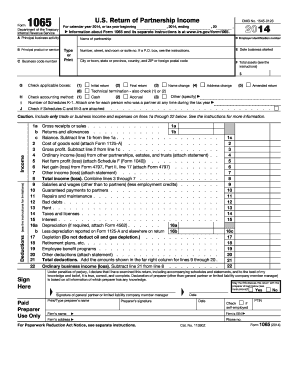

IRS Instruction 1065 - Schedule K-1 2014 free printable template

Instructions and Help about IRS Instruction 1065 - Schedule K-1

How to edit IRS Instruction 1065 - Schedule K-1

How to fill out IRS Instruction 1065 - Schedule K-1

About IRS Instruction 1065 - Schedule K-1 2014 previous version

What is IRS Instruction 1065 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

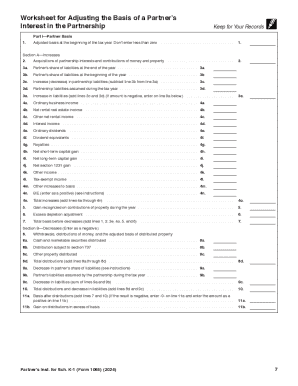

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

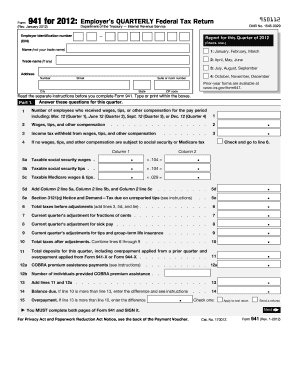

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS Instruction 1065 - Schedule K-1

What should I do if I discover an error after submitting the partner instruction 2014 form?

If you find an error on your submitted partner instruction 2014 form, you should file an amended or corrected form as soon as possible. Ensure that you clearly indicate that the submission is a correction, and provide the necessary details to rectify the mistake. Keeping a copy of the original and the amended submissions is crucial for your records.

How can I track the status of my partner instruction 2014 form submission?

To track the status of your partner instruction 2014 form, you can check online through the relevant IRS portal or contact the customer service of the processing agency. Generally, they can provide updates on whether your submission was received and if it’s being processed. Be mindful of common e-file rejection codes that may indicate issues with your submission.

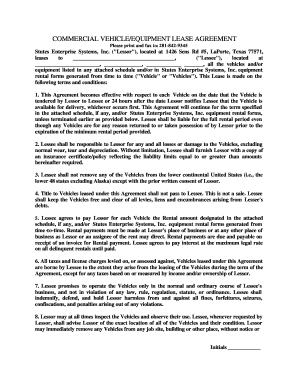

Are there any specific privacy or data security measures I should consider when submitting the partner instruction 2014 form?

When submitting the partner instruction 2014 form, it's essential to ensure that personal information is handled securely. Only use secure methods for submission, especially when using e-filing platforms. It is also advisable to familiarize yourself with the record retention period required for maintaining copies of your submissions in case of audits.

What should I do if I am filing the partner instruction 2014 form on behalf of someone else?

If you are filing the partner instruction 2014 form on behalf of another individual, you must ensure you have the proper authority, such as a power of attorney. Clearly indicate your representative status on the form and provide any necessary documentation. This helps in avoiding confusion and ensures compliance with regulations.

What common errors should I avoid when submitting the partner instruction 2014 form?

To prevent delays with your partner instruction 2014 form submission, ensure that all information is accurate and complete, particularly taxpayer identification numbers and amounts. Review for common mistakes such as typos and incorrect formatting of dates. Carefully following instructions and checking your work can help avoid unintended errors.

See what our users say