NZ Spark Your Debit Direct Form 2010 free printable template

Show details

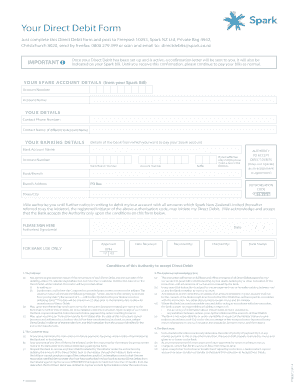

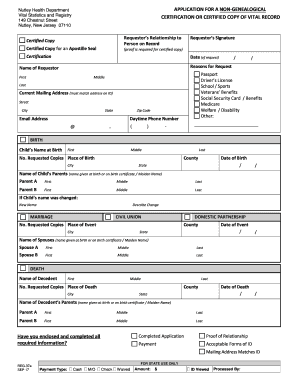

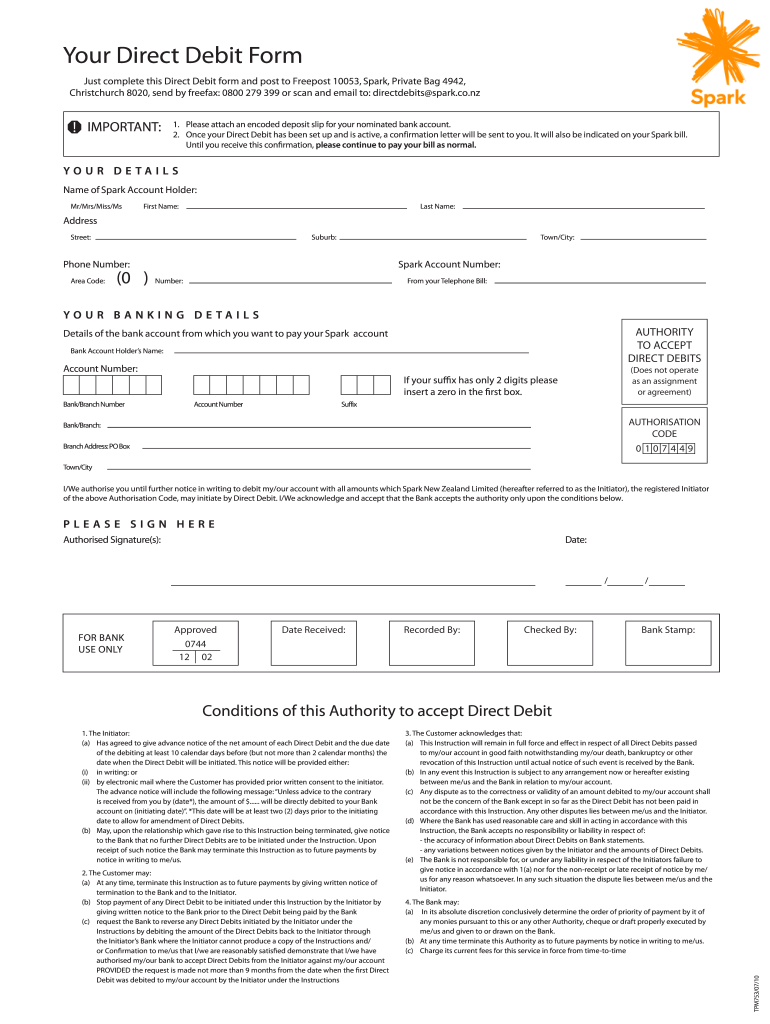

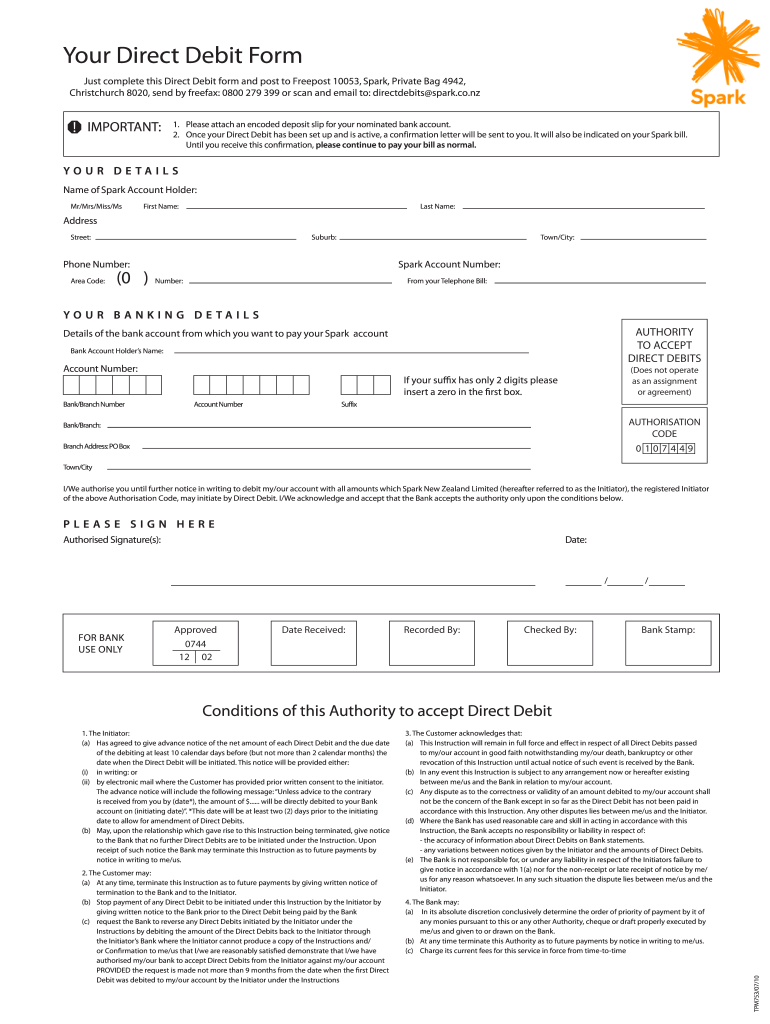

Your Direct Debit Form Just complete this Direct Debit form and post to Freepost 10053 Spark Private Bag 4942 Christchurch 8020 send by freefax 0800 279 399 or scan and email to directdebits spark. co. nz IMPORTANT 1. Please attach an encoded deposit slip for your nominated bank account. 2. Once your Direct Debit has been set up and is active a confirmation letter will be sent to you. It will also be indicated on your Spark bill* Until you receive this confirmation please continue to pay your...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign NZ Spark Your Debit Direct Form

Edit your NZ Spark Your Debit Direct Form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ Spark Your Debit Direct Form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NZ Spark Your Debit Direct Form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NZ Spark Your Debit Direct Form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ Spark Your Debit Direct Form Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ Spark Your Debit Direct Form

How to fill out NZ Spark Your Debit Direct Form

01

Obtain the NZ Spark Your Debit Direct Form from the official website or a Spark store.

02

Fill in your personal details, including your name, address, and contact information.

03

