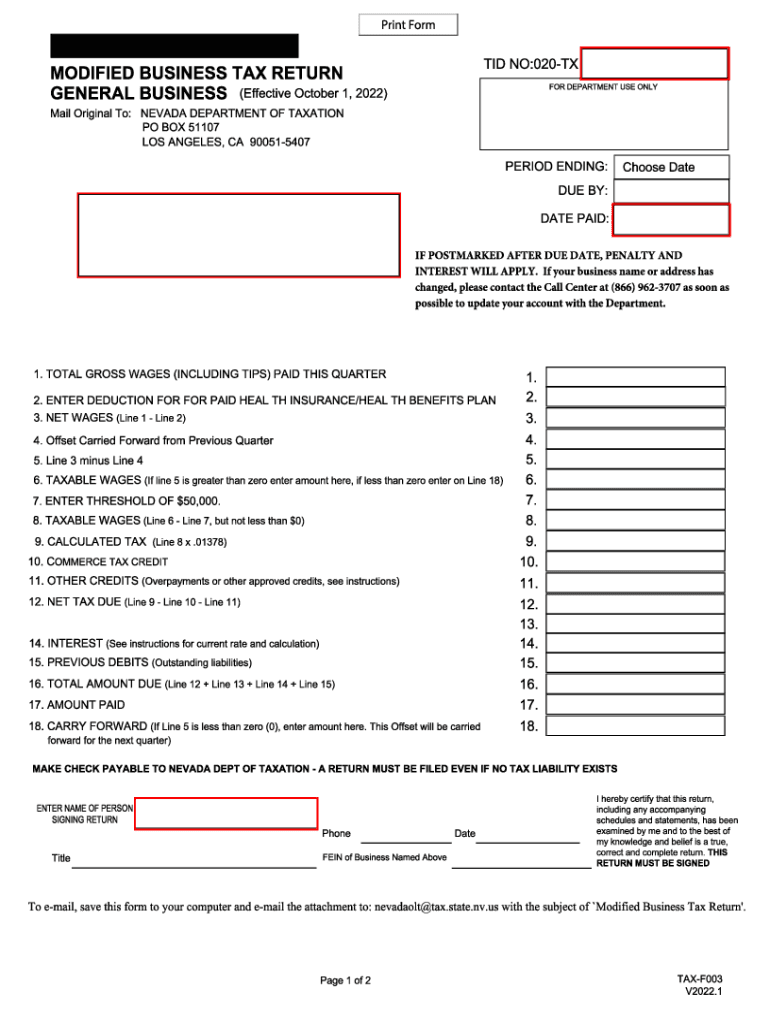

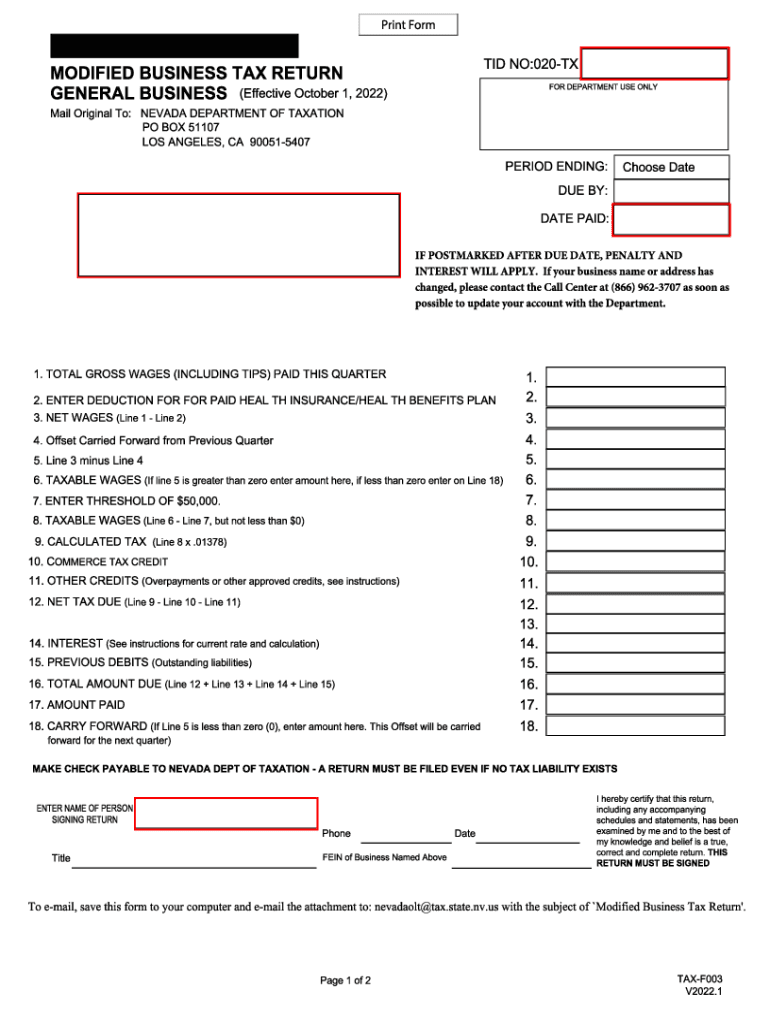

NV Modified Business Tax Return General Business 2022 free printable template

Get, Create, Make and Sign visio- modified business tax

How to edit visio- modified business tax online

Uncompromising security for your PDF editing and eSignature needs

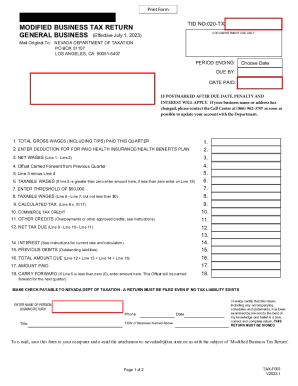

NV Modified Business Tax Return General Business Form Versions

How to fill out visio- modified business tax

How to fill out NV Modified Business Tax Return General Business

Who needs NV Modified Business Tax Return General Business?

Instructions and Help about visio- modified business tax

Music good evening my friends it is November 6, 2018, the actual midterm election day a correction from yesterday I thought it was yesterday, but it was actually today, so I guess we're still waiting on the results of that for those of you interested, but we are going to be talking about a little of weather and then something pretty interesting I found that there's not much talk going on about but first let's talk about our temperatures we can clearly see a little warmer in the Northeast today than it was yesterday, but we could still see this big dip in the jet stream here allowing all that cold air to come down to the Midwest the entire West basically the entire top half of the country is basically in 40s 30s and even 19's we are dropping below 20 degrees in some areas a lot of wind going on around the Great Lakes I have a chart here to show you that we also have winter weather advisories going on currently right now in Colorado right in this area here just leaving Colorado, and then we got Nebraska South Nebraska and then Northwest Kansas all under winter weather advisories, so there is snowfall going on in these areas that is part of that dip that has been coming down this way, and it's kind of interacting with the Great Lakes now too, so we have some wind advisories over the Great Lakes which is also aiding in what will be soon lake effect snow around the Buffalo areas in Watertown, so we're going to be talking a lot about that in this area I mean not over here by Michigan rather excuse me so anyway with that said this is what passed over last night we were talking about the tornado