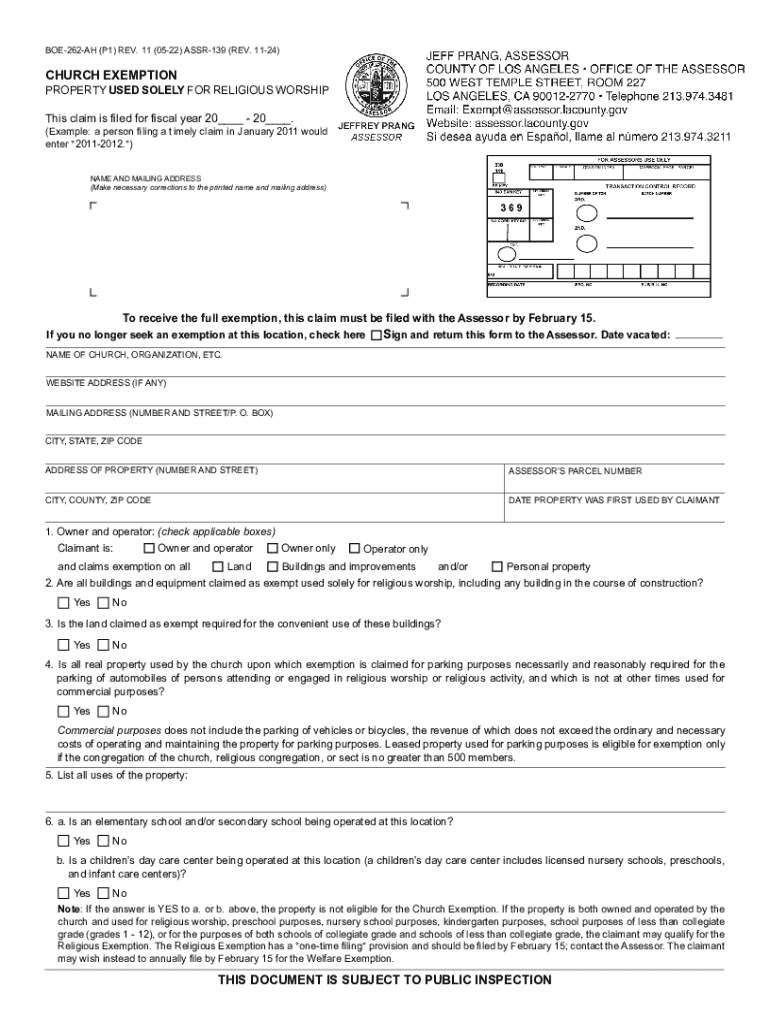

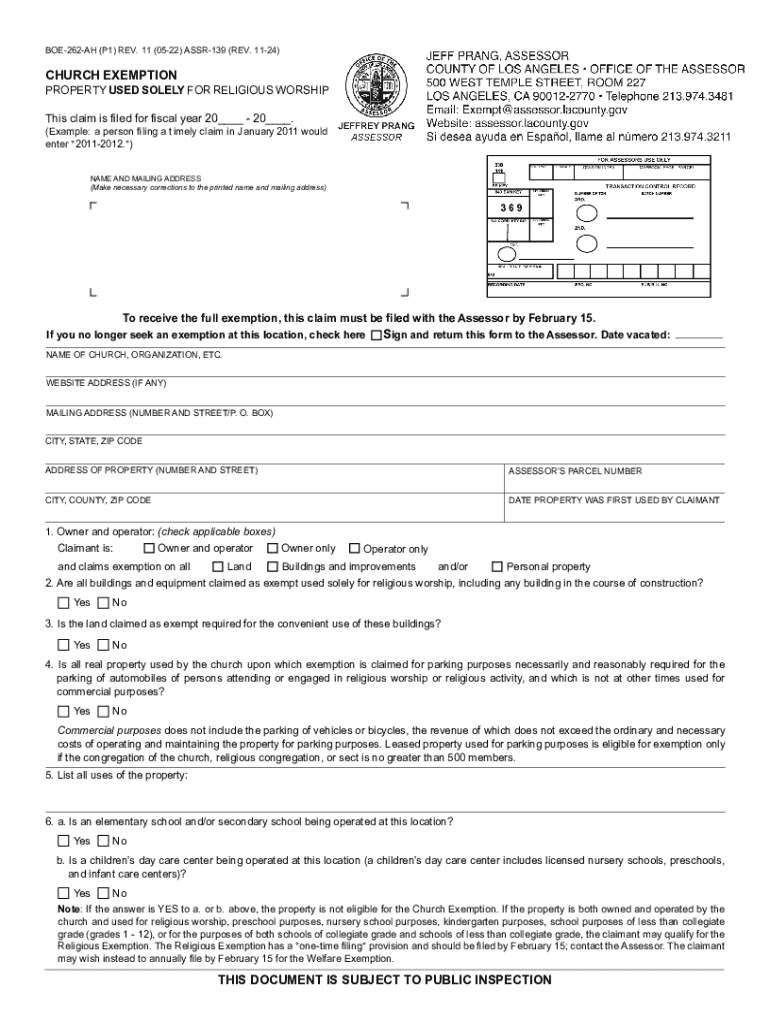

CA BOE-262-AH/ASSR-139 - County Los Angeles 2024-2025 free printable template

Get, Create, Make and Sign boe 262 ah form

Editing boe 262 ah 2024-2025 online

Uncompromising security for your PDF editing and eSignature needs

CA BOE-262-AH/ASSR-139 - County Los Angeles Form Versions

How to fill out boe 262 ah 2024-2025

How to fill out boe-262-ah p1 rev 11

Who needs boe-262-ah p1 rev 11?

