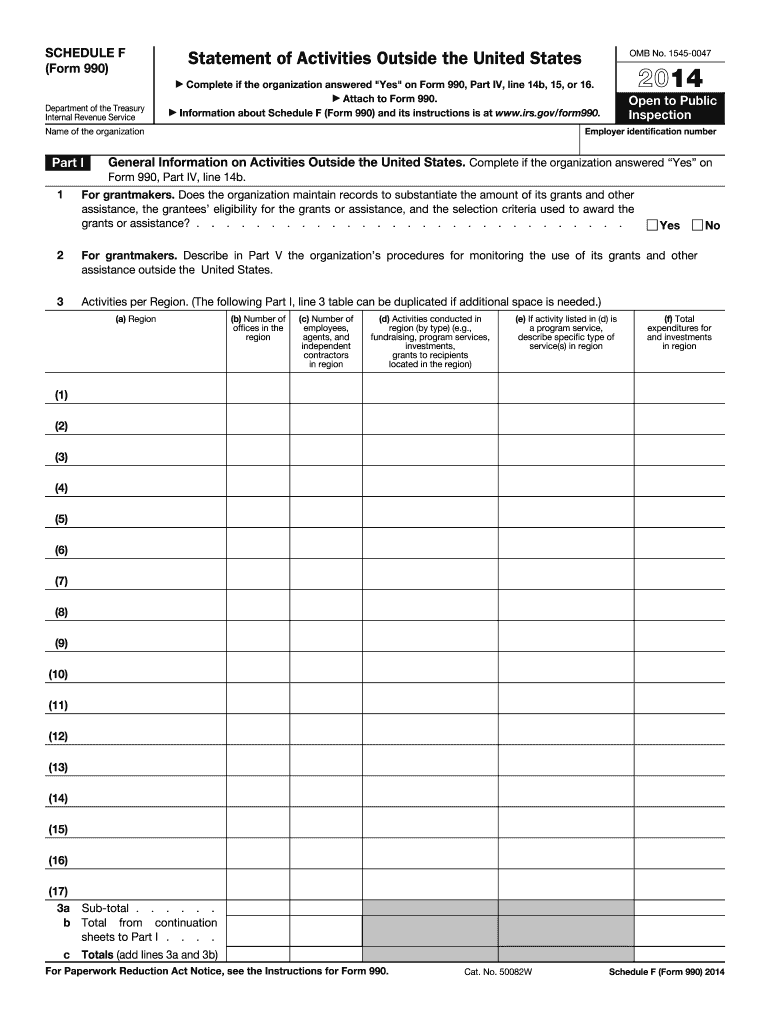

IRS 990 - Schedule F 2014 free printable template

Instructions and Help about IRS 990 - Schedule F

How to edit IRS 990 - Schedule F

How to fill out IRS 990 - Schedule F

About IRS 990 - Schedule F 2014 previous version

What is IRS 990 - Schedule F?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 990 - Schedule F

What should I do if I need to correct a mistake on my filed 2014 form schedule f?

If you realize there's an error after filing your 2014 form schedule f, you will need to submit an amended form schedule f. Make sure to clearly indicate the changes you are making and include any necessary documentation to support your corrections to avoid processing delays.

How can I check the status of my submitted 2014 form schedule f?

To verify the status of your filed 2014 form schedule f, you can check the relevant online system provided by the IRS or other filing agencies. Keep an eye out for common e-file rejection codes, and refer to their guidelines on how to respond if your filing wasn't accepted.

What is the privacy policy regarding personal data on the 2014 form schedule f?

When filing your 2014 form schedule f, your personal data is subject to privacy regulations. Ensure that you are familiar with how your information is stored, shared, and protected, and adhere to any requirements concerning data security during the filing process.