NV Modified Business Tax Return General Business 2023-2026 free printable template

Show details

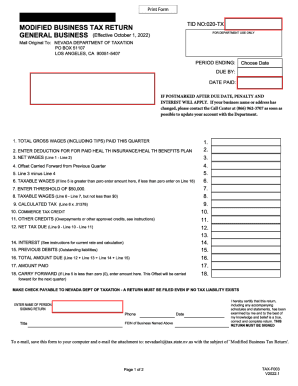

This document is a tax return form for general businesses in Nevada, used for reporting modified business tax due based on total gross wages and other deductions.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign modified business tax return form

Edit your modified business tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pdffiller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nevada department of taxation modified business tax return online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit modified business tax form nevada. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NV Modified Business Tax Return General Business Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out this document is a tax return form for blackout data for discretion add comments and more msockid 0b1f17eee567615b0f260249e40d60c7

How to fill out NV Modified Business Tax Return General Business

01

Obtain the NV Modified Business Tax Return form from the Nevada Department of Taxation website.

02

Fill in your business information, including the name, address, and business type.

03

Report your gross revenues on the designated line.

04

Calculate the taxable amount by subtracting any exemptions as specified in the instructions.

05

Determine the tax due based on the applicable tax rate for your business.

06

Complete any additional schedules required for your specific business activities.

07

Sign and date the form to certify that the information provided is accurate.

08

Submit the completed form along with any payment to the Nevada Department of Taxation by the due date.

Who needs NV Modified Business Tax Return General Business?

01

Any business operating in Nevada that meets the minimum revenue threshold for Modified Business Tax.

02

Corporations, partnerships, and sole proprietorships that generate income in Nevada.

03

Businesses registered with the Nevada Secretary of State that are subject to business licensing and taxation.

Fill

nv mbt form

: Try Risk Free

People Also Ask about nv modified business tax form

What is the MBT GB return in Nevada?

Modified Business Tax Return-General Businesses (10-1-22 to Current) This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. Effective July 1, 2019 the tax rate changes to 1.378% from 1.475%.

Does Nevada have a state withholding form?

Nevada does not use a state withholding form because there is no personal income tax in Nevada.

What is the commerce tax threshold in Nevada?

What entities are subject to Commerce Tax? Each business entity whose Nevada gross revenue in a taxable year exceeds $4,000,000 is required to file the Commerce Tax return.

Who must file a Nevada commerce tax return?

The tax is imposed on businesses with a Nevada gross revenue exceeding $4,000,000 in the taxable year. The Commerce Tax return is due 45 days following the end of the fiscal year (June 30). If the 45th day falls on a weekend or holiday, the return is due on the next business day.

How do I get MBT in Nevada?

How do I register for this tax? When you register with the Nevada Employment Security Division (ESD) for Unemployment Compensation for your employees you are automatically registered with the Department of Taxation for Modified Business Tax. You will start receiving tax returns from the Department of Taxation.

Who needs to file Nevada Commerce tax return?

Business entities with Nevada gross revenue over $4,000,000 during the taxable year are required to file the Commerce Tax return. Refer to Filing Requirements FAQs for more information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 150 211 156 to be eSigned by others?

When you're ready to share your nv modified business tax return, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I execute oregon form 150 211 156 online?

With pdfFiller, you may easily complete and sign NV Modified Business Tax Return General online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the NV Modified Business Tax Return General electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your NV Modified Business Tax Return General and you'll be done in minutes.

What is NV Modified Business Tax Return General Business?

The NV Modified Business Tax Return General Business is a tax form used by businesses in Nevada to report their modified business tax liability based on their gross revenue and taxable payroll.

Who is required to file NV Modified Business Tax Return General Business?

Any business operating in Nevada with a taxable income of $4,000 or more in gross revenue during the quarter is required to file the NV Modified Business Tax Return General Business.

How to fill out NV Modified Business Tax Return General Business?

To fill out the NV Modified Business Tax Return General Business, a business must provide information such as gross wages paid, taxable revenue, and calculate the business tax due based on the applicable tax rates on the taxable wages.

What is the purpose of NV Modified Business Tax Return General Business?

The purpose of the NV Modified Business Tax Return General Business is to collect revenues to fund various state programs, including education and public safety, based on the business operations within Nevada.

What information must be reported on NV Modified Business Tax Return General Business?

The information that must be reported includes total gross payroll, adjusted gross revenue, and any deductions allowed under Nevada tax law, as well as the calculated tax amount due.

Fill out your NV Modified Business Tax Return General online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NV Modified Business Tax Return General is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.