Enter your bank details, including the bank name, account type, and account number.

04

Specify the amount you want to be debited and the frequency of the debits (e.g., weekly, monthly).

05

Sign and date the form to authorize the direct debit arrangement.

06

Submit the completed form to Spark, either online or in person.

Who needs NZ Spark Your Debit Direct Form?

01

Customers who want to automate their payments for Spark services.

02

Individuals or businesses looking to set up direct debit payments for billing convenience.

Fill

form

: Try Risk Free

People Also Ask about

What is a Direct Debit form?

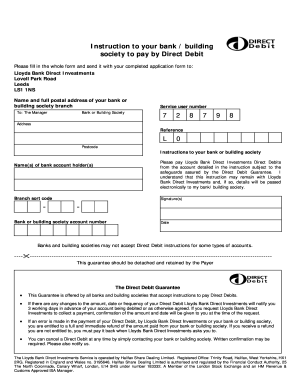

A Direct Debit is an instruction from you to your bank, authorising someone to collect payments from your account when they are due. You give this authorisation by completing a Direct Debit Mandate form – this can be a paper form or a web page that you complete online.

What is a Direct Debit request?

A Direct Debit Request (DDR) is your authorisation to debit your customer's account. An eDDR is the electronic version of the DDR. An eDDR enables you to sign customers up on the go via a tablet, smartphone or website.

How do automatic debit payments from my bank account work?

Automatic debit payments work differently than the recurring bill-pay feature offered by your bank. In recurring bill-pay, you give permission to your bank or credit union to send the payments to the company. With automatic debits, you give your permission to the company to take the payments from your bank account.

