IRS 940 2011 free printable template

Show details

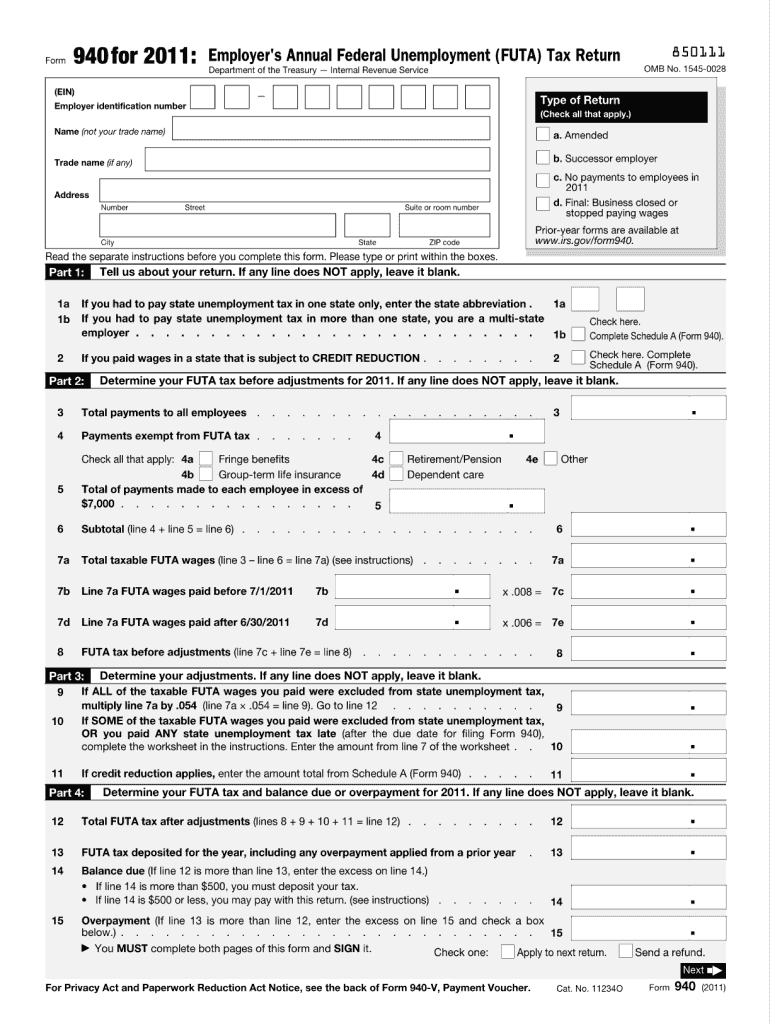

2011 d. Final: Business closed or stopped paying wages. Prior-year forms are available at www.irs.gov/form940. Part 1: Tell us about your return. If any line does ...

