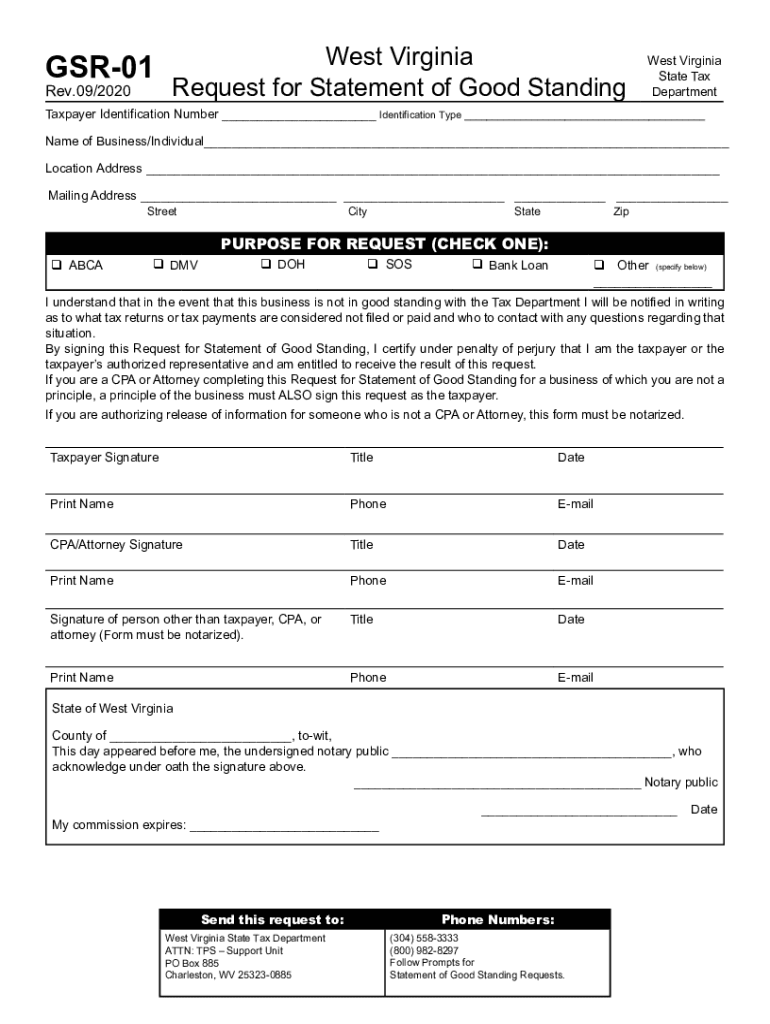

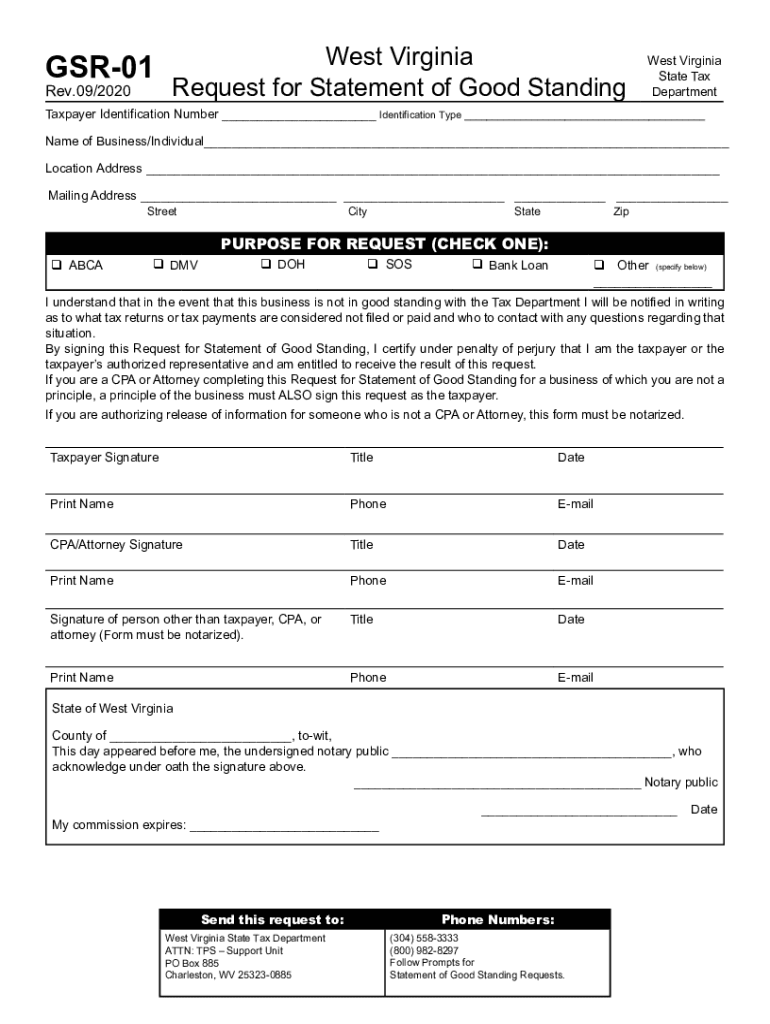

WV GSR-01 2020 free printable template

Get, Create, Make and Sign WV GSR-01

Editing WV GSR-01 online

Uncompromising security for your PDF editing and eSignature needs

WV GSR-01 Form Versions

How to fill out WV GSR-01

How to fill out WV GSR-01

Who needs WV GSR-01?

Instructions and Help about WV GSR-01

Okay welcome to the start business tutorial for LLC formation in West Virginia this main page here is just going to go over the general filing process for both foreign and domestic LLC's, and we encourage you to click on the links found throughout to get more detailed tutorials that'll walk you through exactly what's required to get registered in the state now those filing domestic other profit sorry Professional or standard LLC's ought to pay a 100 filing fee those foreign LLC years will pay one hundred and fifty dollars across the board now for this website and for the state rather there is an online filing portal that is available to all fathers and enables the registration of all business entities as well now you're going to need an online account to access this portal, but that only takes about a minute to set up and once you're set up you're going to be able to register with the Secretary of State the state tax department and the unemployment compensation division, so it's a really beneficial, and we always recommend when there is an online filing option that representatives take it first thing to do before filing however the first step we have here is a business entity search now it's not required that you do this, but it's always a good idea because it makes sure that the name of you're planning on using your entity be a foreign or domestic entity is available in the state of West Virginia now if you find a name that is indistinguishable from your name or at least deceptively similar there's a good chance that if you go ahead and follow up it anyway your application will be rejected now if you've done the search, and you realize that your name it's available, yet you need more time in which to prepare for filing you can perform a name