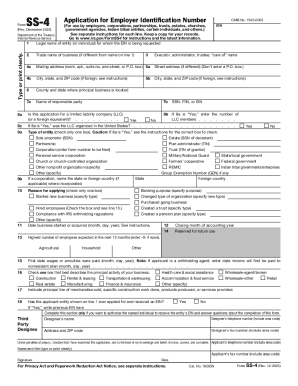

IRS SS-4 2010 free printable template

Instructions and Help about IRS SS-4

How to edit IRS SS-4

How to fill out IRS SS-4

About IRS SS-4 2010 previous version

What is IRS SS-4?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS SS-4

What should I do if I realize I've made a mistake on my 2010 form ss after submission?

If you discover an error on your submitted 2010 form ss, it's important to file an amended return as soon as possible. You can correct mistakes by submitting a new form indicating that it's a correction and ensure you include any required details about the original submission. Staying proactive can help mitigate any issues that may arise from the initial error.

How can I verify if my 2010 form ss has been received and processed?

To verify the receipt and processing of your 2010 form ss, check the confirmation status through your e-filing platform if you submitted electronically. Alternatively, you can contact the IRS directly or check their online tracking tool for updates on your submission status to ensure everything is in order.

Are there specific data privacy measures to consider when filing the 2010 form ss?

When filing the 2010 form ss, it’s crucial to ensure that all personal and financial data is handled securely. Using secure e-filing platforms that comply with data protection guidelines is advisable, as is retaining copies of submitted forms in a safe location to protect against identity theft or data breaches.

What should I do if I receive a notice regarding my 2010 form ss?

If you receive a notice related to your 2010 form ss, first carefully read the communication to understand the nature of the issue. Gather any documentation or evidence needed to address the notice, and respond promptly to the IRS within the specified timeframe, which may include providing additional information or corrections as required.

What common issues might lead to rejection of my 2010 form ss when e-filing?

Common e-filing rejection reasons for the 2010 form ss include incorrect data formats, missing required fields, or discrepancies with previously filed information. It's essential to review all entries for accuracy and ensure all mandatory information is filled out correctly to reduce the risk of rejection.

See what our users say