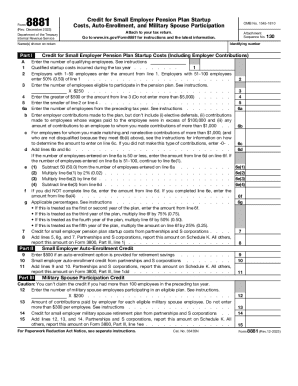

IRS Form 8881 2013 free printable template

Show details

Form 8881 (Rev. December 2013) Department of the Treasury Internal Revenue Service Credit for Small Employer Pension Plan Startup Costs ? OMB No. 1545-1810 ? Attach to your tax return. Information

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign IRS Form 8881

Edit your IRS Form 8881 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IRS Form 8881 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IRS Form 8881 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IRS Form 8881. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IRS Form 8881 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IRS Form 8881

How to fill out retirement plans startup costs:

01

Start by gathering all necessary financial information related to your retirement plans, such as the initial investment amount, annual contributions, and expected returns.

02

Identify and list down all the expenses associated with starting up your retirement plans, such as administrative fees, investment management fees, and any legal or consulting costs.

03

Calculate the projected growth or decline in your retirement plans over a certain period. This can be done by incorporating the expected returns on investments and subtracting the anticipated expenses.

04

Ensure that you accurately include any taxes or inflation rates that may affect your retirement plans startup costs.

05

Once you have all the necessary information and figures, document them in a clear and organized manner, either on paper or using digital tools, such as spreadsheets or retirement planning software.

Who needs retirement plans startup costs:

01

Individuals who are planning to establish their own retirement plans, such as a 401(k), IRA, or pension plan, need to consider the startup costs. These costs are crucial in determining the feasibility and sustainability of the retirement plans.

02

Small business owners who want to offer retirement benefits to their employees may also need to calculate and allocate startup costs for their retirement plans. This is important for budgeting and ensuring the business can afford to implement the plans.

03

Financial advisors, accountants, or retirement plan consultants who assist individuals or businesses in setting up retirement plans should have a thorough understanding of the startup costs. They can provide guidance and help clients make informed decisions based on these costs.

Remember, accurately filling out retirement plans startup costs is essential for effective financial planning and ensuring your retirement funds are allocated appropriately for future benefits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute IRS Form 8881 online?

pdfFiller has made filling out and eSigning IRS Form 8881 easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I create an electronic signature for the IRS Form 8881 in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your IRS Form 8881 in seconds.

Can I create an electronic signature for signing my IRS Form 8881 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your IRS Form 8881 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your IRS Form 8881 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IRS Form 8881 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.