MS DoR Form 80-110 2016 free printable template

Show details

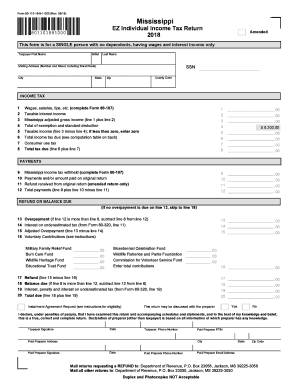

Reset Form 801101681000 (Rev. 4/16) Mississippi EZ Individual Income Tax Return 2016 801101681000 Print Form Amended This form is for a SINGLE person with no dependents, having wages and interest

pdfFiller is not affiliated with any government organization

Instructions and Help about MS DoR Form 80-110

How to edit MS DoR Form 80-110

How to fill out MS DoR Form 80-110

Instructions and Help about MS DoR Form 80-110

How to edit MS DoR Form 80-110

To edit MS DoR Form 80-110, ensure you have the latest version of the form downloaded. You can upload the form to pdfFiller to utilize its editing tools, allowing you to make changes, fill in fields, or correct errors easily. After editing, save your changes securely in pdfFiller for later submission.

How to fill out MS DoR Form 80-110

Filling out MS DoR Form 80-110 requires accurate information about the financial transactions being reported. Start by gathering all necessary financial details, including payee names, amounts, and transaction dates. Use pdfFiller to fill in the fields interactively, ensuring each entry is clear and correct. Review the completed form for errors before submission.

About MS DoR Form 80 previous version

What is MS DoR Form 80-110?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MS DoR Form 80 previous version

What is MS DoR Form 80-110?

MS DoR Form 80-110 is a tax form used to report specific financial transactions to the Department of Revenue. This form serves as a declaration of payments made, ensuring proper tax compliance within the jurisdiction. It captures detailed transaction information, facilitating accurate record-keeping for tax purposes.

What is the purpose of this form?

The primary purpose of MS DoR Form 80-110 is to report payments made to service providers or vendors for services rendered. This reporting aids in maintaining transparency in financial transactions and ensures that all parties fulfill their tax obligations. It allows the Department of Revenue to monitor taxable income and enforce compliance effectively.

Who needs the form?

Individuals or entities that make certain payments or report financial transactions must complete MS DoR Form 80-110. This includes businesses hiring independent contractors, paying rents, or making qualifying service payments. If you engage in such financial activities, you are likely required to file this form for accurate tax reporting.

When am I exempt from filling out this form?

You may be exempt from filing MS DoR Form 80-110 if your payments do not meet the criteria specified in the tax regulations. For instance, payments made below a certain threshold often do not require reporting. However, it’s essential to consult the latest tax guidelines or a tax professional to confirm your specific circumstances.

Components of the form

MS DoR Form 80-110 consists of various sections, each requiring specific information. Key components typically include details of the payer, recipient, payment amounts, and transaction dates. Proper completion of these sections is crucial for compliance and accuracy in reporting.

What are the penalties for not issuing the form?

Failure to issue MS DoR Form 80-110 can result in significant penalties, including fines and potential legal consequences. The severity of penalties often depends on the nature of the noncompliance, such as whether it was willful or unintentional. Understanding these implications is essential for ensuring compliance with tax regulations.

What information do you need when you file the form?

When filing MS DoR Form 80-110, you’ll need pertinent details such as the names and addresses of both the payer and the payee, the total amount paid, and the nature of the services provided. Collecting this information beforehand will streamline the filing process and help prevent inaccuracies that could lead to penalties.

Is the form accompanied by other forms?

MS DoR Form 80-110 does not typically require accompanying forms unless specified by the Department of Revenue. However, depending on your financial situation, other documentation may be necessary for complete tax compliance. It is wise to check the filing requirements to ensure all necessary documents are included.

Where do I send the form?

MS DoR Form 80-110 must be sent to the appropriate address specified by your state’s Department of Revenue. Ensure you verify the mailing address to avoid delays in processing. You can also submit the form electronically through the department's online portal if available.

See what our users say