WV GSR-01 2014 free printable template

Show details

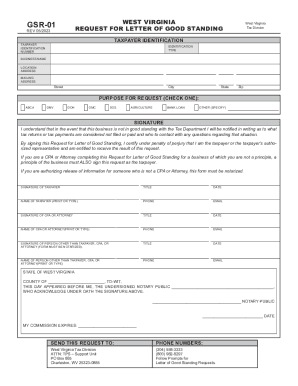

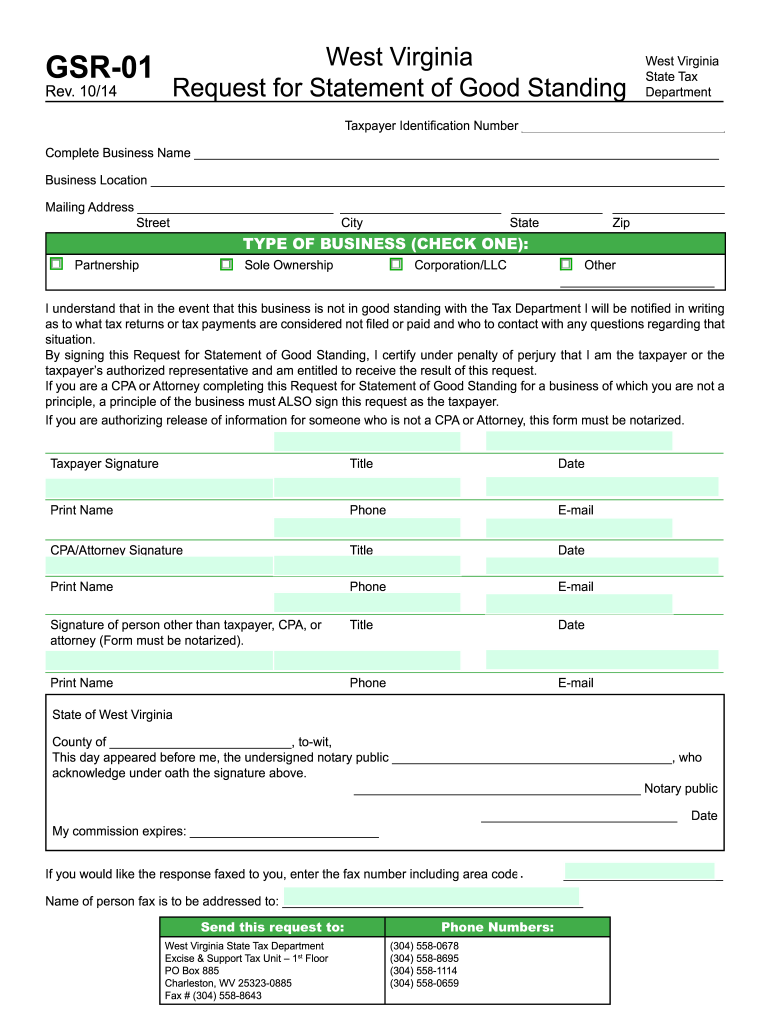

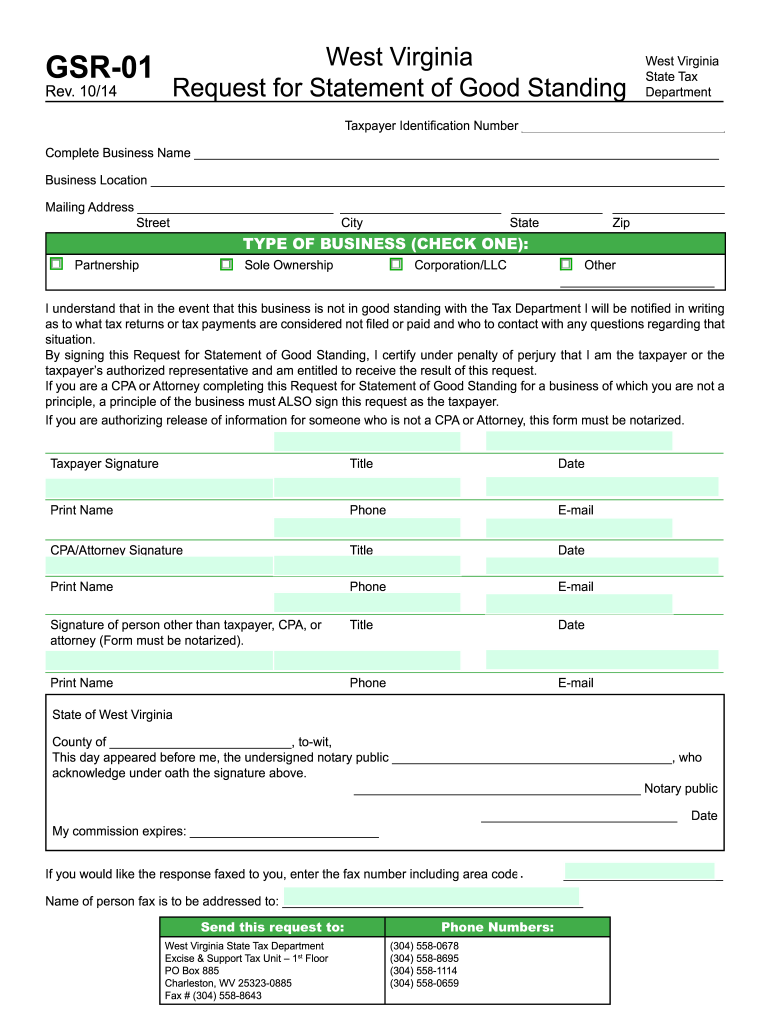

Clear All Values GSR-01 Rev. 10/14 Print Your Return West Virginia Request for Statement of Good Standing State Tax Department Taxpayer Identification Number Complete Business Name Business Location Mailing Address Street City State Zip Type of business check one Partnership Sole Ownership Corporation/LLC Other I understand that in the event that this business is not in good standing with the Tax Department I will be notified in writing as to what tax returns or tax payments are considered...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tax wvgov business goodstanding

Edit your tax wvgov business goodstanding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax wvgov business goodstanding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax wvgov business goodstanding online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax wvgov business goodstanding. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WV GSR-01 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tax wvgov business goodstanding

How to fill out WV GSR-01

01

Gather necessary information such as your personal details and relevant incident information.

02

Complete the 'Incident Information' section, including date, time, and location of the incident.

03

Fill out your contact information in the designated area.

04

Provide details about the incident, including a clear and concise description.

05

Review the form for accuracy to ensure all information is correct.

06

Sign and date the form at the bottom.

Who needs WV GSR-01?

01

Individuals involved in workplace incidents or accidents.

02

Employers or supervisors documenting incidents for records.

03

Regulatory bodies requiring reports of workplace safety incidents.

Fill

form

: Try Risk Free

People Also Ask about

Does West Virginia have a state tax form?

The regular deadline to file a West Virginia state income tax return is April 15. Find additional information about West Virginia state tax forms, West Virginia state tax filing instructions, and government information.Efile-West-Virginia-Tax-Return. Form Name:Instructions:WV-8453Mail in WV-8453

What is the form for WV tax extension?

Complete WV Form 4868, include a Check or Money Order, and mail both to the address on WV Form 4868. Even if you filed an extension, you will still need to file your WV tax return either via eFile or by paper by Oct.

How do I get a business tax ID in WV?

If you are engaged in business activity, a business registration certificate can be obtained by filing an application, either through the Business for West Virginia Website or by filing a BUS-APP with the Tax Commissioner.

How do I get a letter of good standing in WV?

How do I request the Letter of Good Standing? A letter of good standing is requested by completing a GSR-01 form. If you have a MyTaxes account, you may complete this form from your My Taxes account. The form is found under the "I Want To" section.

How to find out if a business is registered in West Virginia?

You can find information on any corporation or business entity in West Virginia or another state by performing a search on the Secretary of State website of the state or territory where that corporation is registered.

