Get the free AR1100S

Show details

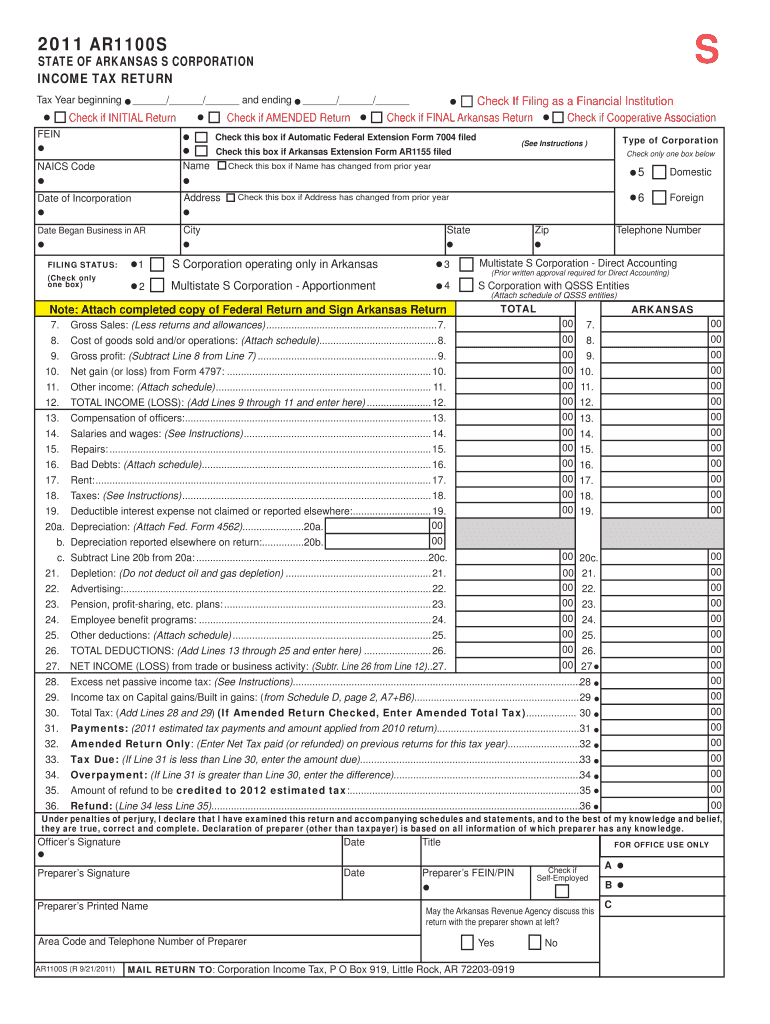

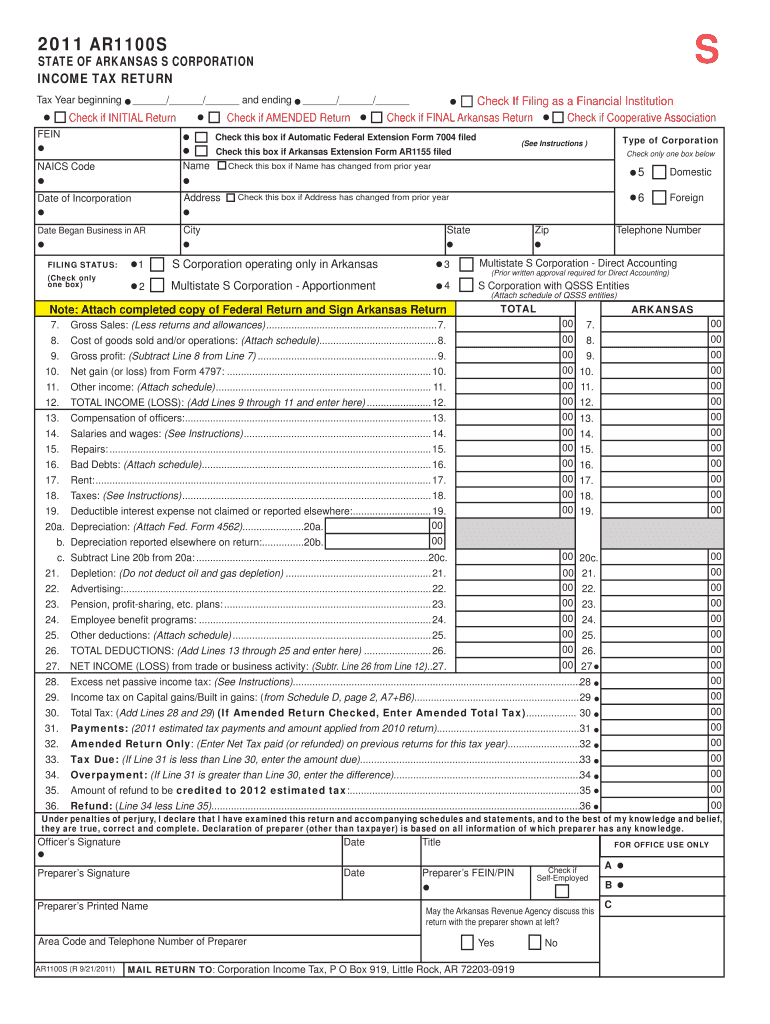

This document is the State of Arkansas S Corporation Income Tax Return form used for reporting income, deductions, and tax owed by S Corporations for the specified tax year. It includes sections to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ar1100s

Edit your ar1100s form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ar1100s form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ar1100s online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit ar1100s. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ar1100s

How to fill out AR1100S

01

Start by reviewing the instructions provided with the AR1100S form.

02

Gather all necessary documentation, such as identification and financial records.

03

Fill in your personal information in the designated fields, ensuring accuracy.

04

Enter your income details, including any self-employment or other sources of income.

05

Complete the sections regarding deductions and credits applicable to you.

06

Review all entered information for correctness and completeness.

07

Sign and date the form as required before submission.

Who needs AR1100S?

01

Individuals applying for certain benefits or programs that require the AR1100S form.

02

Taxpayers seeking to report income and claim deductions.

03

Those participating in programs requiring verification of financial status.

Fill

form

: Try Risk Free

People Also Ask about

What is the income tax limit in Arkansas?

Unlike states with flat tax rates or states with no income tax at all, Arkansas uses a progressive system where the rates increase with income. For example, taxpayers who earn more than $25,700 in taxable income pay the highest rate (3.9%), while those earning less than $5,500 pay no state income tax.

Does Arkansas recognize S Corp?

S Corp election involves filing all of the initial and ongoing paperwork to form and maintain an official Arkansas business. Businesses that have elected S Corporation status must adhere to other obligations of the business structure including elections, notification, and ownership restrictions.

Does Arkansas allow 179 expenses?