reservation or file a name reservation application and that allow you an additional 120 days with which to repair and your name will be secured, and they only cost 15 as well, so it's a pretty good idea so — as of course actually going about filing, so it's downloading the PDF of the following form if you don't plan on filing or creating your online account so that you can access the online filing portal now we've got tutorials for both the domestic LLC and the foreign LLC registration process is here so if you were to click on this you get our little introduction and then how to file online, so you'll have all this information we've included each step an image of each step and a description of what we're what's to go into each field and each option that's given to you once you're finished the forms online or otherwise your need to pay the filing fee now this is going to be done by credit card online this can be done by check your finances the mail the payment of the filing fee will sort of mark the completion of your filing process for LLC's that trellis is yes but for online filers I meant to say for those who are funds the mail you need to attach a check to your application and send both items to this...

People Also Ask about

Does West Virginia have a state tax form?

What is the form for WV tax extension?

How do I get a business tax ID in WV?

How do I get a letter of good standing in WV?

How to find out if a business is registered in West Virginia?

How do I find my personal property tax in WV?

How do you request a letter of good standing?

What does certificate of standing mean?

How do I register my business for sales tax in West Virginia?

How to obtain a certificate for good standing in West Virginia?

What does certificate of good standing do?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get WV GSR-01?

Can I create an eSignature for the WV GSR-01 in Gmail?

How do I complete WV GSR-01 on an iOS device?

What is WV GSR-01?

Who is required to file WV GSR-01?

How to fill out WV GSR-01?

What is the purpose of WV GSR-01?

What information must be reported on WV GSR-01?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.