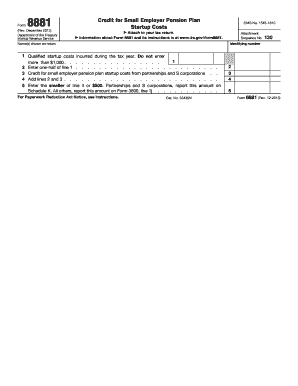

IRS Form 8881 2023-2026 free printable template

Get, Create, Make and Sign irs 8881 form

Editing 2023 irs 8881 online

Uncompromising security for your PDF editing and eSignature needs

IRS Form 8881 Form Versions

How to fill out form 8881 download

How to fill out form 8881 rev december

Who needs form 8881 rev december?

Complete Guide to Form 8881 Rev December Form

Overview of Form 8881

Form 8881, known as the Credit for Small Employer Pension Plan Startup Costs, is designed to provide tax credits to eligible small businesses that initiate retirement plans for their employees. This initiative aims to encourage employers to offer retirement savings options, enhancing the financial literacy and security of their workforce. The Rev November revision may introduce updates that reflect new IRS regulations, offering businesses updated guidelines and benefits.

The December revisions of Form 8881 include adjustments that may affect the calculation of credits available and clarify eligibility criteria. Staying informed of these changes is critical for employers looking to maximize their potential benefits and ensure compliance with the latest tax laws.

Importance of using Form 8881

Using Form 8881 opens the door to significant tax benefits for small employers. The credits afforded through this form serve as financial incentives for businesses to establish retirement plans that can improve employee retention and job satisfaction. These plans often encompass pension plan startup costs, auto-enrollment features, and options for military spouses, promoting a more inclusive workplace.

Employers who successfully implement retirement plans stand to gain numerous advantages, including potential tax breaks. The encouragement to participate not only fosters a culture of saving among employees but also enhances the employer's reputation as a caring and responsible organization, which is pivotal in today’s competitive job market.

Key features of Form 8881

Eligibility for Form 8881 is primarily targeted at small businesses, defined as those with 100 or fewer employees who have not maintained a qualified retirement plan in the previous three years. This opens up access for a large swath of businesses eager to establish formal retirement plans and reap the associated benefits.

The following types of businesses can benefit from using Form 8881:

Various credits tied to this form help cover startup costs as well. These include costs relating to setting up a plan and administrative fees. Each credit has specific conditions which must be met to ensure qualification, such as employing a minimum number of individuals or offering certain features within the retirement plan.

Step-by-step guide to completing Form 8881

Before beginning to fill out Form 8881, it's crucial to gather all necessary documentation. Required information includes employee counts, details of the pension plan to be offered, and records of previous retirement plans your business has maintained. Ensuring you have these details at hand will streamline the completion process.

When filling out the form, follow these section-by-section instructions:

Be cautious to avoid common pitfalls, such as not providing adequate proof of your employee count or miscalculating eligible costs. Double-check all entries to ensure accuracy.

Once the form is filled out, calculating your credit involves applying the eligible percentages to the defined costs. For example, if your total startup costs are $5,000, and the applicable credit rate is 50%, your credit would total $2,500. Always refer back to the current IRS guidelines for the maximum credit amounts.

For filing Form 8881, both electronic and paper options are available. Ensure you’re mindful of deadlines, usually aligned with your business tax return due date, to avoid any complications. If filing electronically, research platforms like pdfFiller that streamline this process.

Troubleshooting common issues

Claiming a credit incorrectly can result in your business facing penalties or an audit. If you find that an error has occurred post-filing, it is imperative to take quick action. You can submit an amended return using Form 1040-X or IRS Form 1120X for corporations.

Here are some common inquiries that individuals ask about Form 8881:

Interactive tools and resources

Utilizing tools such as the SECURE 2.0 Tax Credit Calculator can greatly enhance your accuracy in estimating potential benefits from Form 8881. This interactive resource helps breakdown complex calculations and provides instant feedback based on your input data.

pdfFiller also provides additional tools that make managing Form 8881 easier. Users can edit, sign, and collaborate on forms efficiently, ensuring that each document meets compliance standards with minimal hassle.

Real-life applications and case studies

Many small businesses have successfully leveraged Form 8881 to improve their employee offerings. For instance, A local coffee shop owner implemented a retirement plan thanks to the credits available, resulting in a significant boost in employee morale and retention rates.

These case studies illustrate the potential of Form 8881 not just as a tax advantage, but also as a means to foster a committed workforce. Positive testimonials from business owners further reinforce the benefits of engaging with the retirement planning process.

Compliance and regulatory considerations

Keeping up-to-date with IRS regulations is essential for successfully navigating Form 8881. Changes in tax law can affect not only eligibility but also the amount of credits available. Being proactive in understanding these updates can prevent unnecessary complications down the line.

Regularly check IRS publications and updates impacting retirement savings and tax credits to ensure your business remains compliant with current regulations. Engaging with reputable tax professionals can also provide clarity and guidance.

Community and support

Engaging with communities focused on retirement planning initiatives can provide insights and build a support network for employers. Many organizations host events aimed at educating employers about best practices in establishing retirement plans.

For personalized support, various resources are available for individuals looking to further their understanding of Form 8881. Consultations with tax professionals can offer tailored advice, ensuring your business strategy aligns with available benefits.

Related forms and templates

Exploring other IRS forms related to retirement plans and employee benefits can enhance your overall understanding of available options. Forms such as 5500 for annual report of employee benefit plans and Form 5305 for establishing a simple retirement plan provide additional pathways for businesses seeking to support their workforce.

Website features for enhanced document management

pdfFiller’s cloud-based document management offers a myriad of advantages, particularly for users working with Form 8881. Features like editing, e-signing, and real-time collaboration allow users to handle forms effectively from any location, enhancing productivity.

The platform is designed to simplify the often complex processes of form management, making it a go-to solution for individuals and teams. With pdfFiller, users can seamlessly navigate the intricacies of tax forms while ensuring compliance and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 8881 pdf on a smartphone?

How do I fill out IRS Form 8881 using my mobile device?

How do I edit IRS Form 8881 on an Android device?

What is form 8881 rev december?

Who is required to file form 8881 rev december?

How to fill out form 8881 rev december?

What is the purpose of form 8881 rev december?

What information must be reported on form 8881 rev december?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.