IRS 851 2010 free printable template

Show details

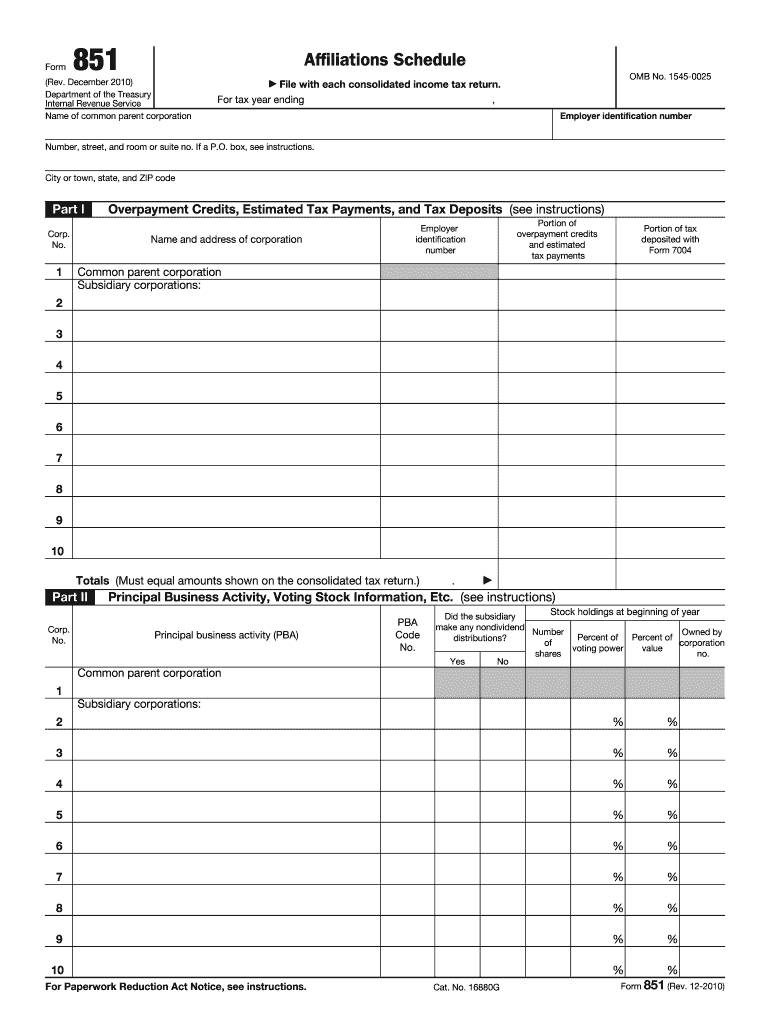

Section references are to the Internal Revenue Code unless otherwise noted. Purpose of Form Use Form 851 to 1. Determine that each subsidiary Who Must File The parent corporation must file Form 851 for itself and for corporations in the affiliated group. File Form 851 by attaching it to the consolidated tax return for the group. includible corporations connected through stock ownership with a common parent common parent must be an includible must be met. PBA Code Stock holdings at beginning of...year Did the subsidiary make any nondividend Owned by Percent of distributions of corporation voting power value shares no. Yes No For Paperwork Reduction Act Notice see instructions. Cat. No. 16880G Form 851 Rev. 12-2010 Page Changes in Stock Holdings During the Tax Year Name of corporation Shareholder of Corporation No. a Changes Date transaction Number of acquired disposed of b Shares held after changes described in column a d If any transaction listed above caused a transfer of a share of...subsidiary stock defined to include dispositions and deconsolidations did the share s basis exceed its value at the time of the transfer See instructions. Yes No For Paperwork Reduction Act Notice see instructions. Cat. No. 16880G Form 851 Rev. 12-2010 Page Changes in Stock Holdings During the Tax Year Name of corporation Shareholder of Corporation No. a Changes Date transaction Number of acquired disposed of b Shares held after changes described in column a d If any transaction listed above...caused a transfer of a share of subsidiary stock defined to include dispositions and deconsolidations did the share s basis exceed its value at the time of the transfer See instructions. c e Did any share of subsidiary stock become worthless within the meaning of section 165 taking into account the provisions of Regulations section 1. Form Affiliations Schedule Rev* December 2010 Department of the Treasury Internal Revenue Service Name of common parent corporation OMB No* 1545-0025 File with...each consolidated income tax return* For tax year ending Employer identification number Number street and room or suite no. If a P. O. box see instructions. City or town state and ZIP code Part I Corp* No* Overpayment Credits Estimated Tax Payments and Tax Deposits see instructions Name and address of corporation Portion of and estimated tax payments Employer identification number deposited with Form 7004 Common parent corporation Subsidiary corporations Totals Must equal amounts shown on the...consolidated tax return* Principal Business Activity Voting Stock Information Etc* see instructions. PBA Code Stock holdings at beginning of year Did the subsidiary make any nondividend Owned by Percent of distributions of corporation voting power value shares no. c e Did any share of subsidiary stock become worthless within the meaning of section 165 taking into account the provisions of Regulations section 1. 1502-80 c during the taxable year See instructions. If the equitable owners of any...capital stock shown above were other than the holders of record provide details of the changes.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 851

