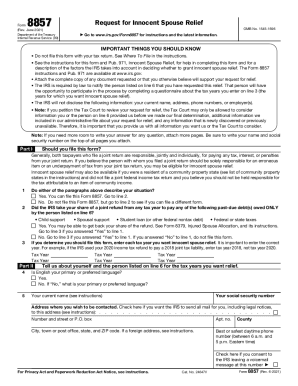

IRS 8857 2010 free printable template

Instructions and Help about IRS 8857

How to edit IRS 8857

How to fill out IRS 8857

About IRS 8 previous version

What is IRS 8857?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 8857

What should I do if I need to correct mistakes on my form 8379 download 2010 after submitting?

If you realize there is an error on your submitted form 8379 download 2010, you should file an amended return as soon as possible. Use the correct form to indicate the changes needed and ensure to follow the IRS guidelines for amendments, which typically requires detailing the corrections and submitting any necessary supporting documents.

How can I check the status of my submitted form 8379 download 2010?

To verify the receipt and processing status of your form 8379 download 2010, you can use the IRS 'Where's My Refund?' tool if you filed it with a refund claim. This online tool provides updates about the processing of your submission, including any potential delays or issues requiring your attention.

Are there any common errors that could lead to rejection of my form 8379 download 2010?

Yes, some common errors that could cause your form 8379 download 2010 to be rejected include mismatched information, incorrect Social Security numbers, and failing to sign the form. Always double-check your entries for accuracy and completeness before submitting to minimize the risk of rejection.

What considerations should I have for e-signatures when submitting form 8379 download 2010?

E-signatures are generally acceptable for submitting form 8379 download 2010 electronically, but ensure that the software you're using meets the IRS requirements for e-signing. Maintain a copy of your e-signed form as part of your records to have documentation of your submission.

What should I do if my form 8379 download 2010 is rejected?

If your form 8379 download 2010 is rejected, you will typically receive a notice from the IRS explaining the reason. Review the issues listed and correct them before resubmitting the form. If you have any questions about the rejection, contacting the IRS directly for clarification can also be beneficial.

See what our users say