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 940

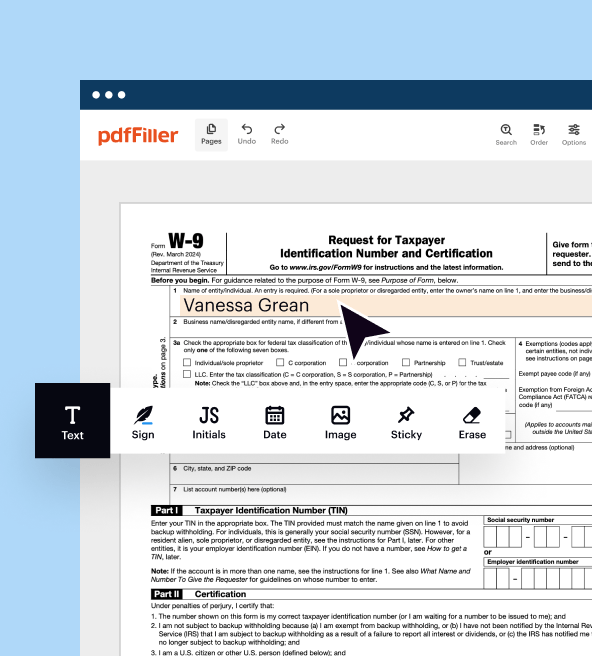

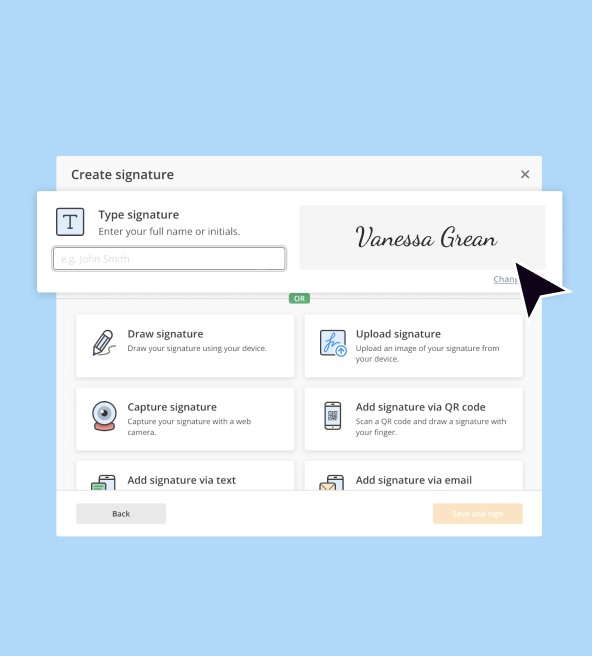

How to edit IRS 940

How to fill out IRS 940

Instructions and Help about IRS 940

How to edit IRS 940

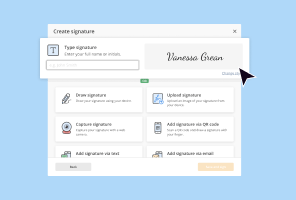

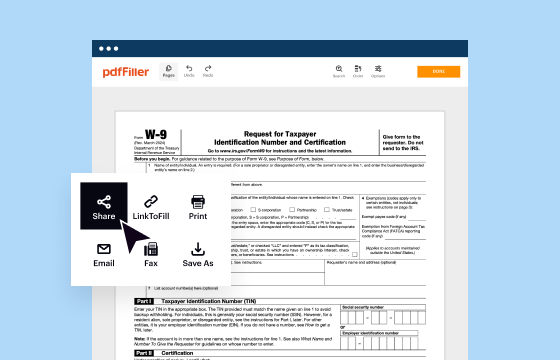

To edit IRS 940, you can use pdfFiller, which provides tools to make necessary adjustments to the form. Start by uploading your current version to the pdfFiller platform. Use the editing tools to correct any errors, fill in missing information, or update details as needed. After making edits, ensure the form is complete and accurate before saving or printing.

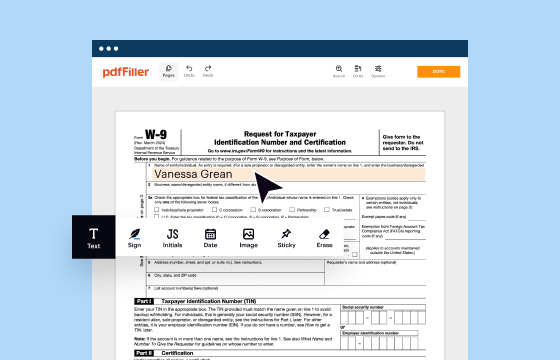

How to fill out IRS 940

Filling out IRS 940 involves several key steps. First, gather all necessary information, such as your employer identification number (EIN), total payments to employees, and any credits applicable to your business. Next, carefully follow the instructions provided on the form, ensuring each section is completed accurately. Once filled, review the form for any errors before submitting. You can also utilize pdfFiller to streamline this process.

About IRS previous version

What is IRS 940?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 940?

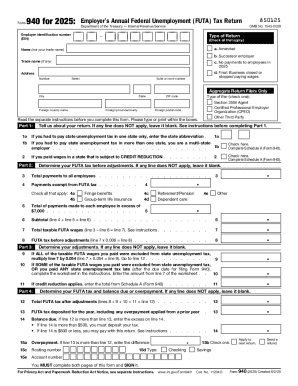

IRS 940 refers to the Employer's Annual Federal Unemployment (FUTA) Tax Return. This form is used by employers to report their annual federal unemployment tax liability to the Internal Revenue Service (IRS). It is essential for businesses that meet certain payroll criteria and is a critical part of U.S. tax compliance for employers.

