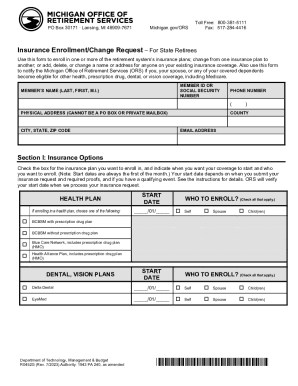

MI R0452G 2013 free printable template

Show details

CITY, STATE, ZIP CODE. VBR. /. /. MA. /. /. DDR. /. /. Use this form to enroll in one or more of the retirement system insurance plans, change from one health plan to another ... QUALIFYING EVENT:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI R0452G

Edit your MI R0452G form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI R0452G form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI R0452G online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI R0452G. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI R0452G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI R0452G

How to fill out MI R0452G

01

Begin by gathering all required personal information.

02

Fill in your full name in the designated field.

03

Provide your address, including city, state, and ZIP code.

04

Enter your Social Security number or other identification number as requested.

05

Complete the section on employment status, including employer name and address.

06

Review any special instructions on the form to ensure all necessary fields are completed.

07

Sign and date the form to certify that the information provided is accurate.

Who needs MI R0452G?

01

Individuals applying for specific government benefits or services.

02

Organizations submitting on behalf of clients who require assistance.

03

Citizens needing to provide updated information for eligibility verification.

Fill

form

: Try Risk Free

People Also Ask about

How many years do you have to work for the state of Michigan to retire?

You will qualify for full retirement at age 60 with at least 10 years of service, or age 55 with 30 years of service. (Exception: If you are an unclassified legislative branch, executive branch, or judicial branch employee, you are vested for a full retirement benefit at age 60 with 5 years of service.)

What are the retirement rules for teachers in Michigan?

When can I retire? Generally, MIP members can retire at age 46 with 30 years of service (YOS), age 55 with 15 YOS (with stipulations), age 60 with 10 YOS, or age 60 with 5 YOS (with stipulations). Basic plan members can retire at age 55 with 30 YOS. Read more about how to qualify for a pension.

Can you retire at 50 with 25 years of service?

Early Retirement Eligibility requirements are identical for all three retirement systems: age 50 with 20 years of service and any age with 25 years.

Can you retire after 25 years of work?

While there is no requirement to work 35 years to earn a Social Security retirement benefit, if you want to maximize your payout, it's a necessity. If you work fewer than 35 years, the SSA will fill in any blanks with zeros, which will drag down your retirement payout.

Can you retire after working 25 years with a company?

While there is no requirement to work 35 years to earn a Social Security retirement benefit, if you want to maximize your payout, it's a necessity. If you work fewer than 35 years, the SSA will fill in any blanks with zeros, which will drag down your retirement payout.

How do I report a death to the Michigan Office of retirement Services?

Upon your death, your personal representative (family member or executor) should contact ORS as quickly as possible. We will need your social security number and a photocopy of the death certificate. See What Your Survivors Should Know for information to give to your survivors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MI R0452G without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing MI R0452G and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How can I fill out MI R0452G on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MI R0452G. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Can I edit MI R0452G on an Android device?

With the pdfFiller Android app, you can edit, sign, and share MI R0452G on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is MI R0452G?

MI R0452G is a form used by taxpayers to report certain tax information to the Michigan Department of Treasury.

Who is required to file MI R0452G?

Individuals and businesses that have certain tax obligations in Michigan are required to file MI R0452G.

How to fill out MI R0452G?

To fill out MI R0452G, taxpayers must provide their personal information, details of their income, and any applicable deductions or credits.

What is the purpose of MI R0452G?

The purpose of MI R0452G is to ensure compliance with Michigan tax laws and to accurately report income and taxes owed.

What information must be reported on MI R0452G?

MI R0452G requires the reporting of personal identification details, income sources, tax withholding amounts, and any applicable deductions.

Fill out your MI R0452G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI r0452g is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.