IRS 1099-DIV 2011 free printable template

Show details

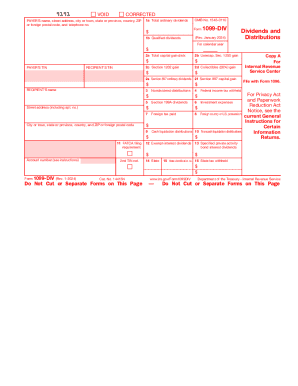

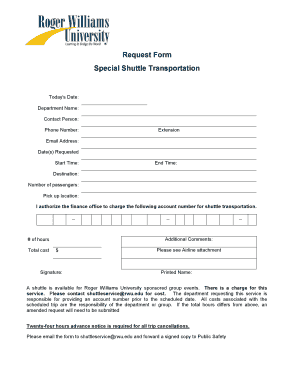

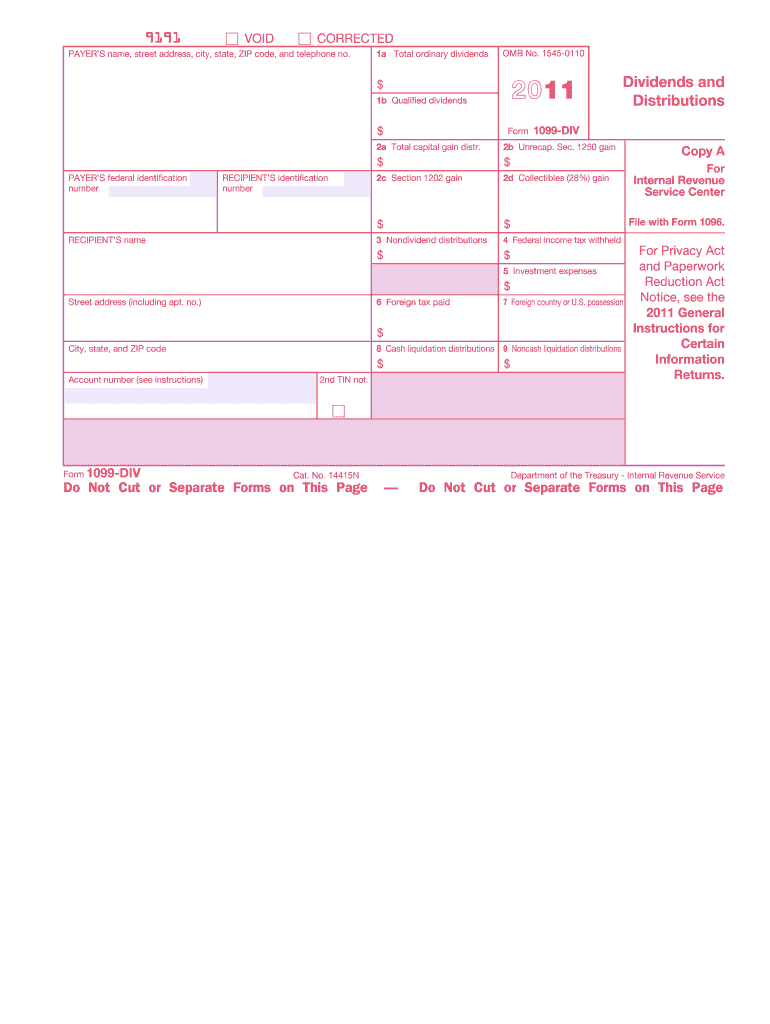

2011. Form 1099-DIV. Dividends and. Distributions. Copy A. For. Internal Revenue. Service Center. File with Form 1096. For Privacy Act and Paperwork.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1099-DIV

How to edit IRS 1099-DIV

How to fill out IRS 1099-DIV

Instructions and Help about IRS 1099-DIV

How to edit IRS 1099-DIV

To edit IRS 1099-DIV, you can use pdfFiller to easily modify the form directly from your computer. This platform allows users to fill in their information, adjust numerical values, and incorporate digital signatures if required. After making your edits, ensure to save the completed form securely, either in your pdfFiller account or by downloading it directly.