The adoption of Internal Code Section 179 will result in the Arkansas Section 179 deduction being raised from $25,000 per year to $1,220,000 for tax years beginning in 2022 and for the dollar-for-dollar phaseout being raised from $200,000 to $3,050,000.

What is Nexus in Arkansas corporate income tax?

In Arkansas, state income tax nexus is triggered when a business has a substantial connection or presence in the state. Factors that may establish nexus include, but are not limited to: 1. Physical Presence: Having an office, store, or other physical location in the state can establish nexus.

What is the $150 tax credit in Arkansas?

The tax relief measure includes a one-time credit of $150 for all taxpayers whose incomes was below $89,600 in 2023.

What qualifies for a Section 179 expense?

The section 179 expense deduction is limited to such items as cars, office equipment, business machinery, and computers.

Does Arkansas allow Section 179 depreciation?

Arkansas Code § 26-51-428 adopts 26 U.S.C § 179, as in effect on January 1, 2009, which allows taxpayers to deduct a certain dollar amount of depreciable property in the year purchased rather than capitalizing and depreciating the property.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AR1100S?

AR1100S is a tax form used by certain partnerships and corporations in Arkansas for filing income and franchise taxes.

Who is required to file AR1100S?

Entities such as partnerships, limited liability companies, and corporations doing business in Arkansas are required to file AR1100S.

How to fill out AR1100S?

To fill out AR1100S, gather the necessary financial information, complete the required sections of the form, calculate the taxes owed, and submit it to the Arkansas Department of Finance and Administration.

What is the purpose of AR1100S?

The purpose of AR1100S is to report the income and franchise taxes owed by businesses operating in Arkansas.

What information must be reported on AR1100S?

Information that must be reported on AR1100S includes business income, deductions, calculations of franchise tax, and other relevant financial information.

Fill out your ar1100s online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ar1100s is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.