How do I get a Direct Debit mandate form?

The three most common ways to do so are: Paper - A paper Direct Debit Instruction form can be completed by your customer and returned to you. Telephone - Your customer's details can be collected over the phone, using a bank-approved script. Online - An electronic mandate form can be completed by your customer.

Can I set up my own Direct Debit?

A Direct Debit is an instruction from you to your bank that authorises a company to take an agreed amount of money from your account. You won't be able to create a new Direct Debit yourself. You'll need to contact the company you want to pay and they'll arrange for you to complete a Direct Debit instruction.

How does Direct Debit request work?

A Direct Debit is an instruction from you to your bank, authorising someone to collect payments from your account when they are due. You give this authorisation by completing a Direct Debit Mandate form – this can be a paper form or a web page that you complete online.

How do I set up automatic direct debit?

Usually, you fill in a form and send it to them, or set it up online or over the phone. They'll let your bank know. You can cancel a Direct Debit at any time by contacting your bank – you can sometimes do this through online banking.

What is Direct Debit mandate registration form?

A Direct Debit mandate gives service providers written permission to take payments from their customers bank accounts. Payments cannot be collected until the mandate has been signed and agreed by the customer. Direct Debits are the safest and most trusted method of collecting recurring payments.

Can I set up a Direct Debit on my account?

Most current accounts at banks and building societies can be used to make Direct Debit payments. Some special deposit accounts also allow them – just ask at your branch.

What is a DDI form?

The Direct Debit Instruction (DDI) is the method by which Service Users obtain a Payer's authority to debit their bank account.

How do I set up a direct debit for Spark?

Direct debit from a bank account To set this up, use MySpark or the Spark app. The direct debit will only come into effect from your next bill. If you select the checkbox to allow payment for your current bill, the first payment will be taken that day.

How do I pay off my Spark phone?

You'll need to pay off the device with payments each month over your interest free term, e.g. over 12, 18, 24 or 36 months. You can't make your interest free term longer or shorter while you're paying off the device. But you can choose to finish it early by paying off the full amount you owe in one payment.

How do I set up automatic payments on Spark?

Automatic monthly payment In the app, tap the menu button and choose MySpark from the menu. Sign in to access your account. Select Billing. Tap on the message about your bill. Choose Set up a monthly payment. Select a payment method. Choose whether you want to pay using a credit/debit card or bank account.

How do I set up automatic debit payments?

0:11 1:51 How to Set Up Automatic Payments - YouTube YouTube Start of suggested clip End of suggested clip Step 2 go online to your bank's website and sign up for online checking. If you haven't already thisMoreStep 2 go online to your bank's website and sign up for online checking. If you haven't already this needs to be done before you can enroll in automatic bill pay step 3 follow the prompts.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NZ Spark Your Debit Direct Form in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your NZ Spark Your Debit Direct Form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send NZ Spark Your Debit Direct Form for eSignature?

When your NZ Spark Your Debit Direct Form is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete NZ Spark Your Debit Direct Form online?

pdfFiller has made it simple to fill out and eSign NZ Spark Your Debit Direct Form. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

What is NZ Spark Your Debit Direct Form?

The NZ Spark Your Debit Direct Form is a direct debit authorization form that allows customers to authorize Spark New Zealand to automatically withdraw payments from their bank account.

Who is required to file NZ Spark Your Debit Direct Form?

Customers who wish to set up direct debit payments for their Spark services are required to fill out and submit the NZ Spark Your Debit Direct Form.

How to fill out NZ Spark Your Debit Direct Form?

To fill out the NZ Spark Your Debit Direct Form, customers need to provide their personal details, bank account information, and specify the amount and frequency of the payments they wish to authorize.

What is the purpose of NZ Spark Your Debit Direct Form?

The purpose of the NZ Spark Your Debit Direct Form is to facilitate automatic payments for services provided by Spark, ensuring timely and hassle-free billing for customers.

What information must be reported on NZ Spark Your Debit Direct Form?

The NZ Spark Your Debit Direct Form requires reporting personal identification details, bank account number, account name, and details regarding the direct debit amount and frequency.

Fill out your NZ Spark Your Debit Direct Form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ Spark Your Debit Direct Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.