MS DoR Form 80-110 2017 free printable template

Show details

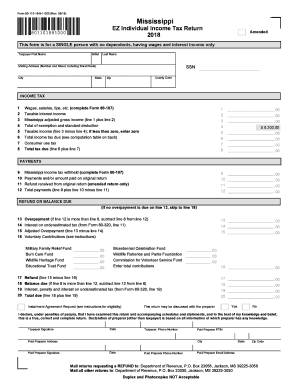

Form 80-110-17-8-1-000 (Rev. 10/17). Duplex and Photocopies NOT Acceptable. 2017. SSN. 801101781000. Amended. Refund received from original return ...

pdfFiller is not affiliated with any government organization

Instructions and Help about MS DoR Form 80-110

How to edit MS DoR Form 80-110

How to fill out MS DoR Form 80-110

Instructions and Help about MS DoR Form 80-110

How to edit MS DoR Form 80-110

To edit MS DoR Form 80-110, use pdfFiller’s online editor. Begin by uploading the form to the platform, then utilize the tools available for text editing, adding signatures, or incorporating necessary annotations. Ensure that all edits adhere to the guidelines and provide accurate information before finalizing your submission.

How to fill out MS DoR Form 80-110

To fill out MS DoR Form 80-110, first download the document from an official source or use an online platform like pdfFiller. Follow these steps for completion:

01

Input your personal identification information in the designated fields.

02

Provide details regarding the transactions or information being reported as specified on the form.

03

Review all entries for accuracy before final submission.

About MS DoR Form 80 previous version

What is MS DoR Form 80-110?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About MS DoR Form 80 previous version

What is MS DoR Form 80-110?

MS DoR Form 80-110 is a document issued by the Department of Revenue that is used for reporting certain financial transactions. This form is crucial for tax purposes, allowing individuals and businesses to report income generated from specific activities.

What is the purpose of this form?

The purpose of MS DoR Form 80-110 is primarily to inform state tax authorities about income transactions that may be subject to taxation. This form helps the Department of Revenue track the financial activities of individuals and entities operating within the state.

Who needs the form?

Individuals and businesses that engage in transactions that necessitate reporting to the Department of Revenue are required to complete MS DoR Form 80-110. This includes, but is not limited to, those receiving certain types of payments or income sources outlined in the form's instructions.

When am I exempt from filling out this form?

You may be exempt from filling out MS DoR Form 80-110 if your income from the specified transactions falls below the minimum threshold set by the Department of Revenue. Additionally, certain entities may have different reporting requirements that could exempt them from using this form.

Components of the form

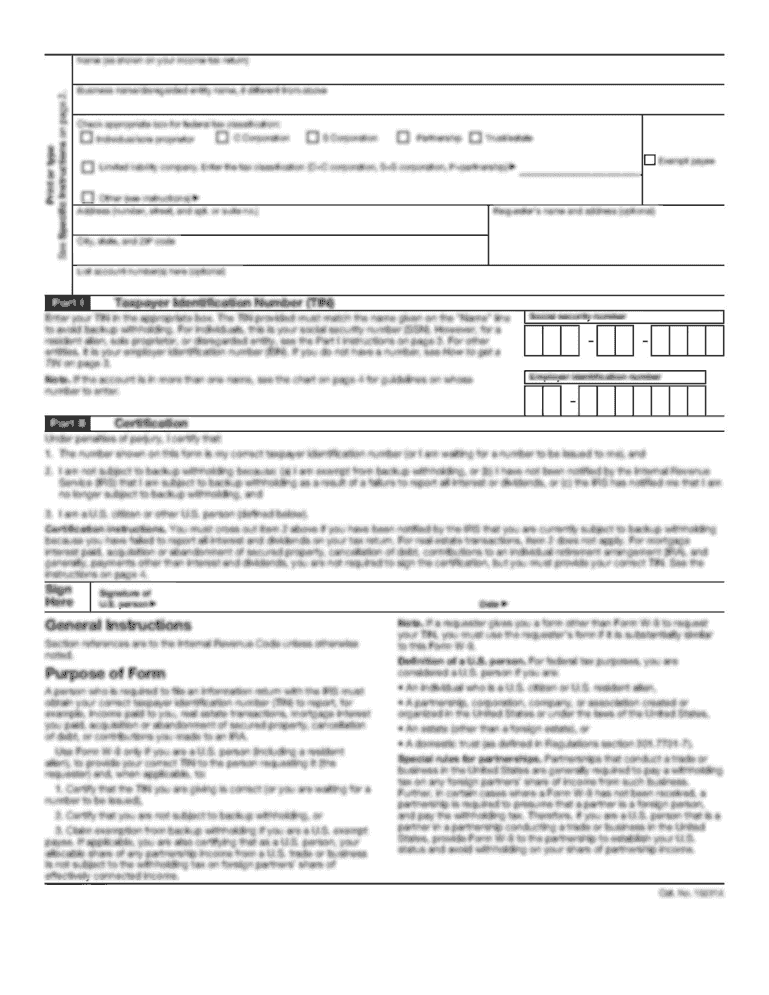

MS DoR Form 80-110 consists of several key components including identification sections, transaction details, and a certification area. Fill in personal information, followed by the specific details of the transactions being reported.

Due date

The due date for submitting MS DoR Form 80-110 typically aligns with the tax filing deadlines established by the Department of Revenue. Ensure to check the current year's deadline as it may vary.

What payments and purchases are reported?

MS DoR Form 80-110 requires reporting of payments received for services rendered, business transactions, and other financial activities specified by the Department of Revenue. Familiarize yourself with the reporting criteria outlined in the form to ensure compliance.

How many copies of the form should I complete?

Generally, you should complete one copy of MS DoR Form 80-110 for your records and submit another to the Department of Revenue. Some situations may require additional copies for third parties, based on the nature of the transactions reported.

What are the penalties for not issuing the form?

Failing to issue MS DoR Form 80-110 when required can result in penalties imposed by the Department of Revenue. Penalties may include fines and additional interest on unpaid taxes, underscoring the importance of timely and accurate submissions.

What information do you need when you file the form?

To file MS DoR Form 80-110, you will need personal identification information, details of the transactions being reported, and any other supporting documentation as required by the form. Gather this information prior to beginning the completion process.

Is the form accompanied by other forms?

MS DoR Form 80-110 may need to be accompanied by supplementary forms based on the transactions being reported. Always check the specific instructions provided to identify if additional documentation is necessary for your filing.

Where do I send the form?

After completing MS DoR Form 80-110, submit it to the appropriate Department of Revenue office as indicated on the form’s instructions. Ensure that it is sent to the correct mailing address based on your residency or the type of reporting being conducted.

See what our users say