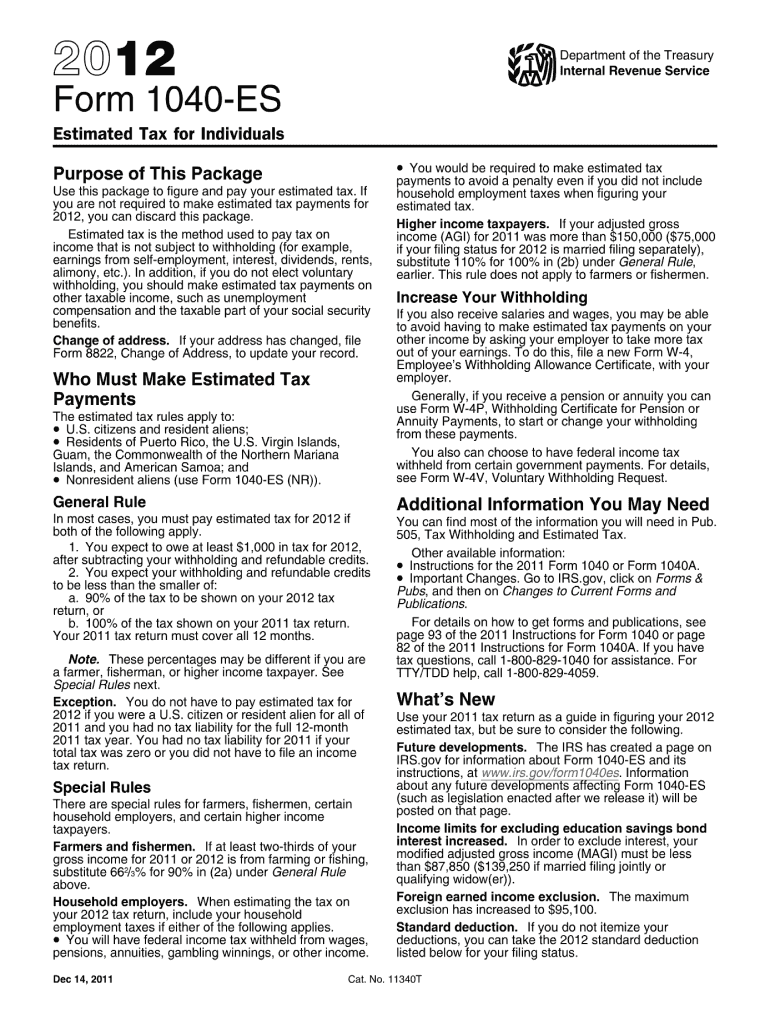

IRS 1040-ES 2012 free printable template

Instructions and Help about IRS 1040-ES

How to edit IRS 1040-ES

How to fill out IRS 1040-ES

About IRS 1040-ES 2022 previous version

What is IRS 1040-ES?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040-ES

What should I do if I need to correct my 2012 form 1040 es after submission?

If you need to correct your 2012 form 1040 es after submission, you should file an amended return using form 1040X. Make sure to include any additional relevant information and explain the changes made. It’s essential to track the status of your amended return to ensure it is processed correctly.

How can I verify the status of my submitted 2012 form 1040 es?

You can verify the status of your submitted 2012 form 1040 es by checking the IRS 'Where's My Refund?' tool online or by contacting the IRS directly. Be sure to have your taxpayer information ready, including social security number and filing status, to access your return details.

Are there any common errors people make when filing the 2012 form 1040 es?

Yes, common errors include incorrect Social Security numbers, miscalculating estimated payments, and failing to sign the form. Always double-check your entries and ensure all necessary fields are completed to minimize mistakes on your 2012 form 1040 es.

Can I e-file my 2012 form 1040 es, and what are the technical requirements?

Yes, you can e-file your 2012 form 1040 es using IRS-approved tax software. Ensure your software is compatible with the 2012 version, and check for any specific technical requirements, such as compatible web browsers or devices, to facilitate a successful e-filing process.

What steps should I take if I receive an audit notice related to my 2012 form 1040 es?

If you receive an audit notice regarding your 2012 form 1040 es, it is crucial to carefully review the notice for details on what information is required. Gather relevant documentation and consider seeking advice from a tax professional to ensure you respond appropriately and comprehensively.

See what our users say