CA BOE-262-AH/ASSR-139 - County Los Angeles 2022 free printable template

Show details

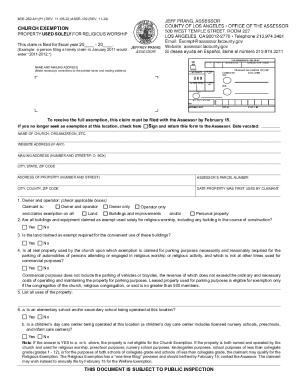

BOE262AH (P1) REV. 11 (0522) ASSR139 (REV. 822)CHURCH EXEMPTIONPROPERTY USED SOLELY FOR RELIGIOUS WORSHIP This claim is filed for fiscal year 20___ 20___.(Example: a person filing a timely claim in

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA BOE-262-AHASSR-139 - County Los Angeles

Edit your CA BOE-262-AHASSR-139 - County Los Angeles form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA BOE-262-AHASSR-139 - County Los Angeles form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA BOE-262-AHASSR-139 - County Los Angeles online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA BOE-262-AHASSR-139 - County Los Angeles. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA BOE-262-AH/ASSR-139 - County Los Angeles Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA BOE-262-AHASSR-139 - County Los Angeles

How to fill out church exemption

01

Obtain the necessary forms from the church or religious organization.

02

Fill out your personal information accurately, including your name, address, and contact details.

03

Provide information about your membership or involvement in the church, such as the date of joining and any duties or responsibilities you hold.

04

Include any supporting documentation, such as letters from church officials or records of attendance, if required.

05

Review the completed form for accuracy and completeness before submitting it to the appropriate authority.

Who needs church exemption?

01

Individuals who are members of or actively involved in a recognized church or religious organization may need a church exemption.

02

Church exemptions are often required for tax purposes or to qualify for certain benefits or privileges offered to members of a particular faith community.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for California homeowners property tax exemption?

You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year. Principal place of residence generally means where: You return at the end of the day.

What is the low income property tax exemption in California?

The California Constitution provides a $7,000 reduction in the taxable value for a qualifying owner-occupied home. The home must have been the principal place of residence of the owner on the lien date, January 1st.

At what age do you stop paying property tax in California?

Reappraisal Exclusion for Seniors - Occurring On or After April 1, 2021. This is a property tax savings program for those aged 55 or older who are selling their home and buying another home. Under Proposition 13, a home is normally appraised at its full market value at the time it is purchased.

How can I lower my property taxes in California?

If you own a home and occupy it as your principal place of residence, you may apply for a Homeowners' Exemption. This exemption will reduce your annual assessed value by $7,000. Exemption becomes ineligible for the exemption. Homeowners' Exemptions are not automatically transferred between properties.

Who qualifies for property tax exemption California?

You must be a property owner, co-owner or a purchaser named in a contract of sale. You must occupy your home as your principal place of residence as of 12:01 a.m., January 1 each year. Principal place of residence generally means where: You return at the end of the day.

How do I get over 65 property tax exemption in California?

The State Controller's Property Tax Postponement Program allows homeowners who are seniors, are blind, or have a disability to defer current-year property taxes on their principal residence if they meet certain criteria, including at least 40 percent equity in the home and an annual household income of $51,762 or less

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the CA BOE-262-AHASSR-139 - County Los Angeles in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your CA BOE-262-AHASSR-139 - County Los Angeles in minutes.

How do I fill out CA BOE-262-AHASSR-139 - County Los Angeles using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CA BOE-262-AHASSR-139 - County Los Angeles and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

How do I edit CA BOE-262-AHASSR-139 - County Los Angeles on an Android device?

You can edit, sign, and distribute CA BOE-262-AHASSR-139 - County Los Angeles on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is church exemption?

Church exemption is a provision that exempts certain religious organizations from paying taxes.

Who is required to file church exemption?

Religious organizations that meet the criteria for church exemption are required to file for it.

How to fill out church exemption?

To fill out church exemption, religious organizations must provide relevant information about their operations and finances.

What is the purpose of church exemption?

The purpose of church exemption is to recognize the unique role that religious organizations play in society and to provide them with financial relief.

What information must be reported on church exemption?

Information such as the organization's mission, activities, leadership, and financial status may need to be reported on church exemption forms.

Fill out your CA BOE-262-AHASSR-139 - County Los Angeles online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA BOE-262-AHASSR-139 - County Los Angeles is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.