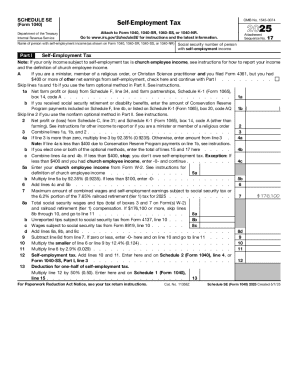

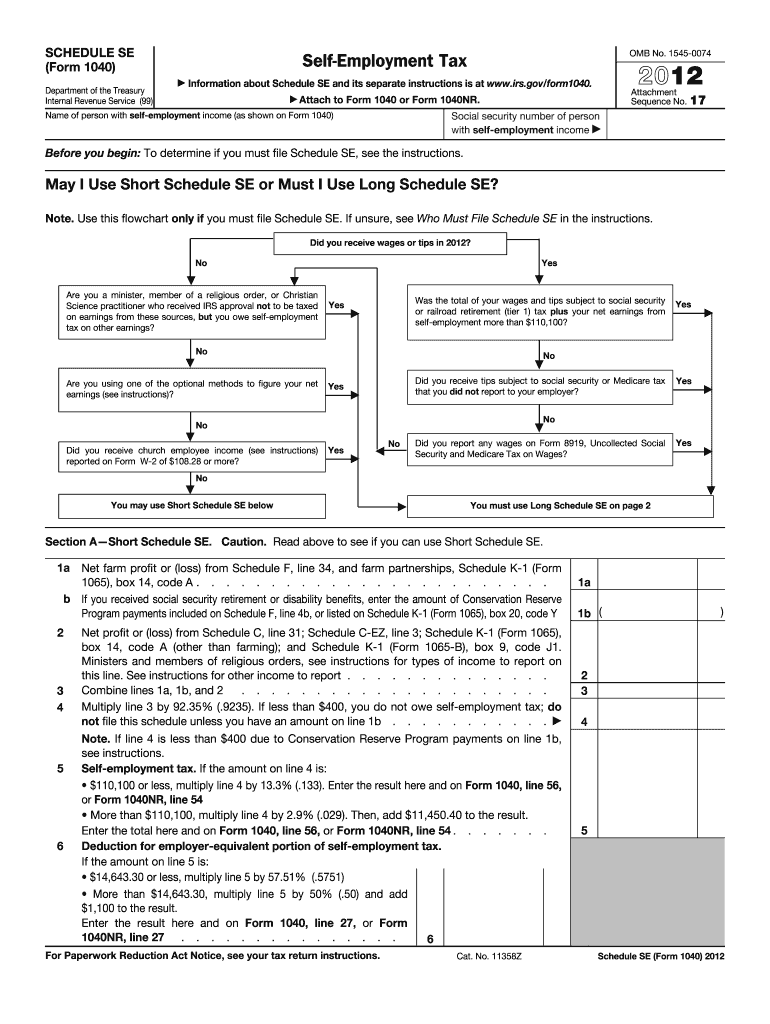

IRS 1040 - Schedule SE 2012 free printable template

Instructions and Help about IRS 1040 - Schedule SE

How to edit IRS 1040 - Schedule SE

How to fill out IRS 1040 - Schedule SE

About IRS 1040 - Schedule SE 2012 previous version

What is IRS 1040 - Schedule SE?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

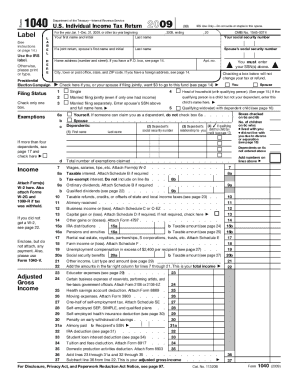

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1040 - Schedule SE

What should I do if I realize there's an error after filing my 2012 schedule se form?

If you discover an error after submitting your 2012 schedule se form, you must file an amended return to correct the mistake. This involves completing the appropriate corrected form and ensuring that all relevant details are accurate this time. It's essential to follow the amendment instructions carefully to avoid further issues.

How can I verify if my 2012 schedule se form has been received and processed?

To verify the status of your 2012 schedule se form, you can use the IRS online tracking tool or contact customer service. Keep in mind that it may take some time for the IRS to update their records, especially during peak filing seasons, so patience is often required during the process.

What are some common mistakes to avoid when submitting the 2012 schedule se form?

Common mistakes when filling out the 2012 schedule se form include incorrect calculation of self-employment tax, failing to report all income, and omitting required details. Double-check all entries and compare them against your records to ensure accuracy before submission.

Are there any fees associated with electronically filing the 2012 schedule se form?

Yes, e-filing the 2012 schedule se form may incur service fees if you choose to use third-party software or services. However, many programs offer free options, so it’s wise to explore various choices to find the most affordable way to file your return.

What steps should I take if I receive a notice from the IRS regarding my 2012 schedule se form?

If you receive a notice from the IRS about your 2012 schedule se form, carefully read the letter to understand the issue. Gather the necessary documentation and respond in a timely manner, providing any requested information or corrections as outlined in the notice to resolve the matter efficiently.

See what our users say