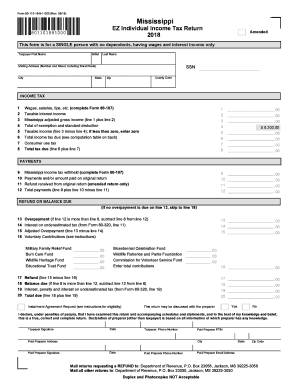

MS DoR Form 80-110 2014 free printable template

Instructions and Help about MS DoR Form 80-110

How to edit MS DoR Form 80-110

How to fill out MS DoR Form 80-110

About MS DoR Form 80 previous version

What is MS DoR Form 80-110?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

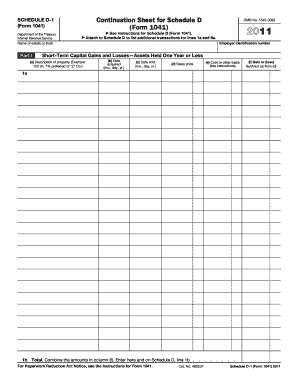

Is the form accompanied by other forms?

Where do I send the form?

FAQ about MS DoR Form 80-110

What should I do if I made a mistake on my MS DoR Form 80-110?

If you've made an error on your MS DoR Form 80-110, it's essential to correct it as soon as possible. You can submit an amended version of the form, clearly marked as 'amended,' along with any necessary explanations for the changes. Be sure to retain a copy of both the original and the amended forms for your records.

How can I verify if my MS DoR Form 80-110 has been received?

To verify the receipt of your MS DoR Form 80-110, you can contact the relevant agency or check their online portal for status tracking options. Make sure to have your submission details handy, as they will help you verify the status more efficiently.

Are there common errors with the MS DoR Form 80-110 that I should be aware of?

Yes, several common errors occur with the MS DoR Form 80-110, including incorrect taxpayer identification numbers and missing signatures. Carefully reviewing all entries before submission can help prevent these mistakes, and utilizing checklists may improve your accuracy.

What should I do if my e-filing of the MS DoR Form 80-110 is rejected?

If your e-filing of the MS DoR Form 80-110 is rejected, carefully review the rejection code provided. The code typically indicates the specific issue that caused the rejection. After addressing these issues, you can resubmit the form based on the guidance provided by the e-filing platform.

What are the data privacy considerations when submitting the MS DoR Form 80-110?

When submitting the MS DoR Form 80-110, it's crucial to ensure that your data is protected. Use secure methods for transmission, such as encrypted email or secure portals, and familiarize yourself with the record retention policies to guarantee your data remains safe for the required duration.