A comprehensive guide to understanding church exemption forms

Understanding church exemption

Church exemption refers to the tax-exempt status granted to churches and religious organizations by the IRS. This exemption allows these entities to operate without being subjected to federal income tax, allowing them to allocate more resources towards their charitable missions and community service efforts.

The importance of tax-exempt status cannot be overstated. It not only helps churches save on operational costs but also enhances their credibility, makes them eligible for public and private grants, and encourages donations from individuals and corporations who appreciate the tax deductibility associated with their contributions.

Criteria for church tax-exempt status

To qualify for tax-exempt status, an organization must meet specific criteria set forth by the IRS. Generally, the designation of a church encompasses various fundamental characteristics including a distinct legal identity, a recognized leadership structure, and active worship activities.

An integrated auxiliary of a church, like a youth ministry or charitable arm, may also be treated as tax-exempt if it shares eligibility. To maintain this status, it’s essential to uphold transparency, regular financial reporting, and adherence to IRS guidelines.

Steps to apply for church exemption

Before applying for church exemption, it’s critical to assess your church’s qualifications. This step might include reviewing compliance with local laws and understanding IRS requirements. Consulting with legal or tax professionals can provide invaluable insights during this process.

Once you’ve established your eligibility, you can proceed with completing the application. The main document required is Form 1023, which is a detailed application for exemption. It includes a range of questions pertaining to your church’s operations, financials, and governance.

Understanding IRS requirements

Churches are automatically considered tax-exempt by the IRS under Section 501(c)(3), exempting them from federal income tax. Despite this automatic exemption, many churches opt for official recognition through an IRS letter of determination to solidify their status. Obtaining this letter can help with credibility and grant eligibility.

There are common misconceptions surrounding IRS requirements for churches. Some believe they do not need to file any forms, which is inaccurate. Depending on annual revenue, churches may have to submit Form 990, which provides details of financial activities.

Managing your church's tax-exempt status

To maintain tax-exempt status, it's essential for a church to keep accurate records of its finances and activities. Record keeping entails maintaining financial statements, donation records, meeting minutes, and compliance documents.

Other forms associated with church tax exemption

Churches may interact with several additional forms beyond their exemption application. Form 990 is among the most notable, serving as an annual report that some churches must file, detailing their financial standing to the IRS.

Other forms are necessary for various organizational types or specific activities, including the IRS application for an Employer Identification Number (EIN), which is crucial for reporting employee taxes and establishing the church's banking identity.

Exploring benefits of having a tax-exempt status

Holding a tax-exempt status comes with numerous financial advantages for churches. The most significant benefit is the ability to receive tax-deductible donations, which can significantly enhance fundraising efforts.

Recent developments and changes in church tax law

Tax laws surrounding churches are continually evolving. Recent updates to legislation have introduced new compliance measures and opportunities for religious organizations. It's crucial for churches to stay informed of these changes as they can impact everything from reporting requirements to eligibility for grants.

Notable case studies or court precedents can also profoundly influence how tax exemptions are interpreted. Churches must monitor legal developments to ensure adherence and proactive compliance.

Quick access tools

For churches looking to streamline their application process, having access to interactive tools can be beneficial. An interactive checklist for applying for church exemption can allow you to ensure that no steps are missed during the application process.

Additionally, a comprehensive FAQ section can aid churches in understanding common queries related to tax exemption. Consider providing downloadable resources, such as editable PDF templates, to improve efficiency while preparing necessary documentation.

Professional help and resources

Navigating the complexities of church tax exemption can be daunting. There may be times when seeking professional assistance is warranted, especially for larger organizations or those facing legal questions.

Legal and financial consulting can provide essential guidance on compliance, helping churches avoid pitfalls that could affect their tax status. Platforms like pdfFiller can simplify document management, allowing for seamless editing, signing, and collaboration on necessary forms.

User testimonials and case studies

Many churches have successfully navigated the church exemption application process to great benefit. Testimonials from organizations that have achieved tax exemption highlight their improved fundraising efforts and community support post-recognition.

Real-life use cases of utilizing pdfFiller for documentation purposes reveal how easy it is to manage forms digitally, leading to efficient completion and submission of the church exemption form and other critical documents.

Conclusion: making an informed decision

Assessing your church’s need for tax exemption starts with a thorough understanding of its activities, community purpose, and financial health. Evaluating these elements ensures that the path toward obtaining a church exemption is fruitful.

Using resources like pdfFiller can aid significantly in managing and processing related documents, notably streamlining the church exemption form and supporting your organization’s mission effectively.

People Also Ask about

Who qualifies for California homeowners property tax exemption?

What is the low income property tax exemption in California?

At what age do you stop paying property tax in California?

How can I lower my property taxes in California?

Who qualifies for property tax exemption California?

How do I get over 65 property tax exemption in California?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute boe 262 ah 2024-2025 online?

How do I edit boe 262 ah 2024-2025 online?

How do I complete boe 262 ah 2024-2025 on an iOS device?

What is boe-262-ah p1 rev 11?

Who is required to file boe-262-ah p1 rev 11?

How to fill out boe-262-ah p1 rev 11?

What is the purpose of boe-262-ah p1 rev 11?

What information must be reported on boe-262-ah p1 rev 11?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.