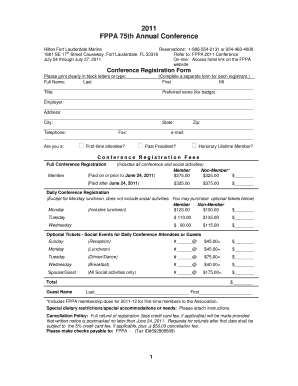

Get the free 2012 TAX INFORMATION FORM

Show details

Este formulario es necesario para el registro de impuestos y certifica que la información proporcionada es precisa para recibir premios monetarios. Attica Raceway Park no se hace responsable de la

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012 tax information form

Edit your 2012 tax information form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 tax information form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 tax information form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2012 tax information form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012 tax information form

How to fill out 2012 TAX INFORMATION FORM

01

Gather all necessary tax documents including W-2s, 1099s, and any applicable receipts.

02

Download the 2012 TAX INFORMATION FORM from the IRS website or obtain a paper copy.

03

Fill out your personal information at the top of the form, including your name, address, and social security number.

04

Report your income by entering the amounts from your W-2s and 1099s in the corresponding sections.

05

Include any deductions or credits you are eligible for, following the instructions provided on the form.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the form by mailing it to the appropriate IRS address or filing electronically if applicable.

Who needs 2012 TAX INFORMATION FORM?

01

Anyone who earned income in the year 2012 and is required to file a federal tax return.

02

Individuals who receive certain types of income, such as wages, dividends, or self-employment income.

03

Taxpayers who are eligible for deductions or tax credits in 2012.

Fill

form

: Try Risk Free

People Also Ask about

How many years is too late to file taxes?

You risk losing your refund if you don't file your return. If you are due a refund for withholding or estimated taxes, you must file your return to claim it within 3 years of the return due date. The same rule applies to a right to claim tax credits such as the Earned Income Credit.

Can I file 10 years of back taxes?

You can file back taxes for any past year, but the IRS usually considers you in good standing if you have filed the last six years of tax returns. If you qualified for federal tax credits or refunds in the past but didn't file tax returns, you may be able to collect the money by filing back taxes.

Where can I download tax forms?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I download IRS tax forms?

There are a number of excellent sources available for taxpayers to obtain tax forms, instructions, and publications. They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center.

What is the 5329 tax form?

Form 5329 is the tax form used to calculate possibly IRS penalties from the situations listed above and possibly request a penalty waiver. Form 5329 applies to each individual that might owe a penalty, so for married couples filing jointly, each spouse must complete their own form.

What is the new 1040 form for seniors?

Form 1040-SR is available as an optional alternative to using Form 1040 for taxpayers who are age 65 or older. Form 1040-SR uses the same schedules and instructions as Form 1040 does.

How far back can you file old taxes?

You can't get a credit or refund if you don't file the claim within 3 years of filing your original return, or 2 years after paying the tax, whichever is later, unless you meet an exception that allows you more time to file a claim.

How to file a 2012 tax return?

In order to file a 2012 IRS Tax Return, download, complete, print, and sign the 2012 IRS Tax Forms below and mail them to the address listed on the IRS and State Forms. Select your state(s) and download, complete, print, and sign your 2012 State Tax Return income forms.

Are tax forms available at the post office?

No, Post Offices do not have tax forms available for customers.

Can I file 10 years of back taxes?

You can file back taxes for any past year, but the IRS usually considers you in good standing if you have filed the last six years of tax returns. If you qualified for federal tax credits or refunds in the past but didn't file tax returns, you may be able to collect the money by filing back taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012 TAX INFORMATION FORM?

The 2012 TAX INFORMATION FORM is a financial document used to report income, deductions, and tax calculations for the tax year 2012.

Who is required to file 2012 TAX INFORMATION FORM?

Individuals or entities that earned income during the tax year 2012 and are subject to taxation are required to file the 2012 TAX INFORMATION FORM.

How to fill out 2012 TAX INFORMATION FORM?

To fill out the 2012 TAX INFORMATION FORM, gather all relevant financial documents, provide personal information, report income sources and amounts, list deductions, and calculate the total tax owed or refund due.

What is the purpose of 2012 TAX INFORMATION FORM?

The purpose of the 2012 TAX INFORMATION FORM is to calculate the taxpayer's liability and ensure compliance with federal and state tax regulations for the year 2012.

What information must be reported on 2012 TAX INFORMATION FORM?

The 2012 TAX INFORMATION FORM must report personal identification details, total income earned, applicable deductions and credits, and tax liability or refund amounts.

Fill out your 2012 tax information form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012 Tax Information Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.