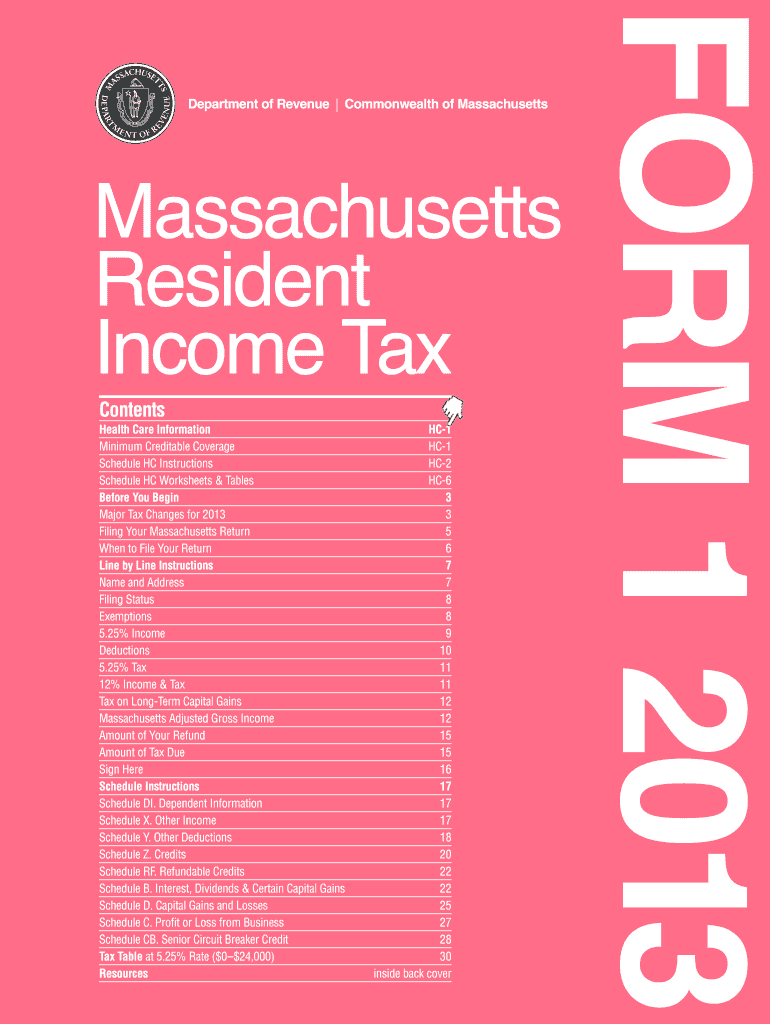

MA DoR 1 Instructions 2013 free printable template

Instructions and Help about MA DoR 1 Instructions

How to edit MA DoR 1 Instructions

How to fill out MA DoR 1 Instructions

About MA DoR 1 Instructions 2013 previous version

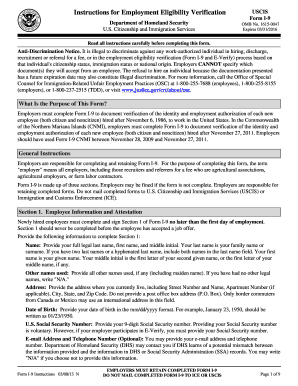

What is MA DoR 1 Instructions?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MA DoR 1 Instructions

What should I do if I realize I've made a mistake after submitting my 2013 mass dor forms?

If you discover an error after filing your 2013 mass dor forms, you will need to submit an amended version. Be sure to follow the guidelines stipulated by the Massachusetts Department of Revenue, ensuring you clearly indicate that the submission is a correction. It's advisable to keep documentation of the original and amended forms for your records.

How can I verify the status of my submitted 2013 mass dor forms?

To track the status of your 2013 mass dor forms, you can utilize the online portal provided by the Massachusetts Department of Revenue. This tool allows you to check receipt and processing updates efficiently. Additionally, be aware of common e-file rejection codes that may require your attention.

What should I know about e-signature regulations for the 2013 mass dor forms?

E-signatures for the 2013 mass dor forms are generally acceptable, provided they comply with the electronic signature standards set by the IRS and Massachusetts authorities. Always confirm that your e-signature meets these requirements to avoid processing issues.

What if I'm a nonresident filing 2013 mass dor forms for a business?

Nonresident filers must adhere to specific regulations when submitting their 2013 mass dor forms for business purposes. Make sure to consult the relevant guidelines that outline how to report income accurately and any deductions that may apply to nonresidents.