How to fill out IRS 1099-DIV

To accurately fill out IRS 1099-DIV, follow these systematic steps:

01

Obtain the form from the IRS website or through a tax preparation service.

02

Enter the payer's identification details in the top section, including name and address.

03

Provide the recipient's information, such as name, address, and Social Security Number (SSN) or Employer Identification Number (EIN).

04

Record any ordinary dividends, qualified dividends, total capital gain distributions, and any federal income tax withheld in the appropriate boxes.

05

Review the completed form for accuracy before submission.

About IRS 1099-DIV 2011 previous version

What is IRS 1099-DIV?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1099-DIV 2011 previous version

What is IRS 1099-DIV?

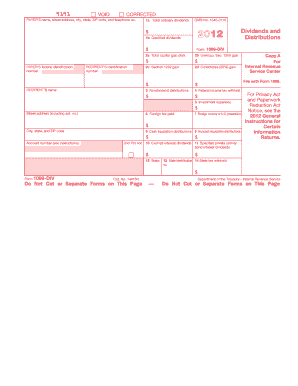

IRS 1099-DIV is a tax form used in the United States to report dividends and distributions to shareholders. This form is essential for taxpayers who have received dividends from investments in stocks or mutual funds during the tax year. It ensures that all dividend income is reported accurately to the IRS for proper taxation.

What is the purpose of this form?

The purpose of IRS 1099-DIV is to provide information about dividends, capital gains distributions, and certain other payments made to shareholders. Taxpayers use this form to report income that must be included when preparing their annual tax returns. It is also utilized by the IRS to help verify the income reported by the taxpayer.

Who needs the form?

Individuals and entities that have received dividends from investments such as stocks or mutual funds will need IRS 1099-DIV. This includes shareholders who own shares directly or through retirement accounts. Businesses that pay dividends must also issue this form to report payments to their shareholders.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 1099-DIV if you did not receive dividends or distributions that meet the reporting threshold, or if your dividends are unreported or low enough to be considered exempt by IRS guidelines. Additionally, certain types of entities may not require the form, such as tax-exempt organizations that do not meet the cash distribution thresholds.

Components of the form

The IRS 1099-DIV consists of several key components, including sections for identifying the payer, the recipient, and various types of dividend and distribution information. Specifically, it includes boxes for reporting ordinary dividends, qualified dividends, total capital gain distributions, and federal income tax withheld. Each box must be filled out accurately to ensure compliance with IRS requirements.

What are the penalties for not issuing the form?

Failure to issue IRS 1099-DIV when required can result in penalties imposed by the IRS. These penalties can vary depending on the length of time the form is late and can range from hundreds to thousands of dollars. Additionally, both the payer and recipient may face issues regarding unreported income, potentially leading to further scrutiny by the IRS.

What information do you need when you file the form?

When filing IRS 1099-DIV, you will need the payer's and recipient's names, addresses, and Tax Identification Numbers (TINs). You must also gather accurate figures for total dividends paid, qualified dividends, capital gain distributions, and any withheld federal tax amounts. It is vital to have this information correct to avoid errors and penalties.

Is the form accompanied by other forms?

IRS 1099-DIV is typically not accompanied by additional forms when filed independently. However, if you are collaborating with a tax professional, they may include supplementary documentation or related forms based on your specific tax situation. Ensure you maintain accurate records of any other forms associated with your dividend income.

Where do I send the form?

The completed IRS 1099-DIV form must be sent to the IRS and a copy provided to the recipient. The filing addresses differ based on the location of the payer. Be sure to check the latest IRS instructions for the appropriate mailing addresses when submitting the form. Additionally, some filers may opt to file electronically, which can streamline the submission process.

See what our users say