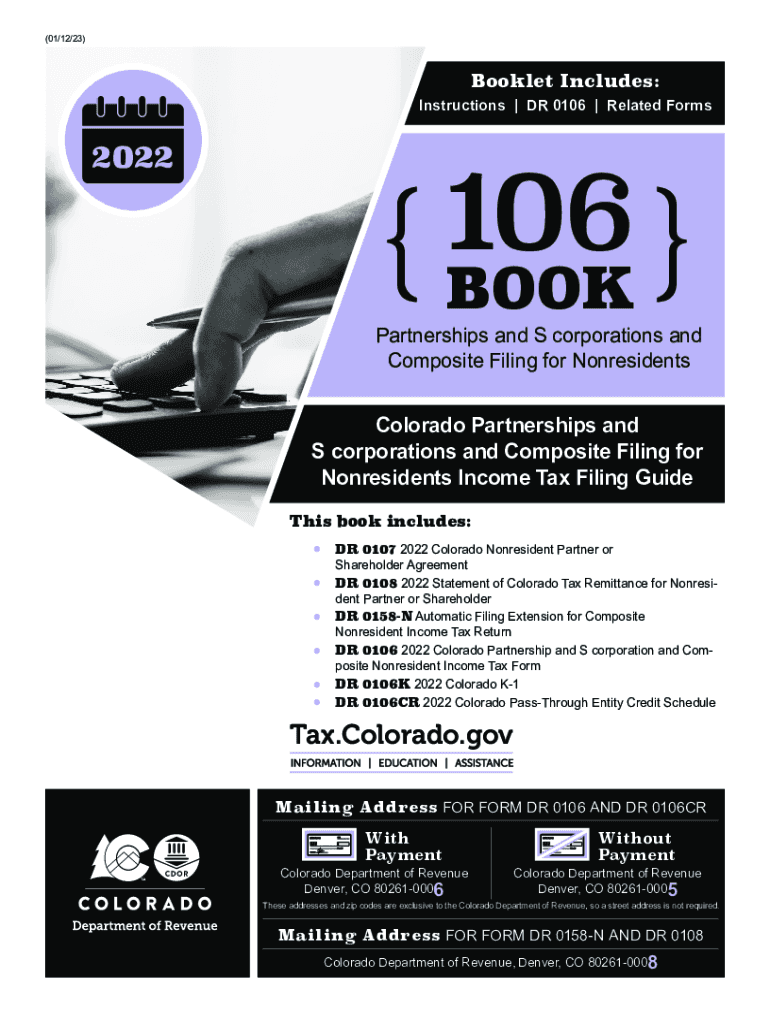

CO DoR 106 2023 free printable template

Instructions and Help about CO DoR 106

How to edit CO DoR 106

How to fill out CO DoR 106

About CO DoR previous version

What is CO DoR 106?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CO DoR 106

What should I do if I need to correct mistakes on a submitted CO DoR 106?

To correct mistakes on a submitted CO DoR 106, you must submit an amended form to the appropriate agency. Ensure that you indicate on the new form that it is an amendment and include a brief explanation of the changes. Keep a copy of both the original and corrected forms for your records.

How can I verify the status of my CO DoR 106 submission?

You can verify the status of your CO DoR 106 submission by checking the online tracking system provided by the filing agency or contacting their office directly. It's advisable to have your submission confirmation number handy for quicker assistance.

What are common errors that lead to rejection of e-filed CO DoR 106 forms?

Common errors that result in the rejection of e-filed CO DoR 106 forms include incorrect taxpayer identification numbers, mismatched names on forms, or missing required fields. Carefully reviewing your data before submission can help prevent these issues.

What should I do if I receive an audit notice related to my CO DoR 106?

If you receive an audit notice related to your CO DoR 106, it's important to respond promptly with the requested documentation. Review the form and associated records thoroughly, and consider consulting a tax professional for guidance on how to address the issues raised.

Are e-signatures acceptable for filing a CO DoR 106?

E-signatures are generally accepted for filing CO DoR 106, provided they comply with federal and state regulations regarding electronic submissions. Make sure to review the specific guidelines issued by the filing agency to ensure compliance.