MD HTC-1 2023 free printable template

Show details

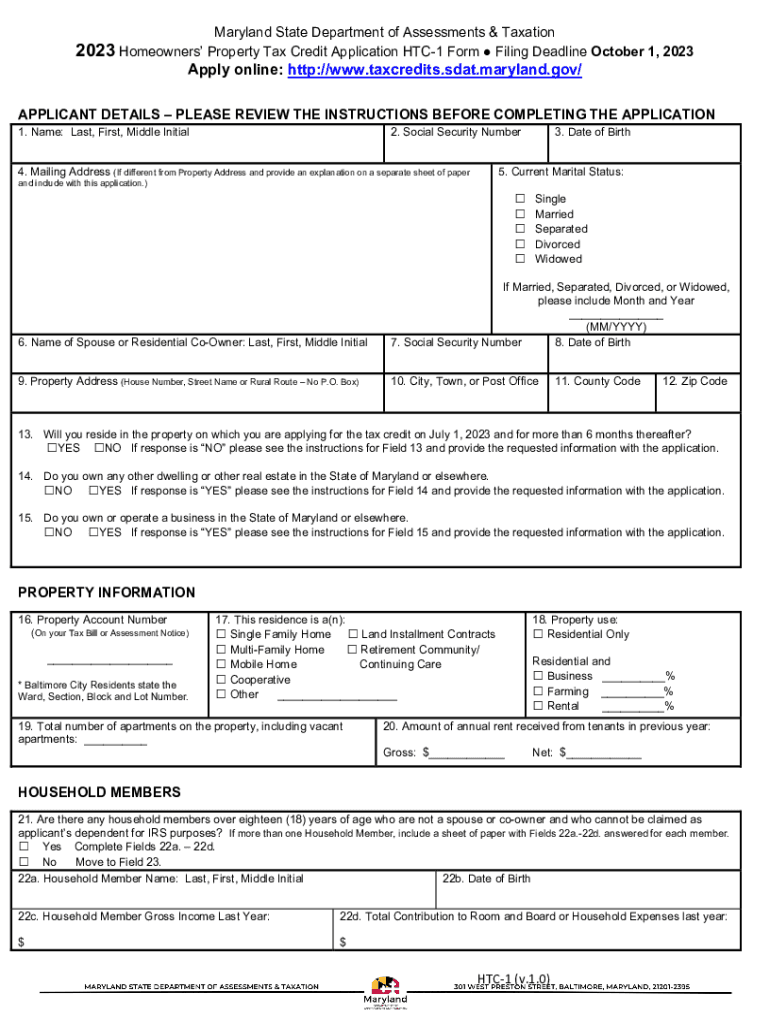

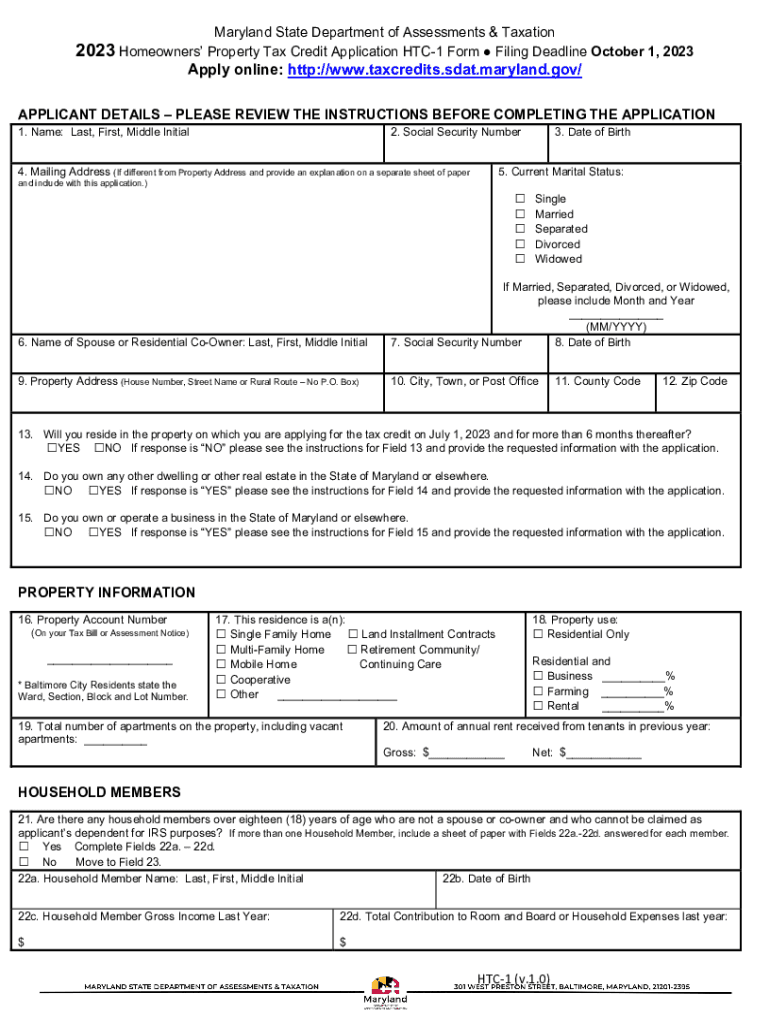

Maryland State Department of Assessments & Taxation2023 Homeowners Property Tax Credit Application HTC1 Form Filing Deadline October 1, 2023, Apply online: http://www.taxcredits.sdat.maryland.gov/APPLICANT

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MD HTC-1

Edit your MD HTC-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MD HTC-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MD HTC-1 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MD HTC-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MD HTC-1 Form Versions

Version

Form Popularity

Fillable & printabley

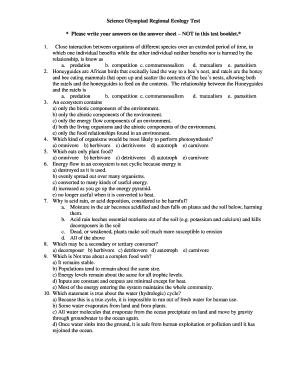

How to fill out MD HTC-1

How to fill out MD HTC-1

01

Gather all necessary personal information, including your name, address, and contact details.

02

Locate the section for medical history and fill in any previous health conditions or treatments.

03

Provide details about current medications, including dosages and frequency.

04

Review the section on allergies and list any known allergies.

05

Complete the emergency contact section with a reliable person's contact details.

06

Double-check all entries for accuracy before submitting.

Who needs MD HTC-1?

01

Individuals seeking medical benefits or coverage in Maryland.

02

Those applying for health insurance or Medicaid options.

03

Patients requiring specific medical assistance or services.

Fill

form

: Try Risk Free

People Also Ask about

At what age do you stop paying property taxes in MD?

Be at least 65 years of age.

How much is the homestead tax credit in Maryland?

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income ing to the following formula: 0% of the first $8,000 of the combined household income; 4% of the next $4,000 of income; 6.5% of the next $4,000 of income; and 9% of all income above $16,000.

How is Maryland homestead tax credit calculated?

The credit is calculated based on the 10% limit for purposes of the State property tax, and 10% or less (as determined by local governments) for purposes of local taxation. In other words, the homeowner pays no property tax on the market value increase which is above the limit.

