ANZ Application for Standby Letter of Credit or Demand Guarantee 2019-2025 free printable template

Show details

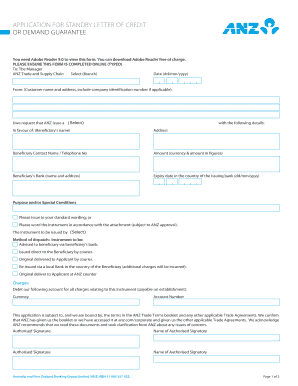

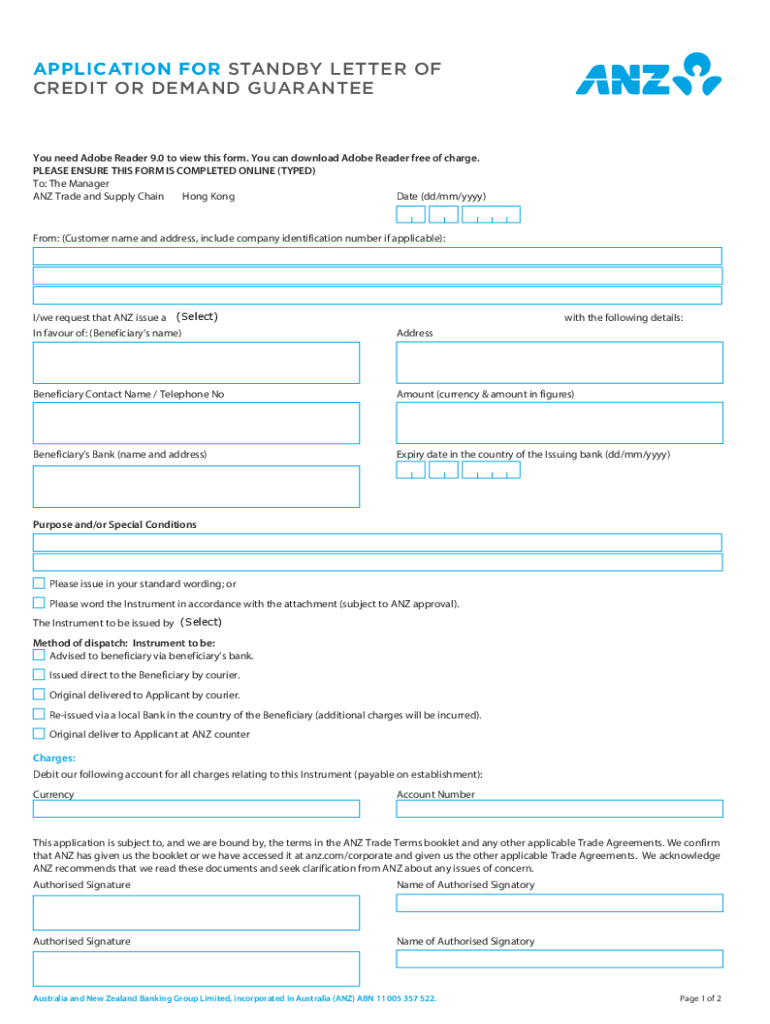

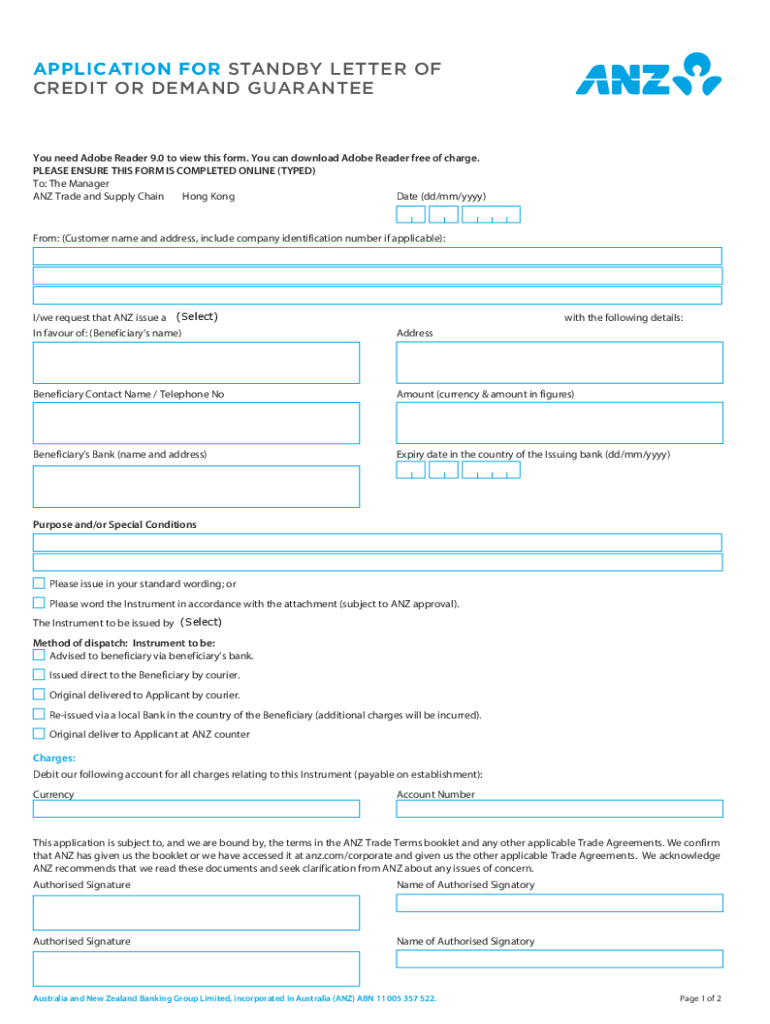

APPLICATION FOR STANDBY LETTER OF CREDIT OR DEMAND Guarantee need Adobe Reader 9.0 to view this form. You can download Adobe Reader free of charge. PLEASE ENSURE THIS FORM IS COMPLETED ONLINE (TYPED)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ANZ Application for Standby Letter of Credit or

