KY DOR 62A500-W 2023 free printable template

Show details

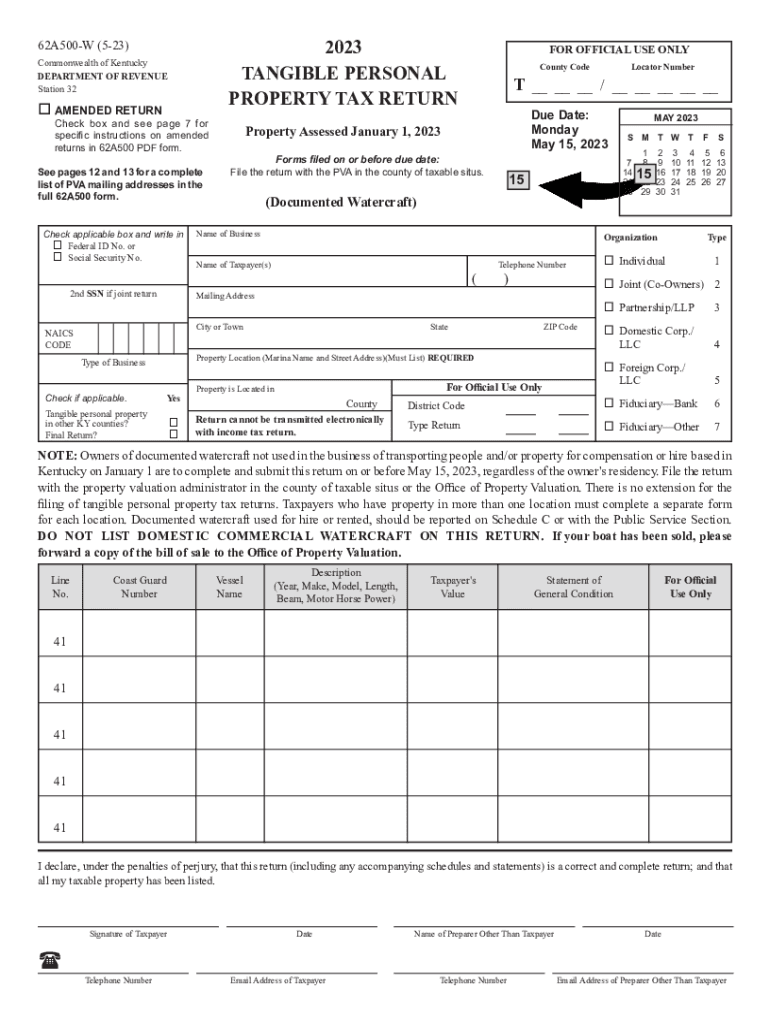

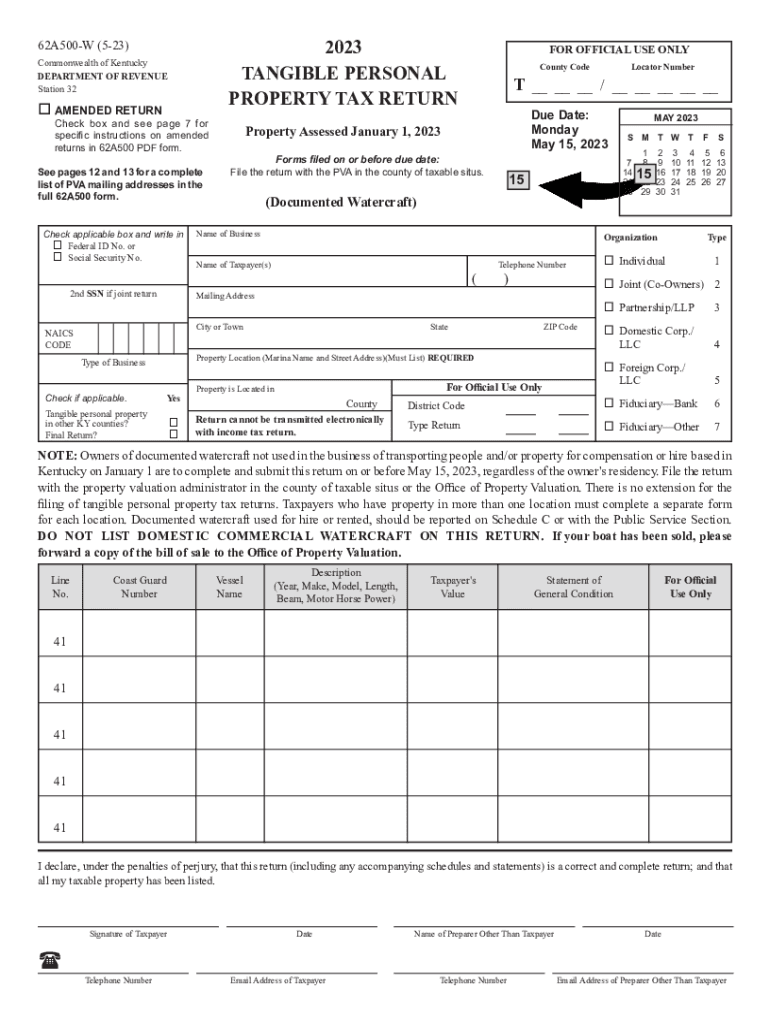

2023 TANGIBLE PERSONAL PROPERTY TAX RETURN62A500W (523) Commonwealth of Kentucky DEPARTMENT OF REVENUE Station 32 AMENDED RETURNCheck box and see page 7 for specific instructions on amended returns

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign kentucky property tax form

Edit your kentucky property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax form online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit kentucky property tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit KY DOR 62A500-W. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KY DOR 62A500-W Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out KY DOR 62A500-W

How to fill out KY DOR 62A500-W

01

Obtain the KY DOR 62A500-W form from the Kentucky Department of Revenue website or local office.

02

Fill in your personal information in the designated sections, including name, address, and Social Security number.

03

Specify the tax year for which you are filing in the appropriate field.

04

Provide details of your income sources as required, including wages, business income, and other taxable income.

05

Complete any applicable deductions or credits that you are eligible for by following the instructions provided in the form.

06

Review the instructions carefully to ensure all information is accurate and complete.

07

Sign and date the form at the designated area to validate your submission.

08

Submit the completed form to the relevant tax authority, either by mailing it or delivering it in person.

Who needs KY DOR 62A500-W?

01

Individuals and business owners in Kentucky who are required to report their income and pay state taxes.

02

Taxpayers seeking to claim deductions or credits on their state tax return.

03

Any entity or person who has received taxable income in the state during the specified tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is the tangible personal property tax in PA?

Section I – Sales and Use Tax Law Pennsylvania's Tax Reform Code of 1971 (“TRC”), as amended, imposes a tax of six percent (6%) of the purchase price on the sale at retail or use of tangible personal property or certain enumerated services within this Commonwealth.

How do you depreciate tangible personal property?

Tangible personal property is a tax term describing personal property that can be physically relocated, such as furniture and office equipment. Tangible personal property is always depreciated over either a five- or seven-year period using straight-line depreciation but is eligible for accelerated depreciation as well.

What are tangible personal property assets?

