Get the free Missing Year Bar Donation Form

Show details

A donation form for the Association of Former Students aimed at collecting contributions to support various student organizations, Aggie traditions, career services, and scholarships.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign missing year bar donation

Edit your missing year bar donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missing year bar donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit missing year bar donation online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missing year bar donation. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

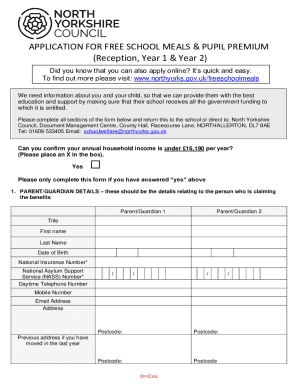

How to fill out missing year bar donation

How to fill out Missing Year Bar Donation Form

01

Obtain the Missing Year Bar Donation Form from the designated source or website.

02

Read the instructions carefully to understand the information required.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide the details of the missing year bar you wish to donate, including its description and any relevant serial numbers.

05

Indicate the purpose of the donation and any specific use you wish for the bar to be applied towards.

06

Review the form for completeness and accuracy.

07

Sign and date the form at the designated area.

08

Submit the form as instructed, either electronically or via mail.

Who needs Missing Year Bar Donation Form?

01

Individuals or organizations looking to donate year bars for charitable purposes.

02

Collectors who want to contribute missing year bars to a specific cause to support.

03

Non-profit organizations that require year bars for fundraising events.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a donation request form?

How do you write a fundraising letter? Key steps Start with a personalized greeting. Explain your mission. Describe your current initiative. Outline your project's needs and what you hope to accomplish. Add meaningful photographs or infographics. Show the tangible impact associated with specific donation amounts.

How do I ask for donations without sounding desperate?

As the saying goes, honesty is the best policy. People want to trust that their donations are going toward a legitimate cause. Be honest in telling your story to reassure those who are looking to help. If a donor connects with your story they will be more willing to donate.

What is good wording for asking for donations?

I'm writing to ask you to support me and my [cause/project/etc.]. Just a small donation of [amount] can help me [accomplish task/reach a goal/etc.]. Your donation will go toward [describe exactly what the contribution will be used for]. [When possible, add a personal connection to tie the donor to the cause.

What is a good sentence for donation?

He would be worth more but for large donations to charity. She and her family are now reliant on food donations. But please remember it is a charity and make some donation if you want help or advice. It added that the company policy now was not to make political donations.

How do you write a formal email asking for donations?

Clearly state the amount of money you are requesting and how the funds will be used. Be as specific as possible about the intended use of the donation. Highlight the benefits and outcomes that the donor's contribution will enable, appealing to their values and interests. Quantify the impact where possible.

How do I write a request for charitable donations?

Explain what the funds will be used for and the impact the donation will have. Establish a personal connection. Share why this cause is meaningful to you and how it has impacted your life or the lives of others you know. This helps build an emotional connection with the reader. Use a conversational tone.

How do you politely ask for money donations?

1. Be direct and specific about the ask amount. 2. Explain how their contribution will make a difference. 3. Offer various giving options (eg, one-time, recurring, in-kind). ``Thank you for considering support for (Organization). We're seeking $ (Amount) to (Specific Program/Initiative).

What is a good sentence for donation?

He would be worth more but for large donations to charity. She and her family are now reliant on food donations. But please remember it is a charity and make some donation if you want help or advice. It added that the company policy now was not to make political donations.

How do I ask for year end donations?

How to Write a Powerful Year-End Giving Letter (with Samples) Plan Your Year-End Campaign. Figure Out and Segment Your Audience. Get Your Donation Forms Ready. Give Thanks and Stay Positive. Keep it Simple and Easy. Tell a Story. Create a Sense of Urgency and Highlight a Call-to-Action. Make it Compelling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Missing Year Bar Donation Form?

The Missing Year Bar Donation Form is a document used to report and make donations for specific tax years that are lacking required filings or payments.

Who is required to file Missing Year Bar Donation Form?

Individuals or entities who have not filed their tax returns for certain designated years and wish to rectify their tax status are required to file the Missing Year Bar Donation Form.

How to fill out Missing Year Bar Donation Form?

To fill out the Missing Year Bar Donation Form, provide your personal or business information, specify the missing years, calculate the total donation amount, and include any required signatures and documentation.

What is the purpose of Missing Year Bar Donation Form?

The purpose of the Missing Year Bar Donation Form is to facilitate compliance with tax obligations by allowing taxpayers to report missing years and make necessary contributions to resolve outstanding issues.

What information must be reported on Missing Year Bar Donation Form?

The information that must be reported includes taxpayer identification details, the tax years in question, the amount being donated, and any relevant supporting documentation.

Fill out your missing year bar donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missing Year Bar Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.