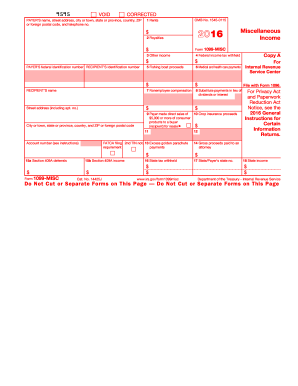

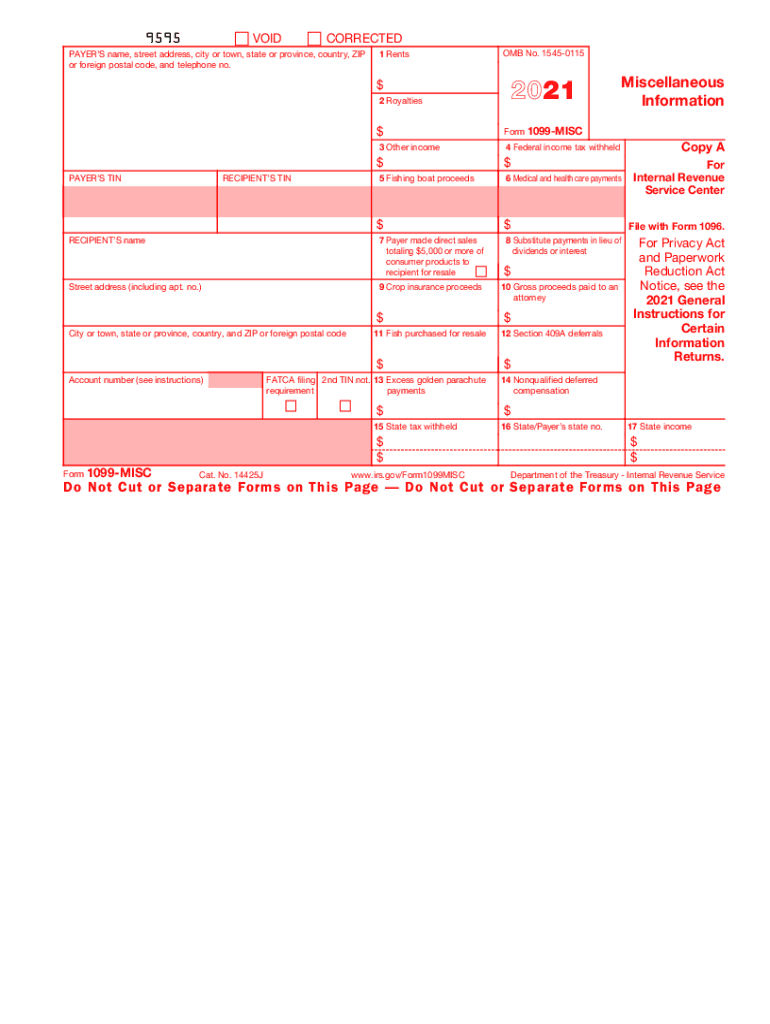

IRS 1099-MISC 2021 free printable template

Instructions and Help about IRS 1099-MISC

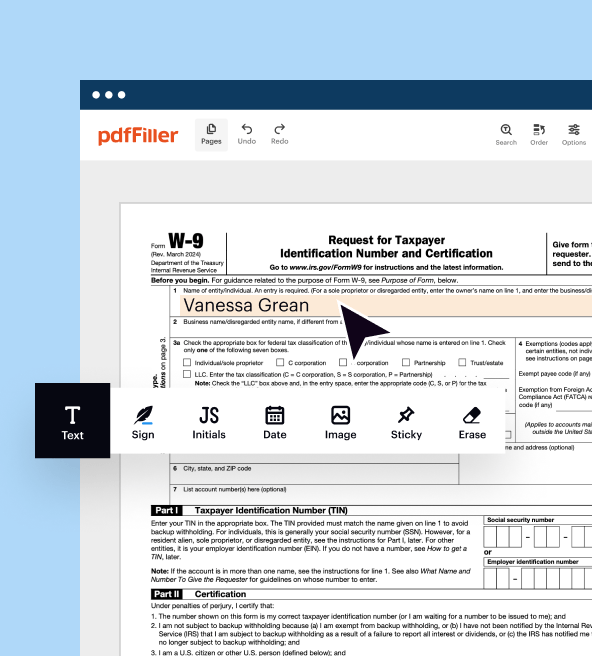

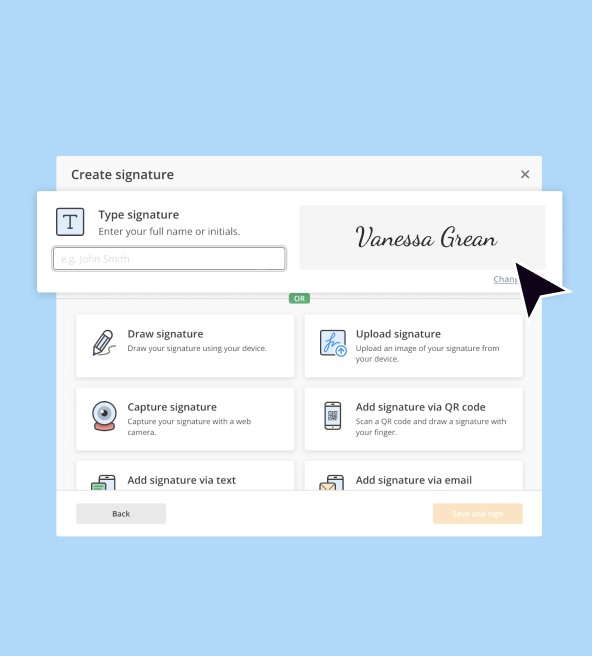

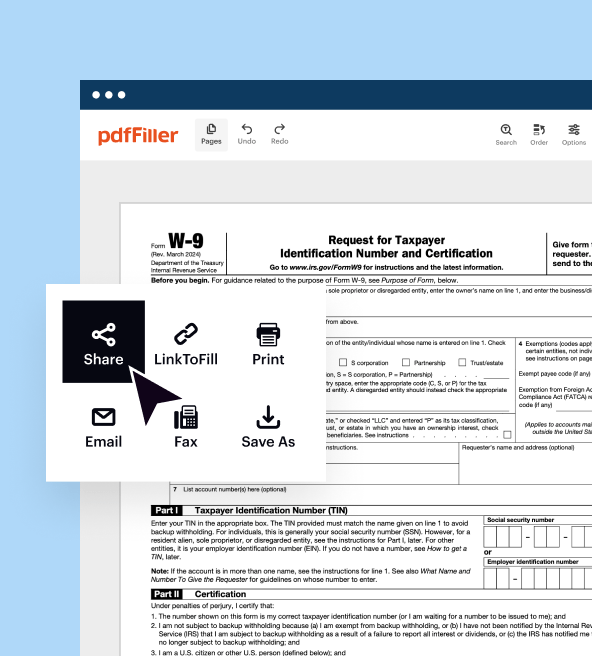

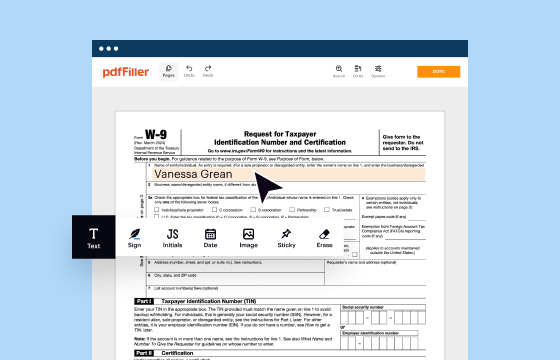

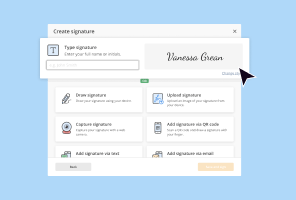

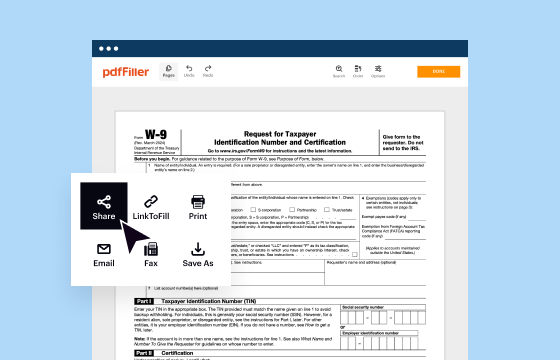

How to edit IRS 1099-MISC

How to fill out IRS 1099-MISC

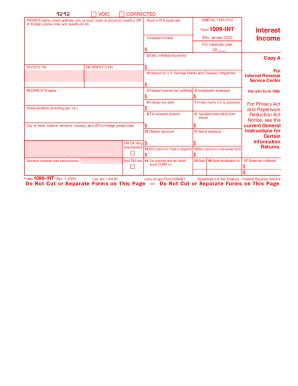

About IRS 1099-MISC previous version

What is IRS 1099-MISC?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 1099-MISC

What should I do if I made a mistake on my IRS 1099-MISC after filing?

If you discover an error on your IRS 1099-MISC after filing, you should file a corrected version of the form. Identify the specific mistake you made and complete both the original form and the corrected version clearly indicating corrections. Ensure you promptly submit this correction to avoid potential penalties.

How can I verify that my IRS 1099-MISC has been received by the IRS?

You can verify the receipt of your IRS 1099-MISC by checking the IRS's e-file status tool if you submitted electronically. For paper submissions, allow a few weeks, and then you may want to call the IRS directly to confirm they have received your form. Keep your submission details handy for any inquiries.

What common errors should I be aware of when filing the IRS 1099-MISC?

Common errors when filing the IRS 1099-MISC include incorrect taxpayer identification numbers, forgotten signatures, and misreporting payments. To avoid these mistakes, double-check all details against your records before submission and ensure you follow proper formatting guidelines.

What do I do if I receive a notice from the IRS regarding my 1099-MISC?

If you receive a notice from the IRS about your 1099-MISC, read it carefully to understand the issue it addresses. Gather necessary documentation to support your case and respond promptly by following the instructions provided in the notice. Consulting a tax professional can also be beneficial in such situations.

Are there technical requirements to consider when e-filing my IRS 1099-MISC?

When e-filing your IRS 1099-MISC, ensure that your software is compatible with the IRS filing system and meets their technical specifications. This includes using the appropriate format, such as XML or .txt, and adhering to size limitations. Regular updates and compliance checks for your software can help prevent common e-filing issues.

See what our users say