Tangible personal property includes equipment, supplies, and any other property (including information technology systems) other than that is defined as an intangible property. It does not include copyrights, patents, and other intellectual property that is generated or developed (rather than acquired) under an award.

Who is required to file a Florida tangible personal property tax return?

At the beginning of each year a tangible personal property tax return is mailed to all property owners for all accounts with a value more than $25,000 in the previous year, new businesses, or purchased a business. Failure to receive a return does not excuse a person from filing or the penalties on late returns.

What is the definition of tangible personal property in Florida?

Tangible personal property (TPP) is all goods, property other than real estate, and other articles of value that the owner can physically possess and has intrinsic value. Inventory, household goods, and some vehicular items are excluded.

Who must file dr 405 Florida?

As a business owner, you have to file a Florida tangible personal property tax return (DR-405), or TPP for short. However, it doesn't work like your income tax return. You have to pay a tax that's determined by your county's tax collector on certain fixed assets you own.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my KY DOR 62A500-W in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your KY DOR 62A500-W along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get KY DOR 62A500-W?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific KY DOR 62A500-W and other forms. Find the template you want and tweak it with powerful editing tools.

Can I sign the KY DOR 62A500-W electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your KY DOR 62A500-W in minutes.

What is KY DOR 62A500-W?

KY DOR 62A500-W is a form used for reporting Kentucky individual income tax withholding.

Who is required to file KY DOR 62A500-W?

Employers who withhold Kentucky income taxes from their employees' wages are required to file KY DOR 62A500-W.

How to fill out KY DOR 62A500-W?

To fill out KY DOR 62A500-W, enter the employer information, total wages paid, total tax withheld, and other necessary details as specified on the form.

What is the purpose of KY DOR 62A500-W?

The purpose of KY DOR 62A500-W is to report the amount of Kentucky income tax withheld from employees' wages to the Kentucky Department of Revenue.

What information must be reported on KY DOR 62A500-W?

KY DOR 62A500-W requires reporting of employer identification information, employee wages, total withholding amount, and any adjustments or corrections.

Fill out your KY DOR 62A500-W online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

KY DOR 62A500-W is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.