Edit your ANZ Application for Standby Letter of Credit or form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ANZ Application for Standby Letter of Credit or form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ANZ Application for Standby Letter of Credit or online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ANZ Application for Standby Letter of Credit or. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

ANZ Application for Standby Letter of Credit or Demand Guarantee Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ANZ Application for Standby Letter of Credit or

How to fill out ANZ Application for Standby Letter of Credit or Demand

01

Obtain the ANZ Application form for Standby Letter of Credit or Demand from the ANZ website or a local branch.

02

Fill in your personal and business details in the application form, including your name, address, and contact information.

03

Provide details of the beneficiary who will receive the Standby Letter of Credit.

04

Specify the amount and currency for the Standby Letter of Credit.

05

Indicate the purpose of the Standby Letter of Credit and attach any necessary supporting documents.

06

Review all information provided to ensure accuracy and completeness.

07

Sign and date the application form where indicated.

08

Submit the completed application form to your local ANZ branch or through the prescribed online method.

Who needs ANZ Application for Standby Letter of Credit or Demand?

01

Businesses or individuals who need to guarantee payment or performance in international or domestic trade transactions.

02

Companies requiring assurance for contracts, particularly in construction, import/export, or service industries.

03

Importers and exporters who seek to provide security to their suppliers or contractors.

Fill

form

: Try Risk Free

People Also Ask about

How much does an SBLC cost?

Once the buyer fulfills all the conditions and the bank deems them fit for receiving the credit, the bank issues them an SBLC and charges 1% to 10% of the total amount as an annual fee for as long as the standby letter of credit is valid.

What is a standby letter of guarantee?

A Standby Letter of Credit (SBLC / SLOC) is a guarantee that is made by a bank on behalf of a client, which ensures payment will be made even if their client cannot fulfill the payment. It is a payment of last resort from the bank, and ideally, is never meant to be used.

What is the difference between a standby letter of credit and a demand guarantee?

There is no difference between a Guarantee and an SBLC in regards to their intended purpose however they may be governed by different rules and local laws. Underpin performance based, non-monetary obligations and payment under the Standby which are triggered in the event of non-performance of a future event.

Is a standby letter of credit a guarantee?

The Standby Letter of Credit (Standby LC) is, like the guarantee, commonly used to cover the risk of a contract party not fulfilling agreed obligations, for instance failure to pay or deliver. Standby LCs can be used in open account trade as well as a complement to collections and documentary credits (DCs).

What does a standby letter of credit do?

The Standby Letter of Credit (Standby LC) is, like the guarantee, commonly used to cover the risk of a contract party not fulfilling agreed obligations, for instance failure to pay or deliver. Standby LCs can be used in open account trade as well as a complement to collections and documentary credits (DCs).

Is a standby letter of credit a demand guarantee?

Standby Letters of Credit are similar to Demand Guarantees in that they provide assurances in the event of non-payment, non-performance, or non- delivery. In some countries the local market practice is to issue or receive Standby Letters of Credit as opposed to Demand Guarantees.

What is ANZ standby letter of credit?

Bank Guarantees/Standby Letters of Credit (SBLC) are used to secure payment of a stated sum of money to a named party (the beneficiary) in the event of non-performance or default by a party in the relationship.

What is the difference between letter of credit and standby letter of credit?

To simplify, LC is a primary method of payment, while, SBLC is a secondary method of payment i.e., payment under SBLC will be made only when buyer defaults in making payment to supplier.

What is the primary difference between a standby letter of credit and a bank guarantee?

Key Takeaways. A bank guarantee is a promise from a lending institution that ensures the bank will step up if a debtor can't cover a debt. Letters of credit are also financial promises on behalf of one party in a transaction and are especially significant in international trade.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the ANZ Application for Standby Letter of Credit or in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your ANZ Application for Standby Letter of Credit or.

How do I fill out the ANZ Application for Standby Letter of Credit or form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign ANZ Application for Standby Letter of Credit or. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Can I edit ANZ Application for Standby Letter of Credit or on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share ANZ Application for Standby Letter of Credit or from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is ANZ Application for Standby Letter of Credit or Demand?

The ANZ Application for Standby Letter of Credit or Demand is a financial document used to request an assurance from ANZ Bank that payments will be made to a beneficiary in the event of default by the applicant.

Who is required to file ANZ Application for Standby Letter of Credit or Demand?

The applicant, typically a business or individual seeking credit, is required to file the ANZ Application for Standby Letter of Credit or Demand.

How to fill out ANZ Application for Standby Letter of Credit or Demand?

To fill out the ANZ Application for Standby Letter of Credit or Demand, applicants must provide their details, the beneficiary's information, the amount requested, the purpose of the credit, and any specific terms or conditions.

What is the purpose of ANZ Application for Standby Letter of Credit or Demand?

The purpose of the ANZ Application for Standby Letter of Credit or Demand is to provide a financial guarantee to the beneficiary that funds will be available in case the applicant fails to meet their contractual obligations.

What information must be reported on ANZ Application for Standby Letter of Credit or Demand?

The application must report the applicant's and beneficiary's names and addresses, the amount of the letter of credit, the purpose of the credit, expiration date, and any special conditions or requirements.

Fill out your ANZ Application for Standby Letter of Credit or online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

ANZ Application For Standby Letter Of Credit Or is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.