How to edit IRS 851

How to fill out IRS 851

Instructions and Help about IRS 851

How to edit IRS 851

To edit the IRS 851 tax form, you should first download the PDF version of the form from the IRS website or access a digital version through pdfFiller. Use pdfFiller's tools to input or modify information directly on the form. Remember to save any changes you make before finalizing the document for submission.

How to fill out IRS 851

Filling out the IRS 851 tax form requires attention to detail and accurate data entry. Start by gathering all needed information, including details about your business structure and any transactions that pertain to the tax year in question. Follow these steps to complete the form:

01

Download and open IRS 851.

02

Provide your business name and Employer Identification Number (EIN).

03

Fill out sections regarding ownership and transactions accurately.

04

Review all information for accuracy before submission.

About IRS previous version

What is IRS 851?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS previous version

What is IRS 851?

IRS 851 is the form used by corporations to report information about foreign transactions. The form is primarily linked to the reporting requirements of controlled foreign corporations (CFC) and is used to examine their U.S. tax obligations.

What is the purpose of this form?

The purpose of IRS 851 is to facilitate the reporting of ownership interests in foreign corporations and certain transactions involving these entities. This allows the IRS to ensure compliance with U.S. tax laws regarding foreign income and taxation.

Who needs the form?

The form is required for U.S. corporations that are shareholders in foreign corporations and meet certain criteria. Specifically, any corporation that is considered a controlling shareholder must file this form to report ownership and transactions accurately.

When am I exempt from filling out this form?

You may be exempt from filling out IRS 851 if your corporation does not meet the criteria for foreign ownership or does not hold enough shares in a foreign corporation to require reporting. Additionally, corporations that do not engage in foreign transactions may also be exempt.

Components of the form

The key components of IRS 851 include sections for the corporation's basic information, details about controlled foreign corporations, and specific transactions relating to those entities. Each section must be completed accurately to ensure compliance with IRS regulations.

Due date

The due date for submitting IRS 851 typically aligns with the corporation's tax filing deadline. Generally, this means it must be filed by the 15th day of the fourth month following the end of the corporation's tax year.

What are the penalties for not issuing the form?

Failure to issue IRS 851 can result in significant penalties. These can include fines for each month the form is not filed, as well as potential interest on any unpaid taxes associated with the undisclosed foreign transactions.

What information do you need when you file the form?

When filing IRS 851, you will need detailed information about your corporation's ownership structure, data about foreign corporations, and specifics regarding any transactions conducted during the tax year. This includes names, identification numbers, and the nature of the transactions to ensure accurate reporting.

Is the form accompanied by other forms?

IRS 851 may need to be accompanied by other forms, such as Form 5471, which provides additional information regarding controlled foreign corporations and their shareholders. Ensure that you check all requirements to meet IRS compliance accurately.

Where do I send the form?

IRS 851 should be mailed to the appropriate address as specified in the IRS instructions for your tax jurisdiction. This will vary depending on whether you are filing electronically or through physical mail. Always verify current mailing addresses or electronic submission procedures from the IRS website.

See what our users say