What is the purpose of this form?

The purpose of IRS 940 is to report federal unemployment tax, which funds unemployment compensation benefits to workers who have lost their jobs. Employers use this form to declare their total taxable wages and compute the tax owed for the year. Accurate completion of this form is crucial to ensure compliance with federal regulations and to avoid penalties.

Who needs the form?

Employers who have paid wages of $1,500 or more in any calendar quarter during the current or previous year are required to file IRS 940. Additionally, any employer who had at least one employee working for them at any time in the past year must file this form. It applies to a range of entities, including corporations, partnerships, and sole proprietorships.

When am I exempt from filling out this form?

Employers may be exempt from filing IRS 940 if they meet certain criteria. For example, if an employer's business is wholly exempt from unemployment tax under state or federal law, or if their total taxable wages do not exceed the filing threshold, they may not need to submit this form. Additionally, non-profit organizations with approval under Section 501(c)(3) may also be exempt under certain conditions.

Components of the form

The IRS 940 form consists of various sections where employers report their total wages, tax calculations, and other relevant information. Key components include the employer identification section, computation of FUTA tax owed, and any allowable credits. Completing all sections accurately is crucial for the form's validity.

What are the penalties for not issuing the form?

Failure to file IRS 940 can result in significant penalties. Employers may face fines for late submissions, which can escalate over time. Additionally, not filing can lead to losing the ability to claim unemployment tax credits, thereby increasing the overall tax liability. It is essential for employers to fulfill this requirement to avoid unnecessary expenses.

What information do you need when you file the form?

When filing IRS 940, you will need various pieces of information, including your EIN, the total wages paid to employees, any employment and unemployment tax credits you intend to claim, and details about the state in which your employees work. Gathering this information beforehand will streamline the filing process.

Is the form accompanied by other forms?

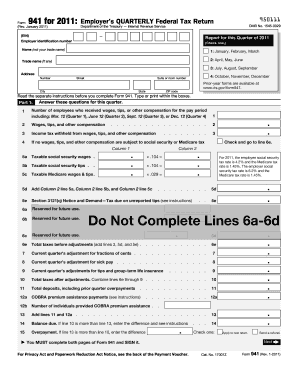

IRS 940 can be accompanied by additional forms if applicable, such as IRS Form 941 or state unemployment tax returns. It is important for employers to check if they need to submit these additional documents to ensure complete compliance with all tax obligations.

Where do I send the form?

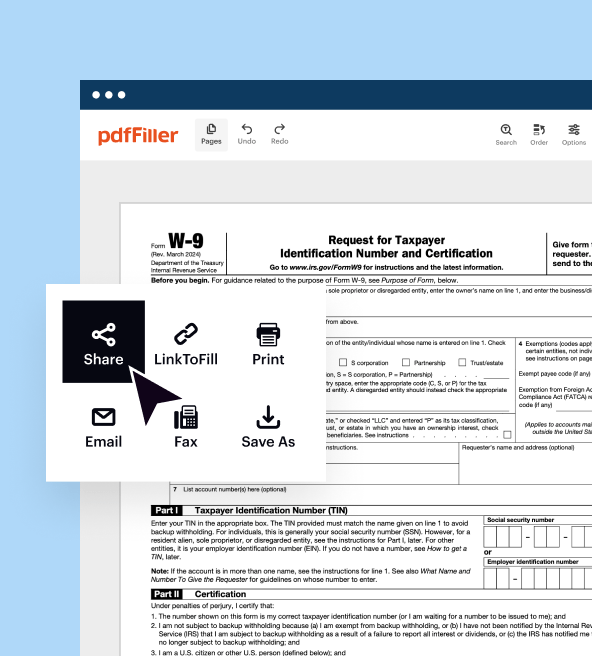

The completed IRS 940 form should be submitted to the address specified in the instructions on the form, which varies based on your business's location. If filing by mail, ensure that you send it to the correct IRS address to avoid delays in processing.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

In spite of the "learning curve" I'm getting the "hang" of it!!!

No experience before I signed up. I like the drag, drop, save as feature and want to learn everything i can about this app.

See what our users say

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.