What is how to write up a contract for payment?

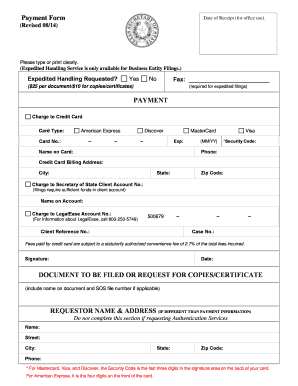

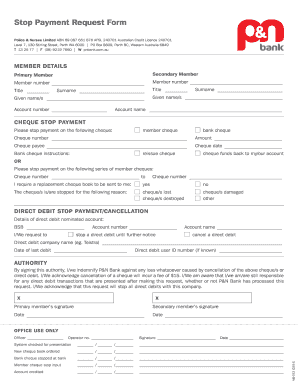

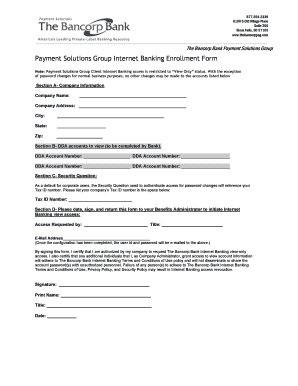

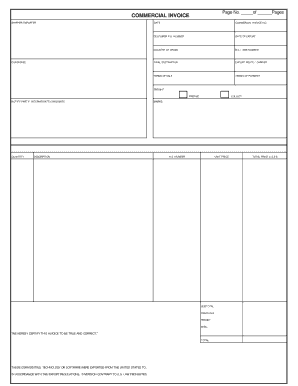

When it comes to writing up a contract for payment, it is important to include specific details and terms that both parties agree upon. The contract should clearly outline the payment amount, due dates, and any additional fees or penalties. It is also essential to include the agreed-upon method of payment, whether it is through cash, check, bank transfer, or any other form. Additionally, the contract should specify how disputes regarding payment will be resolved, including any steps that need to be taken before legal action is pursued.

What are the types of how to write up a contract for payment?

There are different types of contracts for payment depending on the nature of the transaction and the parties involved. Here are some common types:

One-time payment contract: This type of contract is used when a single payment is to be made for a particular product or service.

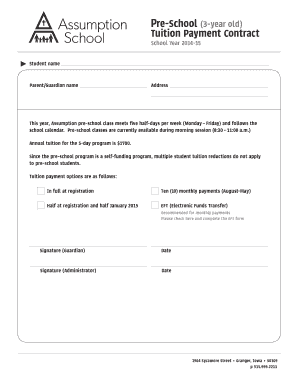

Installment payment contract: This type of contract allows for multiple payments to be made over a specified period of time.

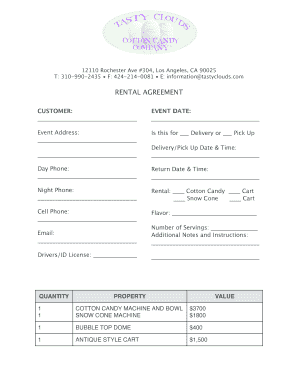

Lease agreement: In the case of renting or leasing, a contract for payment will outline the rental terms, payment amount, and due dates.

Service agreement: When hiring a service provider, a contract for payment is used to define the scope of work, payment terms, and any cancellation policies.

How to complete how to write up a contract for payment

Completing a contract for payment requires attention to detail and thoroughness. Here are some steps to follow:

01

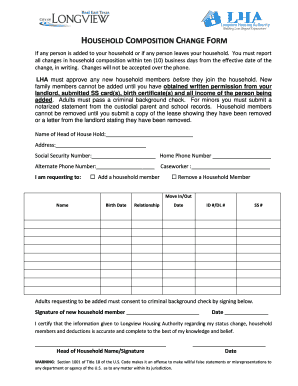

Clearly define the parties involved: Include the full legal names and contact information for both the payer and payee.

02

Specify the payment amount and due dates: Clearly state the agreed-upon payment amount and the dates by which each payment is due.

03

Outline the method of payment: Specify how the payment will be made, whether it is through cash, check, bank transfer, or any other form.

04

Include any additional terms and conditions: If there are any additional fees, penalties, or specific terms for late payments, make sure to include them in the contract.

05

Address dispute resolution: Include a clause that outlines how disputes regarding payment will be resolved, such as through mediation, arbitration, or legal action.

06

Review and sign: Once the contract is drafted, carefully review it to ensure that all terms are accurate and complete. Both parties should then sign the contract to make it legally binding.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.