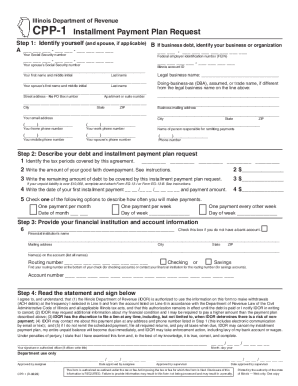

IL DoR CPP-1 2014 free printable template

Show details

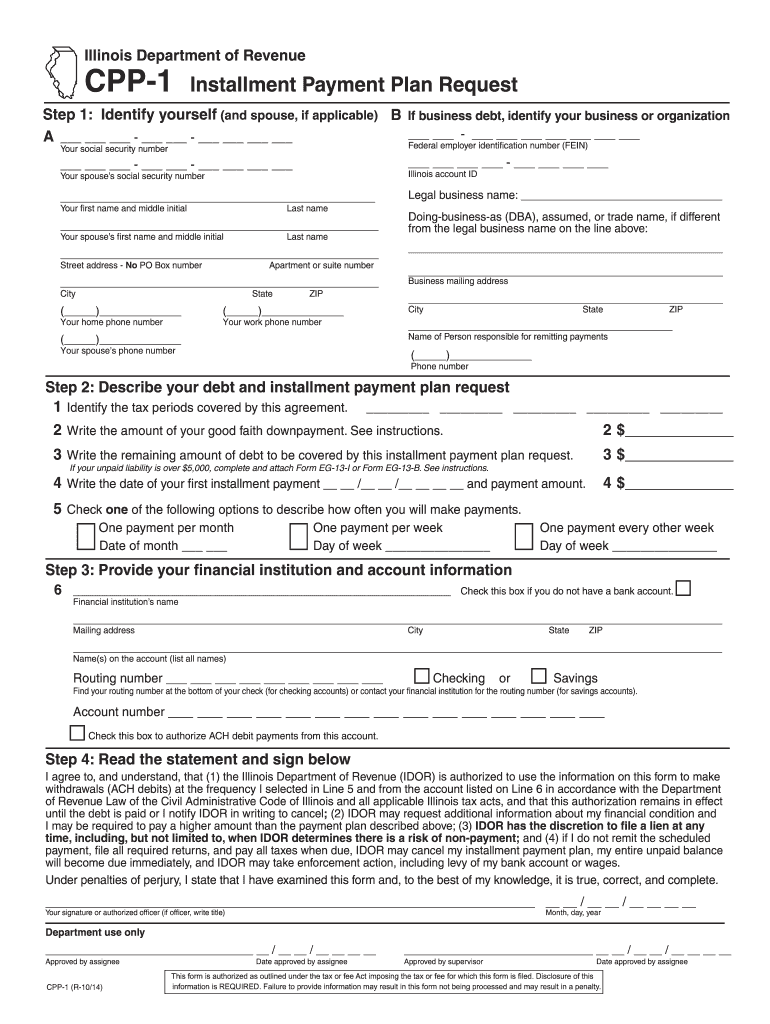

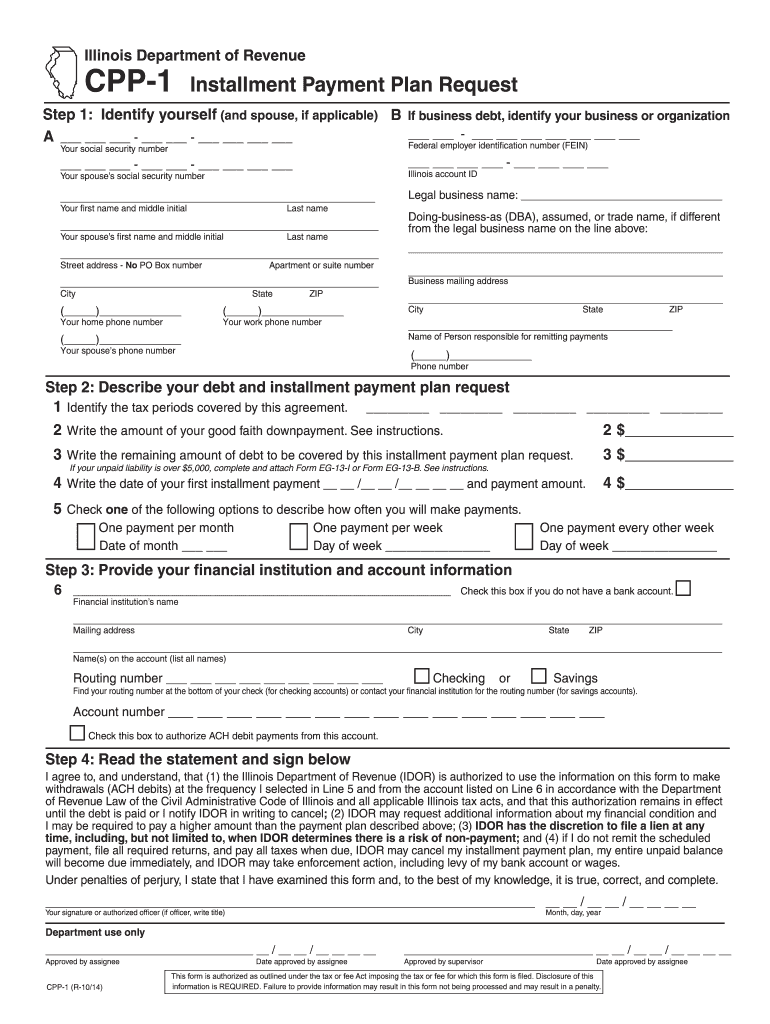

If you are requesting an installment of tax other than individual income tax i.e. sales withholding excise combine the tax types on your Form CPP-1. Reset Print See instructions on next page. Instructions for Form CPP-1 Installment Payment Plan Request General Information Who should file this form You should file Form CPP-1 if you have tax delinquencies that you cannot pay in full because of a financial hardship and you would like to enter into an installment payment plan with us. Write the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL DoR CPP-1

Edit your IL DoR CPP-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL DoR CPP-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IL DoR CPP-1 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit IL DoR CPP-1. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL DoR CPP-1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL DoR CPP-1

How to fill out IL DoR CPP-1

01

Obtain the IL DoR CPP-1 form from the official Illinois Department of Revenue website or local office.

02

Read the instructions provided at the top of the form carefully.

03

Fill in your name and address in the appropriate fields at the beginning of the form.

04

Provide your Social Security Number (SSN) or Employer Identification Number (EIN) as required.

05

Complete any relevant sections about your business or personal tax situation.

06

Double-check all the information for accuracy before submission.

07

Sign and date the form at the bottom.

08

Submit the completed form to the Illinois Department of Revenue via mail or online as instructed.

Who needs IL DoR CPP-1?

01

Individuals or businesses seeking to claim a tax credit or a refund.

02

Those who need to report income adjustments or changes in their tax filing.

03

Taxpayers who received a notice from the Illinois Department of Revenue requesting this form.

Fill

form

: Try Risk Free

People Also Ask about

Can you set up a payment plan with the IRS?

You may request a payment plan (including an installment agreement) using the OPA application. Even if the IRS hasn't yet issued you a bill, you may establish a pre-assessed agreement by entering the balance you'll owe from your tax return. OPA is quick and has a lower user fee compared to other application methods.

Can you get on a payment plan for Illinois taxes?

If you have tax delinquencies that you cannot pay in full because of a financial hardship, you can request a payment installment plan using MyTax Illinois. Simply log into your MyTax Illinois account and click the Set up a Payment Installment Plan with IDOR link.

How long can an IRS payment plan be?

