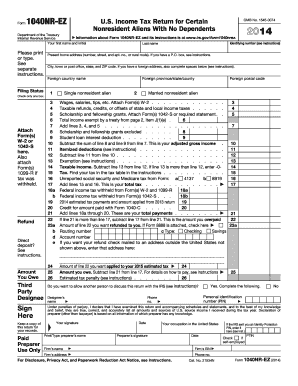

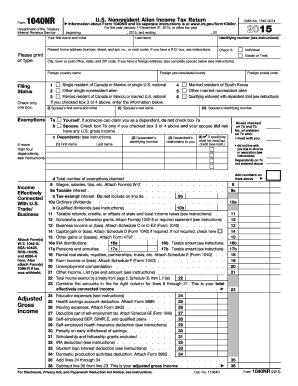

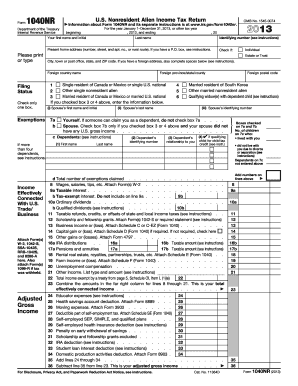

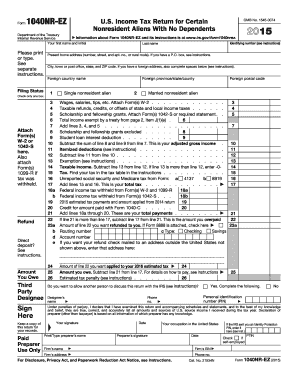

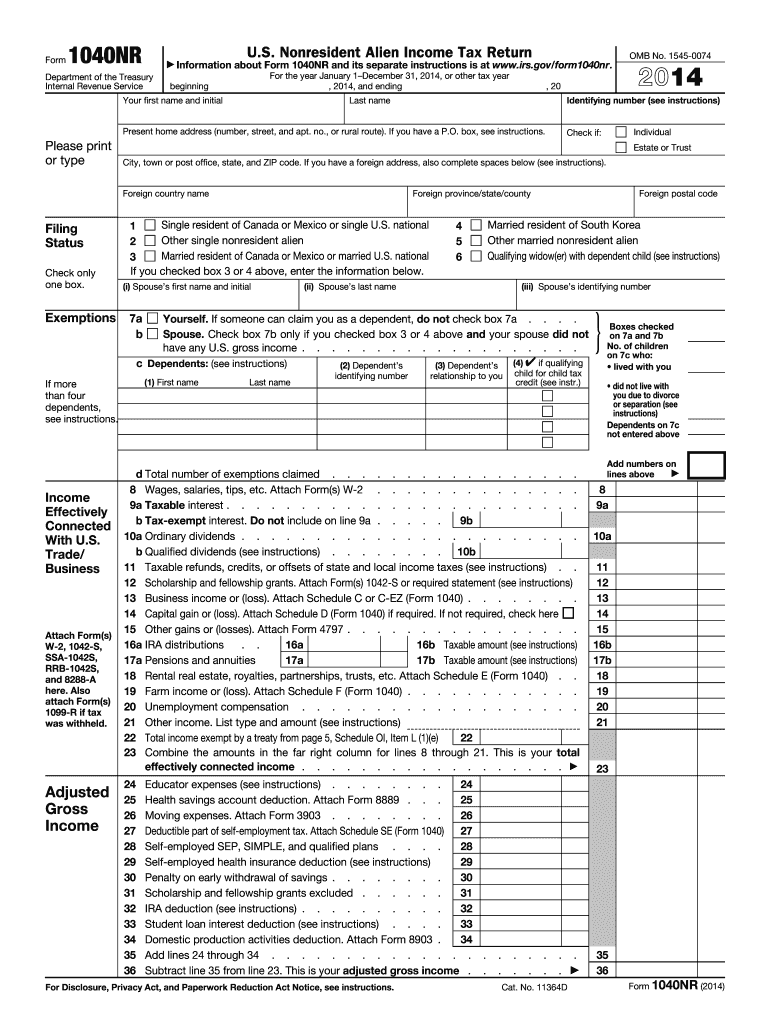

IRS 1040-NR 2014 free printable template

Instructions and Help about IRS 1040-NR

How to edit IRS 1040-NR

How to fill out IRS 1040-NR

About IRS 1040-NR 2014 previous version

What is IRS 1040-NR?

Who needs the form?

Components of the form

What payments and purchases are reported?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Form vs. Form

How many copies of the form should I complete?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1040-NR

What should I do if I need to amend my form 1040 nr 2014?

To amend your form 1040 nr 2014, you'll need to file Form 1040-X, the Amended U.S. Individual Income Tax Return. Ensure to include any new or corrected information relevant to your filing and submit it according to the guidelines laid out by the IRS for amendments.

How can I check the status of my form 1040 nr 2014 submission?

You can check the status of your form 1040 nr 2014 submission through the IRS 'Where's My Refund?' tool if you're expecting a refund. If it's an e-filed form, make sure to note any common rejection codes and follow the necessary steps to resolve them.

What are some common mistakes to avoid when filing form 1040 nr 2014?

Common mistakes when filing form 1040 nr 2014 include incorrect Social Security numbers, mismatched names, and math errors. To avoid these issues, double-check all entries, use automated calculators where possible, and ensure that your information matches IRS records.

How long should I keep records after filing my form 1040 nr 2014?

After filing your form 1040 nr 2014, it is advisable to keep your records for at least three years. This duration is generally recommended for maintaining evidence of your filing in case of an audit or further inquiries from the IRS.

What steps should I take if I receive a notice from the IRS regarding my form 1040 nr 2014?

If you receive a notice from the IRS concerning your form 1040 nr 2014, read it carefully to understand the issue. Prepare any requested documentation and respond promptly, ensuring you meet any specified deadlines to avoid penalties.

See what our users say