MI R0452G 2022 free printable template

Show details

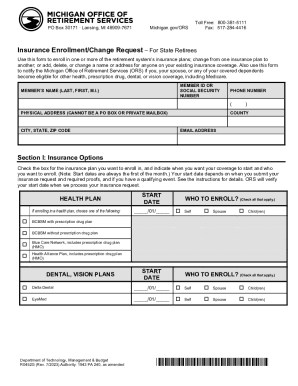

Toll Free: 800-381-5111 Local: 517-284-4400 www.michigan.gov/ors Fax: 517-284-4416 P.O. Box 30171 · Lansing, MI 48909-7671 Insurance Enrollment/Change Request — State Retirees MEMBER’S NAME (LAST,

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI R0452G

Edit your MI R0452G form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI R0452G form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MI R0452G online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI R0452G. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI R0452G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI R0452G

How to fill out MI R0452G

01

Obtain the MI R0452G form from the appropriate source.

02

Read the instructions carefully before starting to fill out the form.

03

Enter your personal information in the designated fields, including your name, address, and contact details.

04

Fill in the specific details required for the purpose of the form, ensuring accuracy.

05

Include any supporting documents or information if required.

06

Review the completed form for any errors or omissions.

07

Sign and date the form where indicated.

08

Submit the form according to the specified instructions (e.g., by mail, online).

Who needs MI R0452G?

01

Individuals or entities required to report specific information as mandated by MI R0452G guidelines.

02

Clients engaging with services or programs that necessitate the completion of this form.

03

Organizations overseeing compliance with regulations related to the form.

Fill

form

: Try Risk Free

People Also Ask about

How many years do you have to work for the state of Michigan to retire?

You will qualify for full retirement at age 60 with at least 10 years of service, or age 55 with 30 years of service. (Exception: If you are an unclassified legislative branch, executive branch, or judicial branch employee, you are vested for a full retirement benefit at age 60 with 5 years of service.)

What are the retirement rules for teachers in Michigan?

When can I retire? Generally, MIP members can retire at age 46 with 30 years of service (YOS), age 55 with 15 YOS (with stipulations), age 60 with 10 YOS, or age 60 with 5 YOS (with stipulations). Basic plan members can retire at age 55 with 30 YOS. Read more about how to qualify for a pension.

Can you retire at 50 with 25 years of service?

Early Retirement Eligibility requirements are identical for all three retirement systems: age 50 with 20 years of service and any age with 25 years.

Can you retire after 25 years of work?

While there is no requirement to work 35 years to earn a Social Security retirement benefit, if you want to maximize your payout, it's a necessity. If you work fewer than 35 years, the SSA will fill in any blanks with zeros, which will drag down your retirement payout.

Can you retire after working 25 years with a company?

While there is no requirement to work 35 years to earn a Social Security retirement benefit, if you want to maximize your payout, it's a necessity. If you work fewer than 35 years, the SSA will fill in any blanks with zeros, which will drag down your retirement payout.

How do I report a death to the Michigan Office of retirement Services?

Upon your death, your personal representative (family member or executor) should contact ORS as quickly as possible. We will need your social security number and a photocopy of the death certificate. See What Your Survivors Should Know for information to give to your survivors.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit MI R0452G on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit MI R0452G.

How do I complete MI R0452G on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your MI R0452G from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

Can I edit MI R0452G on an Android device?

The pdfFiller app for Android allows you to edit PDF files like MI R0452G. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is MI R0452G?

MI R0452G is a specific form used for reporting certain tax-related information to the Michigan Department of Treasury.

Who is required to file MI R0452G?

Businesses and individuals who have specific tax obligations in Michigan are required to file MI R0452G.

How to fill out MI R0452G?

To fill out MI R0452G, one should follow the instructions provided on the form, ensuring that all required fields are completed accurately.

What is the purpose of MI R0452G?

The purpose of MI R0452G is to ensure that the Michigan Department of Treasury receives necessary information for tax compliance and verification.

What information must be reported on MI R0452G?

MI R0452G requires the reporting of financial data, identification information, and any other pertinent details as specified in the instructions.

Fill out your MI R0452G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI r0452g is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.