MD HTC-1 2024-2025 free printable template

Show details

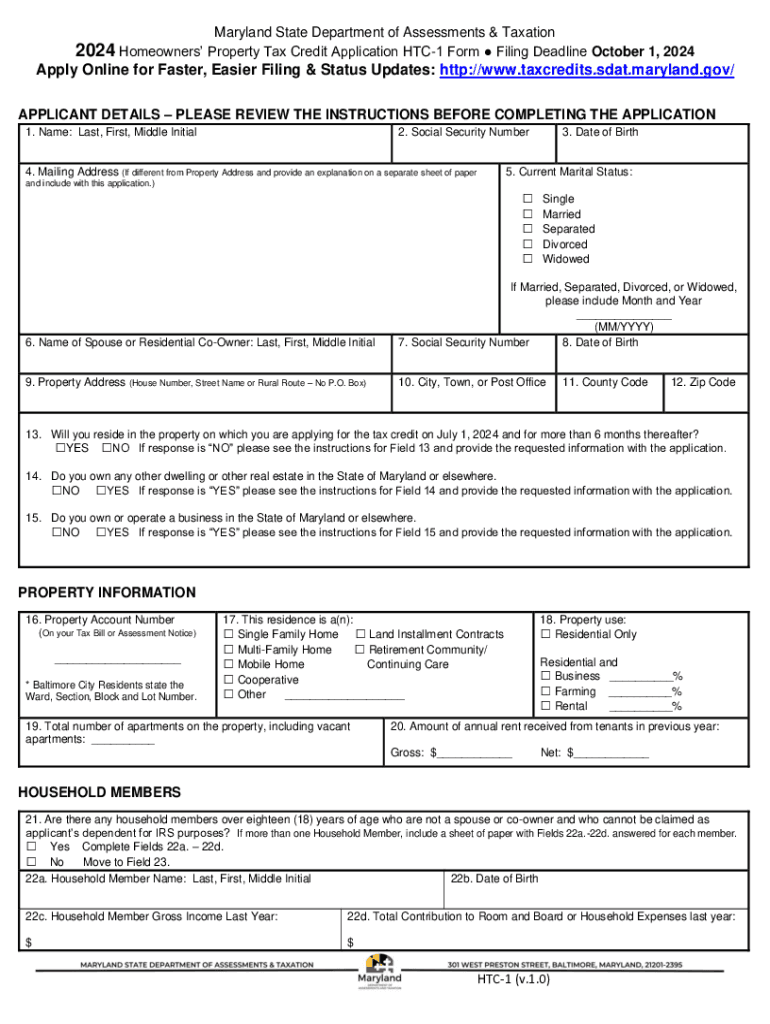

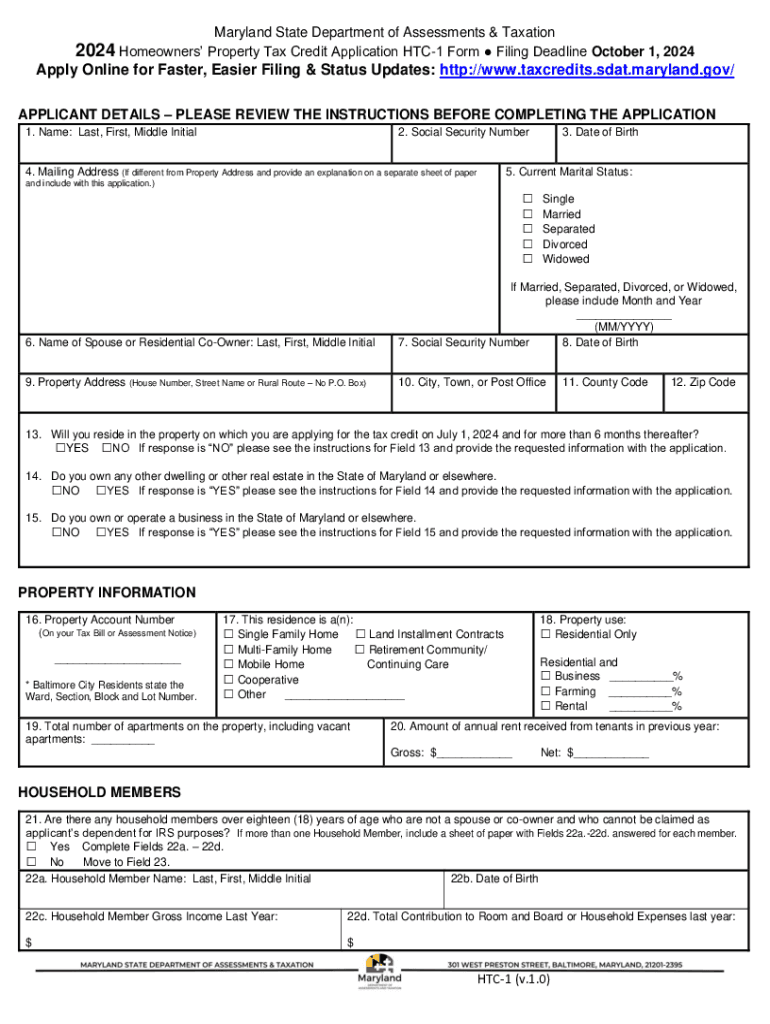

Maryland State Department of Assessments & Taxation2024 Homeowners Property Tax Credit Application HTC1 Form Filing Deadline October 1, 2024 Apply Online for Faster, Easier Filing & Status Updates:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign md homeowners property tax credit form

