IRS 1065 - Schedule K-1 2014 free printable template

Show details

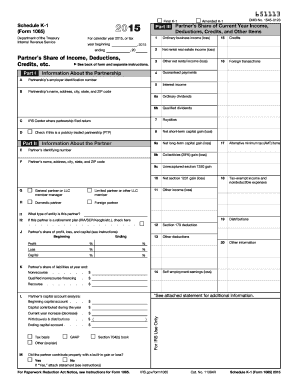

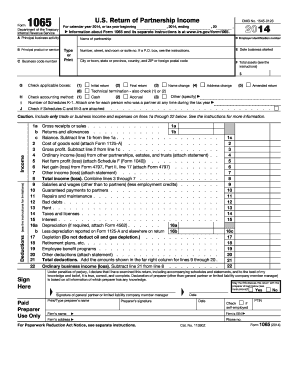

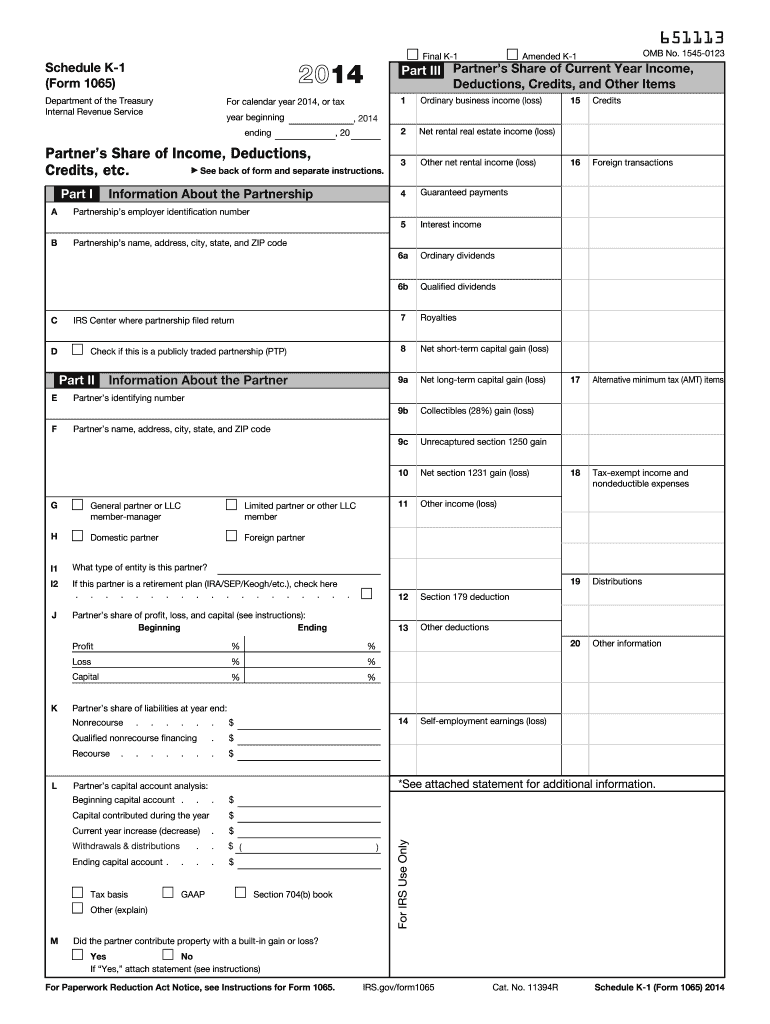

Credits etc. Other net rental income loss 6b ending 6a year beginning Net rental real estate income loss For calendar year 2014 or tax Ordinary business income loss Department of the Treasury Internal Revenue Service OMB No. 1545-0123 Amended K-1 Other deductions Partner s identifying number Partner s name address city state and ZIP code G General partner or LLC member-manager Limited partner or other LLC member H Domestic partner Foreign partner I1 What type of entity is this partner I2 If this...partner is a retirement plan IRA/SEP/Keogh/etc. check here. Beginning Profit Loss Capital K Nonrecourse. Qualified nonrecourse financing Current year increase decrease Withdrawals distributions See attached statement for additional information. Partner s capital account analysis Beginning capital account. Capital contributed during the year Ending capital account. Tax basis GAAP Section 704 b book Other explain M Self-employment earnings loss Recourse L For IRS Use Only J Did the partner...contribute property with a built-in gain or loss Yes No If Yes attach statement see instructions For Paperwork Reduction Act Notice see Instructions for Form 1065. 651113 Final K-1 Schedule K-1 Form 1065 Part III Partner s Share of Current Year Income Deductions Credits and Other Items A B Guaranteed payments Interest income Ordinary dividends Qualified dividends Alternative minimum tax AMT items Tax-exempt income and nondeductible expenses Distributions Other information Collectibles 28 gain...loss Unrecaptured section 1250 gain Net section 1231 gain loss Other income loss Section 179 deduction Information About the Partner Net long-term capital gain loss Check if this is a publicly traded partnership PTP Net short-term capital gain loss 9a IRS Center where partnership filed return Royalties F Foreign transactions Partnership s name address city state and ZIP code Part II E 9c D Credits 9b C Partner s Share of Income Deductions See back of form and separate instructions. Credits etc....Other net rental income loss 6b ending 6a year beginning Net rental real estate income loss For calendar year 2014 or tax Ordinary business income loss Department of the Treasury Internal Revenue Service OMB No. 1545-0123 Amended K-1 Other deductions Partner s identifying number Partner s name address city state and ZIP code G General partner or LLC member-manager Limited partner or other LLC member H Domestic partner Foreign partner I1 What type of entity is this partner I2 If this partner is a...retirement plan IRA/SEP/Keogh/etc. check here. 651113 Final K-1 Schedule K-1 Form 1065 Part III Partner s Share of Current Year Income Deductions Credits and Other Items A B Guaranteed payments Interest income Ordinary dividends Qualified dividends Alternative minimum tax AMT items Tax-exempt income and nondeductible expenses Distributions Other information Collectibles 28 gain loss Unrecaptured section 1250 gain Net section 1231 gain loss Other income loss Section 179 deduction Information...About the Partner Net long-term capital gain loss Check if this is a publicly traded partnership PTP Net short-term capital gain loss 9a IRS Center where partnership filed return Royalties F Foreign transactions Partnership s name address city state and ZIP code Part II E 9c D Credits 9b C Partner s Share of Income Deductions See back of form and separate instructions.

