UK NHS AW8P 2023 free printable template

Show details

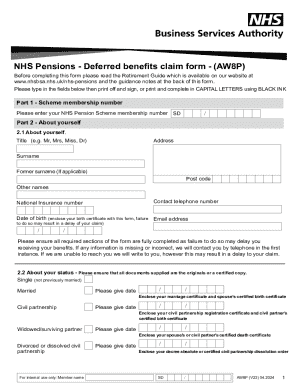

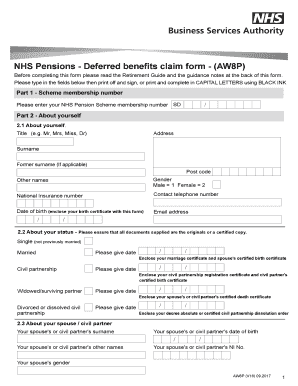

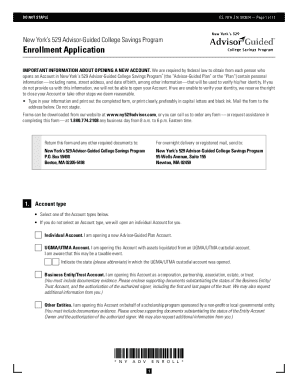

NHS Pensions Deferred benefits claim form (AW8P)Before completing this form please read the Retirement Guide which is available on our website at www.nhsbsa.nhs.uk/nhspensions and the guidance notes

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UK NHS AW8P

Edit your UK NHS AW8P form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK NHS AW8P form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UK NHS AW8P online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK NHS AW8P. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK NHS AW8P Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK NHS AW8P

How to fill out UK NHS AW8P

01

Download the UK NHS AW8P form from the official NHS website.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal details including name, address, and contact information in the designated sections.

04

Fill in details about your medical history as required, including any relevant diagnoses.

05

Include information about the treatments or services you are requesting.

06

If applicable, provide details of your current medications and any allergies.

07

Review all information for accuracy before signing the declaration at the end of the form.

08

Submit the completed form as per the instructions provided, either online or by post.

Who needs UK NHS AW8P?

01

Individuals seeking to access specific medical treatments or services from the NHS.

02

Patients who have received an NHS referral for treatments that require a completed AW8P form.

03

People applying for funding or support related to their healthcare needs within the NHS framework.

Fill

form

: Try Risk Free

People Also Ask about

What is an AW8P form?

NHS Pensions - Deferred benefits claim form (AW8P)

How can I access my NHS Pension if I quit?

If you are leaving NHS employment, or just the Scheme, you may be able to transfer your pension rights to a new pension provider. You may only transfer to a pension scheme or arrangement that is registered with HM Revenue and Customs (HMRC) and able to accept a transfer payment from the NHS Pension Scheme.

What is a AW8P form?

NHS Pensions - Deferred benefits claim form (AW8P)

What form do I need to claim my NHS pension?

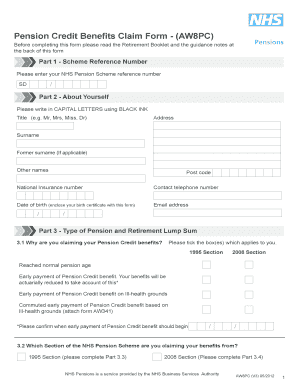

The purpose of this factsheet is to clarify which pension application form should be completed when a member claims their NHS Pension Scheme benefits: retirement benefits claim form (AW8), deferred benefits claim form (AW8P) or application form for Pension Credit members (AW8PC).

How to calculate 1995 NHS pension?

Pensionable pay x pensionable membership x 1/80 = pension. The retirement lump sum is calculated as: Pensionable pay x pensionable membership x 3/80 = retirement lump sum. Part years will also count towards your pension.

Can I access my NHS pension details online?

Pensions Online is only available on a HSCN connection. If you have an N3 service or need a HSCN connection, you can read guidance on the NHS Digital website.

How do I claim my NHS Pension?

If you are still in NHS employment you should contact your employer for a Retirement benefits claim form (AW8) which they can get from the Employer Hub. This includes if you opted out of the scheme, achieved maximum membership or maximum pensionable age but remained in NHS employment.

How do I find out about my old NHS pension?

You can phone the Pension Tracing Service on 0800 731 0193 or use the link below to search their online directory for contact details.

Who do I contact about my old NHS pension?

For Member pension queries, retirement calculations, benefit statements or NHS Pension Scheme information: Email: nhsbsa.pensionsmember@nhsbsa.nhs.uk. Telephone the Member Helpline: 0300 3301 346. Or visit the NHS Pensions Member Hub.

Can I claim back my NHS Pension contributions?

If you have re-entered pensionable NHS employment after a break of 12 months or more, you may be entitled to a refund of your earlier contributions. If you have requested a transfer of this earlier membership (within the transfer time limits) to another pension arrangement you will not be able to request a refund.

Who do I send my AW8 to?

NHS Pension Scheme Retirement Guide Once you complete the AW8, you can submit it to PCSE, along with your documents, via our online enquiries form, using the tile below.

How many years do you need for a full NHS Pension?

Where maximum 45 years pensionable membership is reached after age 60 but before age 65 a member must cease paying contributions when 45 years membership is achieved.

How do I find out how much my old NHS pension is worth?

If you're an active member, your employer may be able to provide different types of an estimate. You should check with them first before contacting NHS Pensions. You can request an estimate from us if: your employer can't provide you with an estimate.

How do you complete AW8?

The member should complete Parts 7 to 15 of the form with their personal details and return the form to their employer together with any relevant certificates. Only original or certified copies of original documents are acceptable.

How do you get AW8 form?

If you are still in NHS employment you should contact your employer for a Retirement benefits claim form (AW8) which they can get from the Employer Hub. This includes if you opted out of the scheme, achieved maximum membership or maximum pensionable age but remained in NHS employment.

When can I claim my NHS Pension?

The minimum pension age is 55.

What form do I need to claim my NHS Pension?

The purpose of this factsheet is to clarify which pension application form should be completed when a member claims their NHS Pension Scheme benefits: retirement benefits claim form (AW8), deferred benefits claim form (AW8P) or application form for Pension Credit members (AW8PC).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find UK NHS AW8P?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the UK NHS AW8P. Open it immediately and start altering it with sophisticated capabilities.

Can I create an eSignature for the UK NHS AW8P in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your UK NHS AW8P directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete UK NHS AW8P on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your UK NHS AW8P from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is UK NHS AW8P?

UK NHS AW8P is a form used by the National Health Service (NHS) in the UK to collect information about the employment status and remuneration of NHS staff for remuneration purposes.

Who is required to file UK NHS AW8P?

The UK NHS AW8P must be filed by NHS employers for each employee who is receiving remuneration, including those in temporary or contracted positions.

How to fill out UK NHS AW8P?

To fill out UK NHS AW8P, employers should gather necessary employment details of the staff, including personal information, job title, salary details, and any additional allowances or bonuses, and input this data into the form accurately.

What is the purpose of UK NHS AW8P?

The purpose of UK NHS AW8P is to ensure accurate reporting of NHS workforce remuneration and to facilitate payroll processing, along with compliance with NHS regulations.

What information must be reported on UK NHS AW8P?

The UK NHS AW8P must report information including employee's personal details, employment start and end dates, job title, pay scale, any additional payments, deductions, and other relevant employment information.

Fill out your UK NHS AW8P online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK NHS aw8p is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.