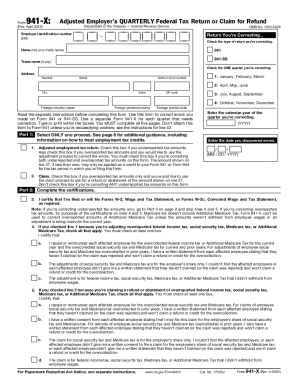

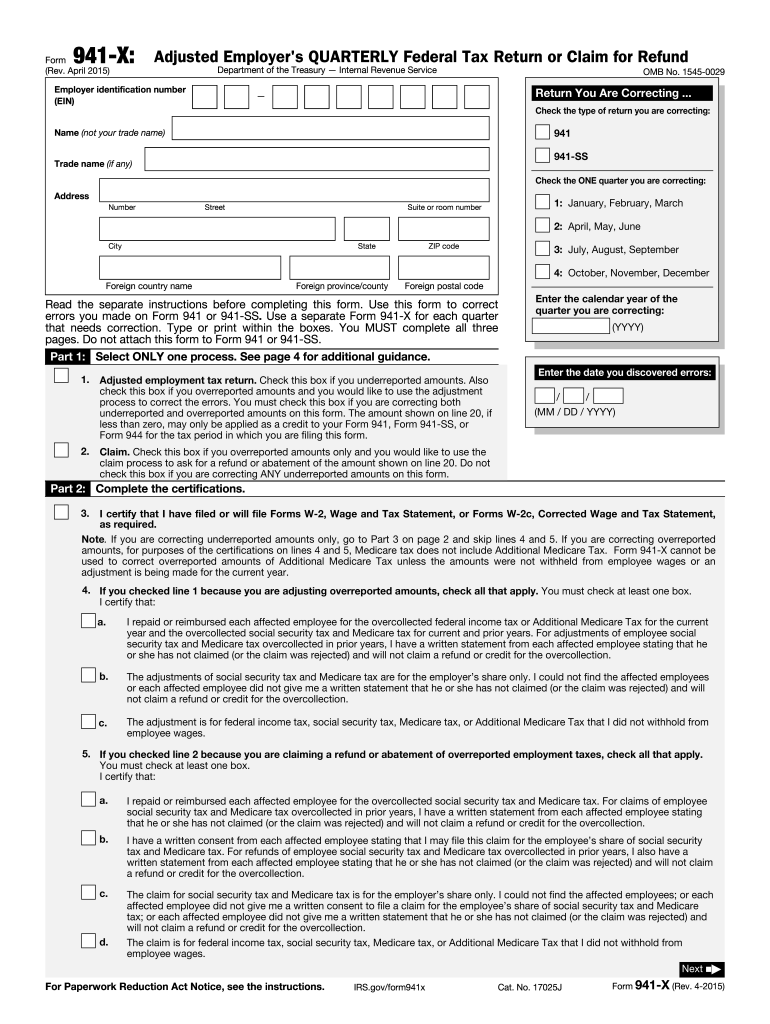

IRS 941-X 2015 free printable template

Instructions and Help about IRS 941-X

How to edit IRS 941-X

How to fill out IRS 941-X

About IRS 941-X 2015 previous version

What is IRS 941-X?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 941-X

What should I do if I realize I made an error after submitting my 941x 2015 form?

If you discover an error after submitting your 941x 2015 form, you should promptly file an amended form to correct the mistake. Ensure you clearly indicate the changes made and provide any necessary documentation to support your correction. Keep copies of both your original and amended submissions for your records.

How can I verify that the IRS received and processed my 941x 2015 form?

To verify the status of your 941x 2015 form, you can contact the IRS directly or check your online account if you have one set up. Be prepared to provide your details, including personal identification and specifics about the submission, to facilitate the process. It's advisable to wait a few weeks from submission before checking for updates.

Are there any common mistakes to avoid when filing the 941x 2015 form?

Yes, common errors to avoid when filing the 941x 2015 form include miscalculating amounts, failing to include all necessary signatures, and not using the correct version of the form. Double-check your entries and ensure all calculations are accurate to reduce the likelihood of rejection or delays.

What should I do if I receive an IRS notice or audit related to my 941x 2015 form?

If you receive an IRS notice or audit regarding your 941x 2015 form, carefully review the correspondence. Gather all relevant documents and records related to your submission, and respond promptly with the requested information. If necessary, consider consulting a tax professional for assistance in resolving any issues.

What are the record retention requirements for documentation related to the 941x 2015 form?

It's important to retain copies of your 941x 2015 form and any supporting documents for at least four years, as this duration aligns with the IRS' statute of limitations. Keeping these records can help substantiate your filings in case of inquiries or audits in the future.

See what our users say