situation going from Louisiana all the way up through Tennessee and Kentucky then we had more touchdowns there was more damage reported I will put that all into another video as of right now at frame 200 we could see a little of some severe weather brewing around the Lewis area through Mississippi Alabama Florida and then moving up through Georgia and South Carolina, so we're going to keep an eye on that as well this is actually expected to be that second round that comes up and then begins to do that low pressure spin over the Northeast, so we got to see what happens with that when it mixes with this cold air that is still coming down from Canada, so we have a lot to watch there and really quick yesterday we spoke of tropical storm Xavier and the Pacific we said it would be a non threat, and it's still looking to be that way as we see it as now remnants of Xavier it is breaking up still continuing to head west away from land which is a good thing, and now I want to bring your attention to something pretty interesting I found while searching through the earthquake data maps I do this every day I check the daily earthquakes and then sometimes I go back seven days just to see what's been going on, and I noticed in the Nevada area this is a Nevada here mostly earthquakes are marked by these circles here so if you click on one you could see the information down in...

People Also Ask about

What is the MBT GB return in Nevada?

Does Nevada have a state withholding form?

What is the commerce tax threshold in Nevada?

Who must file a Nevada commerce tax return?

How do I get MBT in Nevada?

Who needs to file Nevada Commerce tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my visio- modified business tax directly from Gmail?

Can I edit visio- modified business tax on an iOS device?

Can I edit visio- modified business tax on an Android device?

What is NV Modified Business Tax Return General Business?

Who is required to file NV Modified Business Tax Return General Business?

How to fill out NV Modified Business Tax Return General Business?

What is the purpose of NV Modified Business Tax Return General Business?

What information must be reported on NV Modified Business Tax Return General Business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.