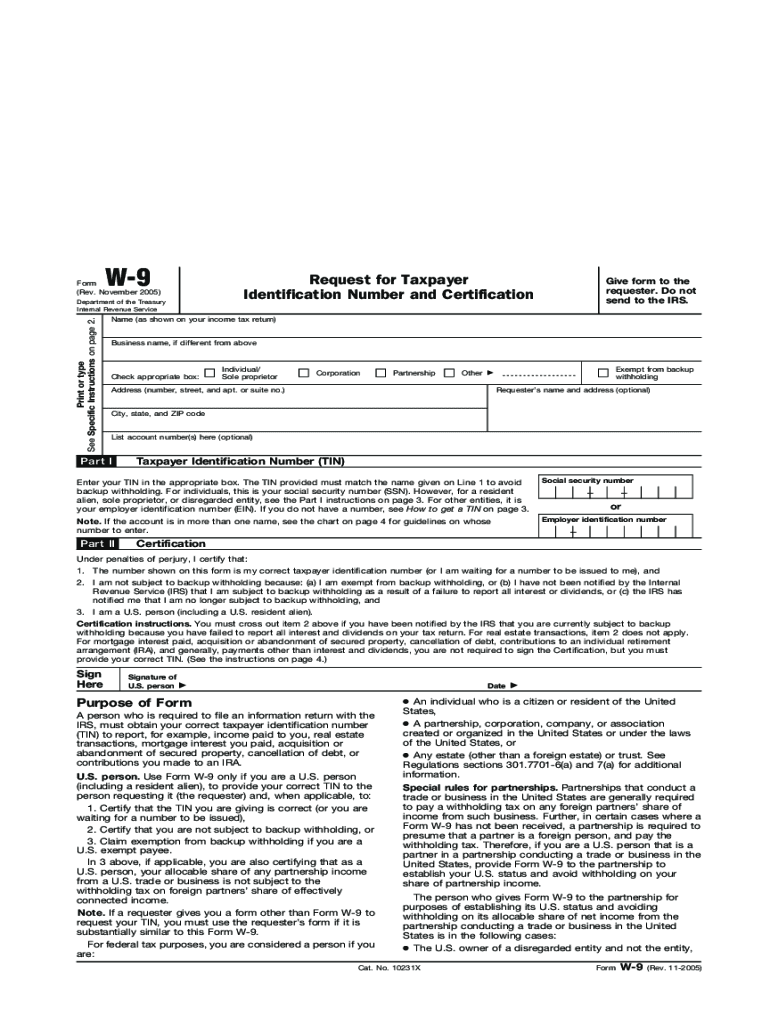

IRS W-9 2005 free printable template

Instructions and Help about IRS W-9

How to edit IRS W-9

How to fill out IRS W-9

About IRS W-9 2005 previous version

What is IRS W-9?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS W-9

What should I do if I realize I made a mistake on my 2005 form w 9 after submission?

If you discover an error on your 2005 form w 9 after submission, you should file a corrected form. Indicate that it is a corrected submission by checking the appropriate box, if available. Ensure that all updated information is accurate and double-check for any potential mistakes to avoid complications.

How can I verify the status of my submitted 2005 form w 9?

To verify the status of your submitted 2005 form w 9, you can contact the organization or agency to whom you submitted the form. They typically have a tracking system in place and can confirm if your form has been received and processed. Keep your submission details handy for reference.

What should I do if my e-filed 2005 form w 9 is rejected?

If your e-filed 2005 form w 9 is rejected, review the rejection notice to understand the reason for the rejection. Common issues include incorrect or incomplete information. Make the necessary corrections and resubmit your form according to the guidelines specified in the rejection notice to ensure successful filing.

Are e-signatures accepted for the 2005 form w 9?

Yes, e-signatures are generally acceptable for the 2005 form w 9, provided that the entity receiving the form accepts them. It is crucial to check their specific requirements regarding digital signatures. Maintain records of your submission and e-signature for your records.

What precautions should I take regarding privacy when filing my 2005 form w 9?

When filing your 2005 form w 9, it is important to ensure that your personal information is submitted through secure channels, especially if done electronically. Use encryption and secure networks, and review the privacy policies of the entity receiving your form to understand how your data will be handled and protected.

See what our users say