IRS 656-B 2023 free printable template

Show details

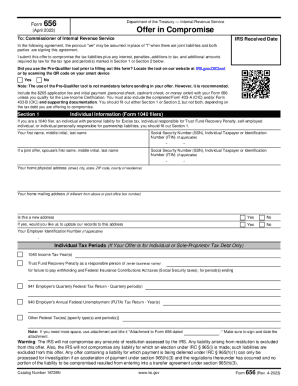

Make checks payable to the United States Treasury and attach to the front of your Form 656 Offer in Compromise. Form 656 Booklet Offer in Compromise CONTENTS What you need to know. 1 Paying for your offer. 3 How to apply. A video on how to complete an offer in compromise is available for viewing on our website at https //www. Do not send original documents. Fill out Form 656. The Form 656 identifies the tax years and type of tax you would like to compromise. IRS.gov. For answers to frequently...asked questions about the offer process from submission to closure see Offer in Compromise FAQs. Furthermore the IRS will not compromise any IRC 965 tax liability for which an election was made under IRC 965 i. Note Include attachments if additional space is needed to respond completely to any question. This form should only be used with the Form 656 Offer in Compromise. Also the IRS will not compromise any liability for which an election under IRC 965 i is made such liabilities are excluded...from this offer. irsvideos. gov/Individual/PayingTaxes/CompletingForm656-OfferInCompromiseApplication* Forms and publications are available by calling 800-TAX-FORM 800-829-3676 by visiting your local IRS office or at www. Taxpayer resources The Taxpayer Advocate Service TAS is an independent organization within the Internal Revenue Service IRS that helps taxpayers and protects taxpayers rights. TAS can offer you help if your tax problem is causing a financial difficulty you ve tried and been...unable to resolve your issue with the IRS or you believe an IRS system process or procedure just isn t working as it should. If you qualify for TAS assistance which is always free TAS will do everything possible to help you. Visit www. taxpayeradvocate. irs. gov or call 877-777-4778. Low Income Taxpayer Clinics LITCs are independent from the IRS and TAS* LITCs represent individuals whose income is below a certain level and who need to resolve tax problems with the IRS* LITCs can represent...taxpayers in audits appeals and tax collection disputes before the IRS and in court. In addition LITCs can provide information about taxpayer rights and responsibilities in different languages for individuals who speak English as a second language. Services are offered for free or a small fee. For more information or to find an LITC near you see the LITC page at www. taxpayeradvocate. irs. gov/litc or IRS Publication 4134 Low Income Taxpayer Clinic List. This publication is also available online...at www*irs*gov/forms-pubs or by calling the IRS toll-free at 800-TAX-FORM 800-829-3676. Submitting an application does not ensure that the IRS will accept your offer. It begins a process of evaluation and verification by the IRS taking into consideration any special circumstances that may affect your ability to pay. This booklet will lead you through a series of steps to help you calculate an appropriate offer based on your assets income expenses and future earning potential* The application...requires you to describe your financial situation in detail so before you begin make sure you have the necessary information and documentation* Are You Eligible Before your offer can be considered you must 1 file all tax returns you are legally required to file 2 have received a bill for at least one tax debt included on your offer 3 make all required estimated tax payments for the current year and 4 if you are a business owner with employees make all required federal tax deposits for the...current quarter and the two preceding quarters.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 656-B

How to edit IRS 656-B

How to fill out IRS 656-B

Instructions and Help about IRS 656-B

How to edit IRS 656-B

Editing IRS 656-B is straightforward when using tools like pdfFiller. Begin by uploading the form to the platform where you can easily make changes. Utilize the editing features to fill in missing information or correct any errors before finalizing the document for submission.

How to fill out IRS 656-B

Filling out IRS 656-B involves several steps to ensure accuracy. Start by gathering all required financial information and documentation related to your tax situation. Follow the structured sections in the form carefully, ensuring each entry is accurate and complete. It’s best to review your form thoroughly before submission to prevent any potential issues.

About IRS 656-B 2023 previous version

What is IRS 656-B?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 656-B 2023 previous version

What is IRS 656-B?

IRS 656-B is the official form used by taxpayers who wish to apply for an Offer in Compromise (OIC) due to their inability to pay their tax debts. This form is essential for taxpayers seeking a resolution with the IRS under certain circumstances, allowing for reduced payment options based on financial hardship or other qualifying factors.

What is the purpose of this form?

The primary purpose of IRS 656-B is to provide a structured means for taxpayers to propose an Offer in Compromise to the IRS. This offer allows the taxpayer to settle their tax liabilities for less than the full amount owed, provided they demonstrate inability to meet payment obligations. The IRS evaluates submissions based on the taxpayer's income, expenses, and overall financial situation.

Who needs the form?