How do I find my personal property tax in WV?

How can I find how much I owe? Either call our office at 357-0210 or you may look your taxes up online by clicking on the 'Tax Inquiry' link.

How do you request a letter of good standing?

How Do You Get a Letter of Good Standing? Businesses must request a Certificate of Good Standing from the state's Secretary of State or equivalent office that is responsible for filing entities and maintaining business records in the state. Many states have an online form for requesting a Letter of Good Standing.

What does certificate of standing mean?

A certificate of good standing certifies that a company is properly registered with the state, is up to date on all state registration fees and required document filings, and is legally permitted to engage in business activities in the state.

How do I register my business for sales tax in West Virginia?

If you are engaged in business activity, a business registration certificate can be obtained by filing an application, either through the Business for West Virginia Website or by filing a BUS-APP with the Tax Commissioner.

How to obtain a certificate for good standing in West Virginia?

A letter of good standing is requested by completing a GSR-01 form. If you have a MyTaxes account, you may complete this form from your My Taxes account. The form is found under the "I Want To" section.

What does certificate of good standing do?

The meaning of Certificate of Good Standing It serves as proof, or evidence, that the entity exists and is authorized to transact business in the state. Business entity laws vary among the states.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax wvgov business goodstanding without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your tax wvgov business goodstanding into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make changes in tax wvgov business goodstanding?

The editing procedure is simple with pdfFiller. Open your tax wvgov business goodstanding in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How can I fill out tax wvgov business goodstanding on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your tax wvgov business goodstanding by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

What is WV GSR-01?

WV GSR-01 is a form used in West Virginia for the reporting of gross revenues and other necessary financial information by certain businesses.

Who is required to file WV GSR-01?

Businesses that have gross revenues from business operations in West Virginia above a certain threshold are required to file WV GSR-01.

How to fill out WV GSR-01?

To fill out WV GSR-01, businesses must provide their gross revenue figures, relevant financial data, and any requested information specified in the form.

What is the purpose of WV GSR-01?

The purpose of WV GSR-01 is to ensure compliance with state regulations and to collect data for tax assessment purposes.

What information must be reported on WV GSR-01?

WV GSR-01 requires businesses to report gross revenues, deductions, and any other pertinent financial information as specified on the form.

Fill out your tax wvgov business goodstanding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Wvgov Business Goodstanding is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.