Edit your htc 1 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2024 maryland homeowners property tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing maryland homeowners property tax credit form online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2024 maryland homeowners property tax credit htc1 printable form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

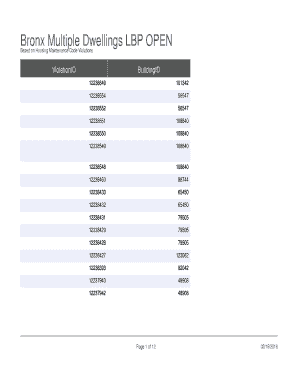

MD HTC-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out homeowners property tax credit application htc1 form

How to fill out MD HTC-1

01

Obtain the MD HTC-1 form from the relevant authority or website.

02

Carefully read the instructions provided at the top of the form.

03

Fill in your personal information, including name, address, and contact details in the designated fields.

04

Provide accurate information regarding your employment or service details as required.

05

Complete any sections that apply to your specific situation, such as income or expenses.

06

Review your entries for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the form according to the submission guidelines provided.

Who needs MD HTC-1?

01

Individuals applying for a specific benefit or assistance program related to MD.

02

Residents of Maryland seeking to document their eligibility for state assistance.

03

Healthcare professionals assisting clients with documentation for services.

Fill

maryland htc 1

: Try Risk Free

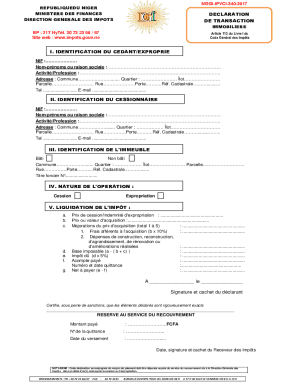

People Also Ask about 2024 homeowners property tax credit application

At what age do you stop paying property taxes in MD?

Be at least 65 years of age.

How much is the homestead tax credit in Maryland?

The tax credit is based upon the amount by which the property taxes exceed a percentage of your income ing to the following formula: 0% of the first $8,000 of the combined household income; 4% of the next $4,000 of income; 6.5% of the next $4,000 of income; and 9% of all income above $16,000.

How is Maryland homestead tax credit calculated?

The credit is calculated based on the 10% limit for purposes of the State property tax, and 10% or less (as determined by local governments) for purposes of local taxation. In other words, the homeowner pays no property tax on the market value increase which is above the limit.

How to get Maryland first time home buyer tax credit?

In order to be eligible, the home you purchase must be in Maryland and you must meet the income requirements and home purchase price limits set by the Maryland Mortgage Program. Also, the home you purchase must be your primary residence and you cannot have owned a home within the past three years.

Does Maryland have a homestead tax credit?

Maryland requires all homeowners to submit a one-time application to establish eligibility for the Homestead Tax Credit. The Homestead Tax Credit Eligibility Application is needed to ensure that homeowners receive the Homestead credit only on their principal residence.

Do you have to apply for homestead exemption every year in Maryland?

Maryland requires all homeowners to submit a one-time application to establish eligibility for the Homestead Tax Credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 2024 md homeowners property tax credit application from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2024 md homeowners property tax credit application fillable. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I edit 2024 md homeowners property tax credit application blank on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 2024 application htc1.

How can I fill out homeowners property tax credit application add on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your homeowners property tax credit form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is MD HTC-1?

MD HTC-1 is a form used by the Maryland state government for reporting certain tax information related to high technology companies.

Who is required to file MD HTC-1?

Businesses that are classified as high technology companies and wish to claim Maryland's high technology tax credits are required to file MD HTC-1.

How to fill out MD HTC-1?

To fill out MD HTC-1, businesses must provide their business information, details about their high technology activities, and complete the required sections for tax credit eligibility.

What is the purpose of MD HTC-1?

The purpose of MD HTC-1 is to allow high technology companies in Maryland to report their activities and apply for state tax credits, incentivizing growth in the tech sector.

What information must be reported on MD HTC-1?

The information that must be reported on MD HTC-1 includes the company name, address, federal tax identification number, details on high technology activities, and any applicable tax credits being claimed.

Fill out your homeowners property tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2024 Maryland Application Htc 1 Form Fill is not the form you're looking for?Search for another form here.

Keywords relevant to md homeowners property tax credit add

Related to 2024 md homeowners property tax credit application get

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.