Get the free Short-term Bank Facilities

Show details

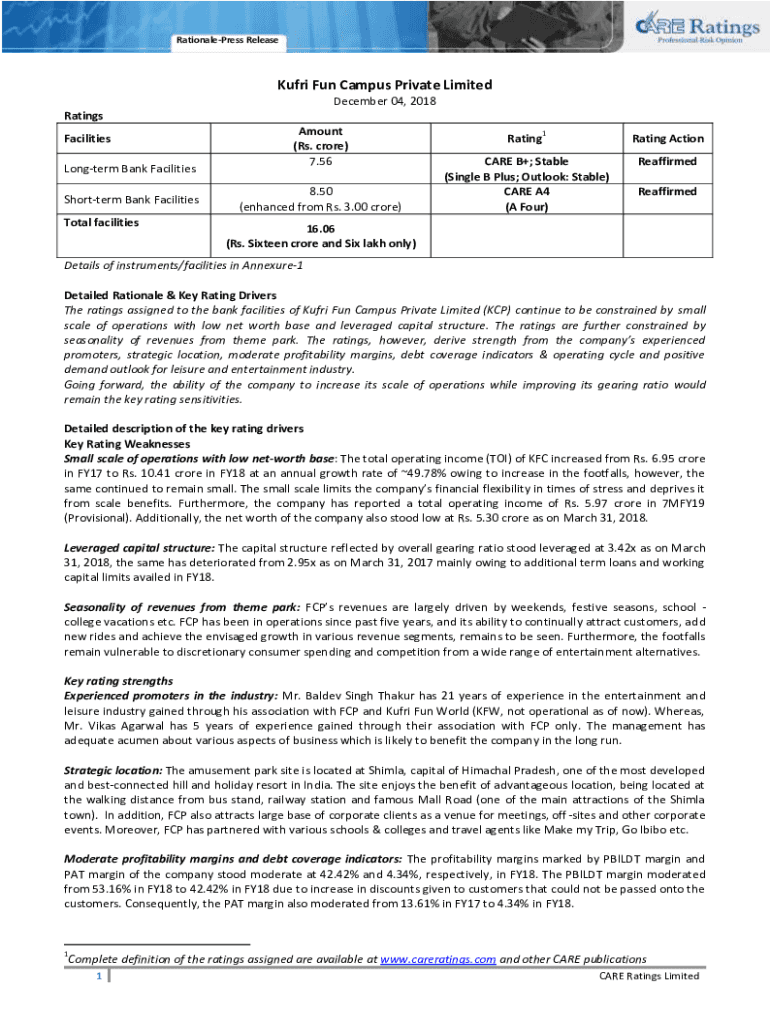

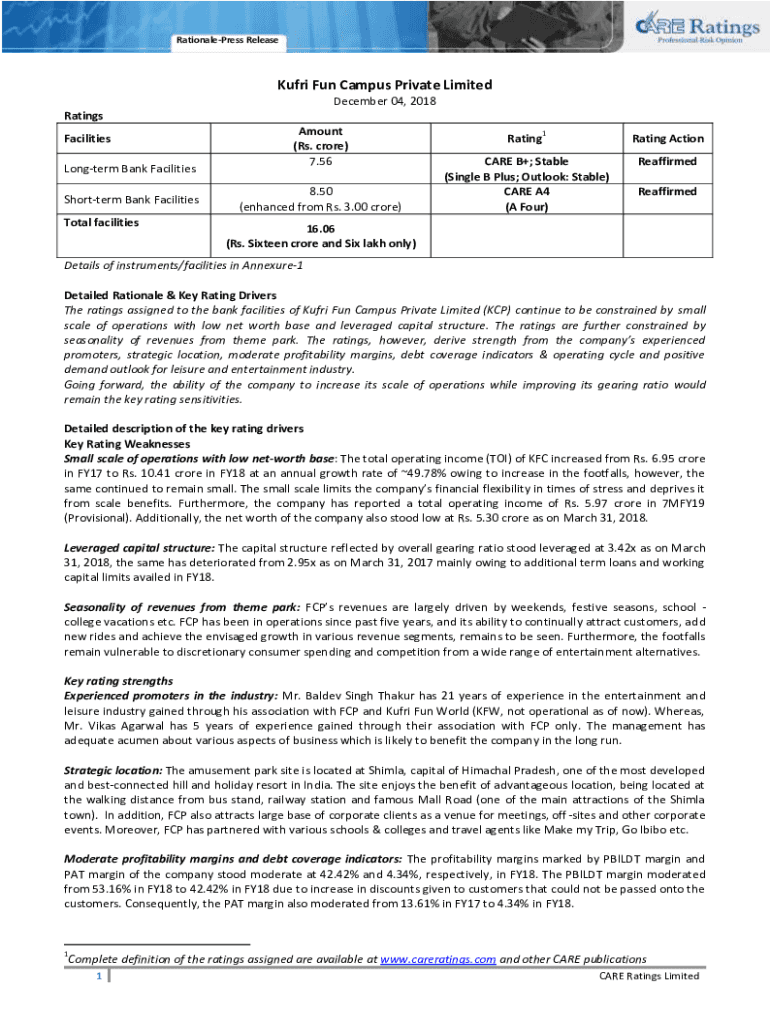

RationalePress ReleaseKufri Fun Campus Private Limited December 04, 2018, Ratings Facilities Long term Bank Facilities Short term Bank Facilities Total facilitiesAmount (Rs. Crore) 7.56 8.50 (enhanced

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign short-term bank facilities

Edit your short-term bank facilities form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your short-term bank facilities form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing short-term bank facilities online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit short-term bank facilities. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out short-term bank facilities

How to fill out short-term bank facilities

01

Determine the purpose of the short-term bank facilities.

02

Gather all the necessary documents required by the bank.

03

Submit the application form along with the required documents.

04

Provide any additional information or documentation requested by the bank.

05

Wait for the bank's decision on approving the short-term bank facilities.

06

Once approved, carefully review the terms and conditions before signing the agreement.

07

Utilize the funds responsibly and make timely repayments to avoid any penalties.

Who needs short-term bank facilities?

01

Small businesses looking to meet short-term cash flow needs.

02

Individuals facing unexpected financial emergencies.

03

Startups in need of working capital to fund their operations.

04

Companies experiencing seasonal fluctuations in revenue and need temporary financing.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my short-term bank facilities directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your short-term bank facilities and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit short-term bank facilities on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing short-term bank facilities, you can start right away.

How do I edit short-term bank facilities on an iOS device?

Create, edit, and share short-term bank facilities from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is short-term bank facilities?

Short-term bank facilities are financial arrangements provided by a bank to a borrower for a specific period of time, typically one year or less, to meet short-term liquidity needs.

Who is required to file short-term bank facilities?

Companies and individuals who have obtained short-term bank facilities are required to file relevant documentation with regulatory authorities, such as the Securities and Exchange Commission (SEC).

How to fill out short-term bank facilities?

To fill out short-term bank facilities, borrowers need to provide detailed information about the terms of the facility, the amount borrowed, interest rates, repayment schedules, and any collateral offered.

What is the purpose of short-term bank facilities?

The purpose of short-term bank facilities is to provide borrowers with access to temporary funding to meet immediate financial needs, such as funding working capital requirements or covering short-term cash flow gaps.

What information must be reported on short-term bank facilities?

Information that must be reported on short-term bank facilities includes the amount borrowed, interest rates, maturity dates, collateral details, and any fees associated with the facility.

Fill out your short-term bank facilities online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Short-Term Bank Facilities is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.