Get the free 3RD QUARTER ELIGIBILITY UPDATE FORM

Show details

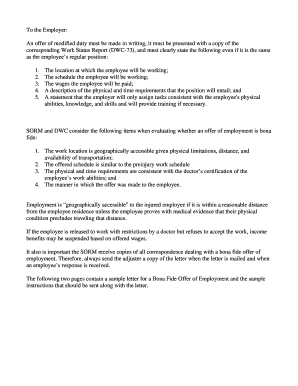

This form is used by participants in the Loan Repayment Assistance Programs administered by the DC Bar Foundation to certify their continued eligibility through September 30, 2012. Participants must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 3rd quarter eligibility update

Edit your 3rd quarter eligibility update form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 3rd quarter eligibility update form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 3rd quarter eligibility update online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 3rd quarter eligibility update. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 3rd quarter eligibility update

How to fill out 3RD QUARTER ELIGIBILITY UPDATE FORM

01

Obtain the 3RD QUARTER ELIGIBILITY UPDATE FORM from the relevant institution or website.

02

Fill in your personal information at the top of the form, including your name, student ID, and contact details.

03

Review the eligibility criteria and ensure that you meet all requirements.

04

Complete the sections regarding income verification, if applicable, by providing necessary documentation.

05

Confirm your current course enrollment and any changes since the last reporting period.

06

Sign and date the form at the designated section to certify the information provided.

07

Submit the completed form to the appropriate office by the stated deadline.

Who needs 3RD QUARTER ELIGIBILITY UPDATE FORM?

01

Students who are enrolled in programs that require periodic eligibility verification.

02

Individuals receiving financial aid or scholarships that are contingent on eligibility criteria.

03

Those whose circumstances have changed since the last eligibility update and need to report these changes.

Fill

form

: Try Risk Free

People Also Ask about

How do I report ERC refunds on my tax return?

For open tax years, taxpayers may file an amended return, administrative adjustment request (AAR), or protective claim for refund to deduct their wage expense for the year in which the ERC was claimed. Alternatively, these taxpayers could elect to report the refund as income in the year it is received.

Is the IRS automatically send unclaimed $1,400 stimulus checks to 1 million people?

The IRS in December announced plans to automatically send "special payments" of up to $1,400 to 1 million taxpayers who didn't claim the 2021 recovery rebate credit on tax returns for that year.

Do I need to amend my tax return for ERC credit?

The initial IRS guidance directed taxpayers to amend tax returns to reduce wage deductions related to the amount of ERC credit claimed (2020 tax return for 2020 ERC claims, 2021 tax return for 2021 ERC claims).

How does Employee Retention Credit affect state tax returns?

California Treatment of the Employment Retention Credit Under federal law, employers that claim the ERC must reduce their wage and salary expense deduction by the amount of the ERC. California does not conform to these provisions and does not have a similar credit.

Do you have to amend your tax return for ERC credit?

Under these facts, you're not required to file an amended return or, if applicable, an administrative adjustment request (AAR) to address the overstated wage expenses. Instead, you can include the overstated wage expense amount as gross income on your income tax return for the tax year when you received the ERC.

Will the IRS audit the ERC credit?

FIRSTLY, WILL THE ERC BE AUDITED? Yes, the ERC tax credit could be audited. The IRS may conduct an ERC audit to verify that an employer has accurately calculated and claimed the credit in ance with the provisions of the CARES Act and subsequent legislation.

Who qualifies for the 3rd stimulus check?

The stimulus amount is dependent on your adjusted gross income. In order to qualify for the full $1,400, the taxpayers' annual income must not have been more than $75,000 for single filers or $150,000 for married couples filing jointly.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 3RD QUARTER ELIGIBILITY UPDATE FORM?

The 3RD QUARTER ELIGIBILITY UPDATE FORM is a document used to collect and update eligibility information for specific programs or benefits within the third quarter of the year.

Who is required to file 3RD QUARTER ELIGIBILITY UPDATE FORM?

Individuals or organizations participating in programs that require regular updates of eligibility status are required to file the 3RD QUARTER ELIGIBILITY UPDATE FORM.

How to fill out 3RD QUARTER ELIGIBILITY UPDATE FORM?

To fill out the form, individuals must enter their personal or organizational information, ensure all required fields are completed accurately, and submit the form by the specified deadline.

What is the purpose of 3RD QUARTER ELIGIBILITY UPDATE FORM?

The purpose of the form is to ensure that the eligibility records are current and to maintain compliance with program regulations, allowing for the proper allocation of resources and benefits.

What information must be reported on 3RD QUARTER ELIGIBILITY UPDATE FORM?

The form typically requires reporting of personal information, changes in income, family status, and any other relevant updates that may affect eligibility.

Fill out your 3rd quarter eligibility update online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

3rd Quarter Eligibility Update is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.