There are two types of Streamlined Installment Agreements, depending on how much you owe and for what type of tax. For both types, you must pay the debt in full within 72 months (six years), and within the time limit for the IRS to collect the tax, but you won't need to submit a financial statement.

How long do I have to pay my illinois state taxes?

Department of Revenue Reminds Taxpayers that April 18 Filing Deadline is Quickly Approaching. CHICAGO - The Illinois Department of Revenue (IDOR) is reminding taxpayers that the upcoming deadline for filing 2022 state individual income tax returns is Tuesday, April 18, 2023.

How do I get a copy of my IRS payment agreement?

You can view details of your current payment plan (type of agreement, due dates, and amount you need to pay) by logging into the Online Payment Agreement tool using the Apply/Revise button below.

What happens if I don't pay my illinois state taxes?

Payments less than 31 days late are penalized at 2% of the amount due and payments 31+ days late are penalized at 10% of the amount due.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit IL DoR CPP-1 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your IL DoR CPP-1 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I make changes in IL DoR CPP-1?

With pdfFiller, the editing process is straightforward. Open your IL DoR CPP-1 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out IL DoR CPP-1 on an Android device?

Use the pdfFiller mobile app to complete your IL DoR CPP-1 on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is IL DoR CPP-1?

IL DoR CPP-1 is a form used by the Illinois Department of Revenue for reporting and remitting certain tax information. It is specifically related to the state's tax processes and compliance requirements.

Who is required to file IL DoR CPP-1?

Individuals or businesses that are subject to specific tax obligations in Illinois, particularly those that involve calculated tax liabilities requiring compliance with the state's revenue regulations, are required to file IL DoR CPP-1.

How to fill out IL DoR CPP-1?

To fill out IL DoR CPP-1, obtain the form from the Illinois Department of Revenue website, provide accurate information regarding your tax situation, including any applicable figures, and follow the instructions to complete the form correctly before submission.

What is the purpose of IL DoR CPP-1?

The purpose of IL DoR CPP-1 is to facilitate the reporting and payment of certain taxes imposed by the state of Illinois, ensuring compliance with state tax laws and regulations.

What information must be reported on IL DoR CPP-1?

The information that must be reported on IL DoR CPP-1 includes taxpayer identification details, tax calculation figures, any applicable deductions or credits, and payment information related to the taxes owed.

Fill out your IL DoR CPP-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL DoR CPP-1 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.