IRS 656-B must be completed by taxpayers who are experiencing financial hardship and wishing to negotiate a settlement of their unpaid taxes. Individuals and businesses alike may find this form necessary if they are unable to pay off their tax debts and are seeking an OIC. It is vital for filers to assess their specific circumstances to determine eligibility before submitting this form.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 656-B if your financial status reflects that you can fully pay your tax liabilities or if you have filed for bankruptcy. Additionally, if you are currently in the process of an IRS installment agreement that meets your tax obligations, filing this form may not be necessary. Always review your financial and tax situation carefully to ensure proper compliance.

Components of the form

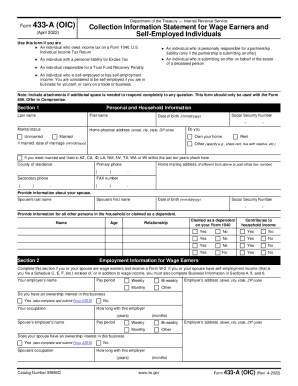

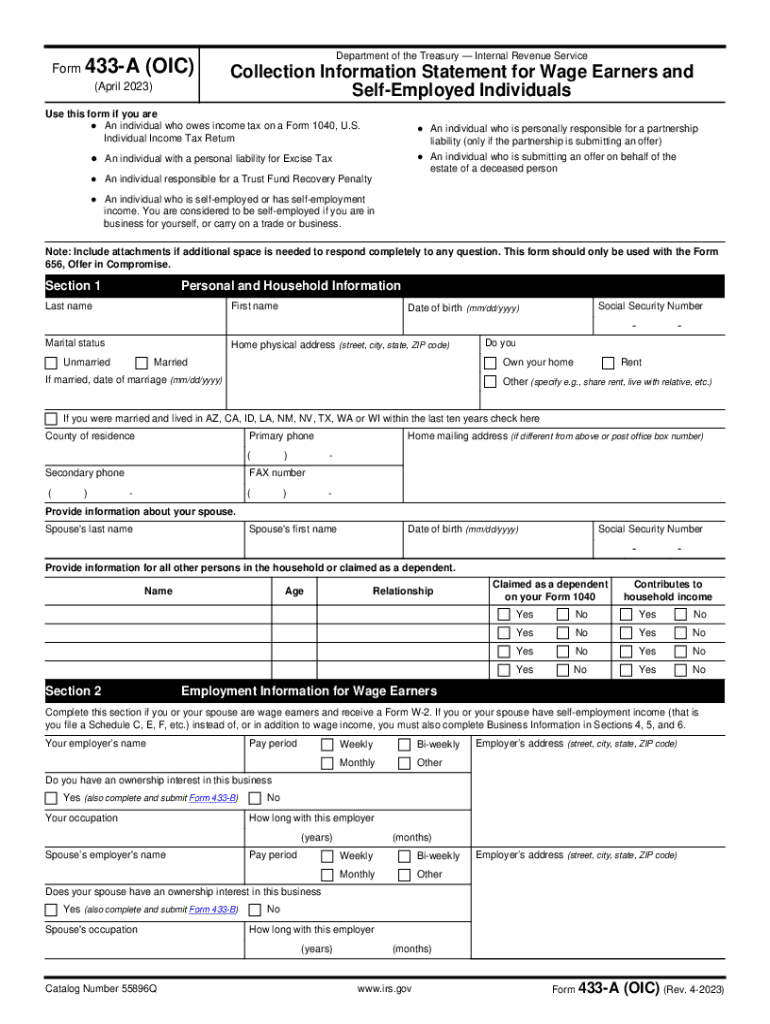

IRS 656-B contains several key components that taxpayers must address when submitting their application. These components include personal identification information, details about the tax liability, and a collection information statement that outlines the taxpayer's financial situation. Each section must be completed accurately to ensure the IRS can effectively evaluate the offer.

What are the penalties for not issuing the form?

A failure to file IRS 656-B or to properly fulfill any obligations associated with the Offer in Compromise can lead to potential penalties, including continued collection efforts by the IRS. The taxpayer is responsible for any outstanding taxes until a formal agreement is reached. Additionally, improper or incomplete submissions may lead to delays or denials of the OIC, which can exacerbate tax liability issues.

What information do you need when you file the form?

When filing IRS 656-B, you will need detailed financial information, including income sources, expenses, assets, and liabilities. This information will help the IRS assess your ability to pay off your tax debts. Documentation, such as pay stubs, bank statements, and records of monthly expenses, should be prepared to support your application for an OIC and to ensure the IRS has complete information.

Is the form accompanied by other forms?

Yes, IRS 656-B is often submitted alongside Form 433-A (OIC) or Form 433-B (OIC) depending on whether you are an individual or a business. These forms provide detailed financial information that is necessary for the IRS to evaluate your Offer in Compromise. Ensuring that all necessary forms are submitted together helps facilitate the review process.

Where do I send the form?

Once completed, IRS 656-B should be mailed to the address specified in the form instructions based on your specific situation. It is crucial to ensure that it is sent to the correct location to prevent processing delays. Always consider obtaining a tracking number or confirmation receipt when submitting tax forms to the IRS for record-keeping purposes.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Perfect... Thank you so much. Expensive but the experience has been worth the cost.

it is so much easily to redact any confidential information.

See what our users say