How to get Maryland first time home buyer tax credit?

In order to be eligible, the home you purchase must be in Maryland and you must meet the income requirements and home purchase price limits set by the Maryland Mortgage Program. Also, the home you purchase must be your primary residence and you cannot have owned a home within the past three years.

Does Maryland have a homestead tax credit?

Maryland requires all homeowners to submit a one-time application to establish eligibility for the Homestead Tax Credit. The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence.

Do you have to apply for homestead exemption every year in Maryland?

Maryland requires all homeowners to submit a one-time application to establish eligibility for the Homestead Tax Credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my MD HTC-1 directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your MD HTC-1 and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How can I edit MD HTC-1 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing MD HTC-1.

How do I complete MD HTC-1 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MD HTC-1. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MD HTC-1?

MD HTC-1 is a form used in the state of Maryland to report the information related to housing tax credits and ensure compliance with state regulations.

Who is required to file MD HTC-1?

Entities that own or manage properties that participate in the Maryland housing tax credit program are required to file MD HTC-1.

How to fill out MD HTC-1?

MD HTC-1 should be completed by providing the necessary property and owner information, along with the required financial and compliance data as outlined in the form's instructions.

What is the purpose of MD HTC-1?

The purpose of MD HTC-1 is to collect data for monitoring compliance with housing credit program guidelines and to assess the impact of the program on affordable housing in Maryland.

What information must be reported on MD HTC-1?

The information required includes property details, tenant demographics, income levels, financial statements, and occupancy rates, among other relevant data.

Fill out your MD HTC-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MD HTC-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.