pdfFiller is not affiliated with IRS

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

How to fill out IRS 1065 - Schedule K-1

Instructions and Help about IRS 1065 - Schedule K-1

How to edit IRS 1065 - Schedule K-1

To edit the IRS 1065 - Schedule K-1, utilize pdfFiller's interface which allows for easy modifications. After opening the form in pdfFiller, you can click on the field you wish to edit. Ensure that all changes reflect accurate information as per your tax documents. After editing, save the form to maintain the updates.

How to fill out IRS 1065 - Schedule K-1

Filling out the IRS 1065 - Schedule K-1 requires the following steps:

01

Gather all relevant financial information concerning your partnership.

02

Enter the partnership's name, address, and tax identification number at the top of the form.

03

Provide details about each partner, including their share of income, deductions, and credits accordingly.

04

Review the completed form for accuracy and completeness.

05

Submit the form to each partner by the designated deadline.

About IRS 1065 - Schedule K-1 2014 previous version

What is IRS 1065 - Schedule K-1?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

About IRS 1065 - Schedule K-1 2014 previous version

What is IRS 1065 - Schedule K-1?

The IRS 1065 - Schedule K-1 is a tax document used by partnerships to report the income, deductions, credits, and other tax attributes of each partner. This form provides essential details needed by partners to accurately report their share of the partnership's income on their individual tax returns.

What is the purpose of this form?

The purpose of the IRS 1065 - Schedule K-1 is to allocate a partnership’s income, gains, losses, deductions, and credits among its partners. Each partner uses their K-1 to report this information on their personal tax returns, ensuring that all income and deductions are properly accounted for per IRS regulations.

Who needs the form?

Any partnership that conducts business in the United States must file Form 1065 and issue Schedule K-1 to its partners. This includes general partnerships, limited partnerships, and limited liability companies (LLCs) treated as partnerships for tax purposes. Each partner should receive a copy of the K-1 to report on their taxes.

When am I exempt from filling out this form?

Exemptions from filling out IRS 1065 - Schedule K-1 vary by situation. Generally, if an entity does not generate income as a partnership or does not have any operational activity, filing may not be necessary. Additionally, certain organizations may be exempt based on IRS regulations, like LLCs that elect for S corporation status.

Components of the form

The IRS 1065 - Schedule K-1 includes several key components. It lists the partnership's identifying information as well as the individual partner's details. The form delineates items such as ordinary business income, net rental income, and other specific credits and deductions applicable to each partner. Understanding these components is critical for accurate filing.

Due date

The IRS 1065 - Schedule K-1 must be filed by the partnership by March 15th of the year following the tax year for which the form is filed. It is crucial to adhere to this timeline to ensure timely distribution to all partners, allowing them to meet their own tax filing deadlines.

What are the penalties for not issuing the form?

If a partnership fails to issue IRS 1065 - Schedule K-1 to its partners, it may face penalties from the IRS. The penalty for failing to file accurate K-1s can be substantial, including fees per partner for each month that the K-1 is late. This underscores the importance of compliance in regard to K-1 issuance.

What information do you need when you file the form?

When filing the IRS 1065 - Schedule K-1, you will need essential information including the partnership’s EIN, details of each partner, their respective shares of income, and any deductions or credits they are entitled to claim. Having accurate financial records on hand is vital for completing the form properly.

Is the form accompanied by other forms?

Yes, the IRS 1065 - Schedule K-1 is typically filed along with Form 1065, the partnership return. These forms should be submitted together to ensure proper processing by the IRS and accurate reporting by the partners. Other related forms may be required depending on the specific deductions and credits claimed.

Where do I send the form?

The completed IRS 1065 - Schedule K-1 should be sent to each respective partner. The partnership should also file a copy with the IRS along with Form 1065 at the designated IRS address, which is based on the location of the partnership and whether the return is filed electronically or by mail.

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

Just started using. Seems pretty easy to navigate.

Just subscribed but my first form was excellently done. Intuitive and easy to negotiate the Dashboard. I really liked the alignment lines that assist to keep things neat when typing data into the field. Look forward to learning more about the capabilities. Thanks

See what our users say