KY DOR 62A500-W 2021 free printable template

Show details

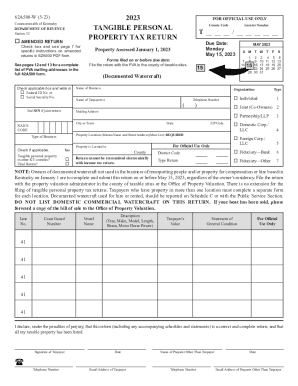

2021 TANGIBLE PERSONAL PROPERTY TAX RETURN62A500W (121) Commonwealth of Kentucky DEPARTMENT OF REVENUE Station 32FOR OFFICIAL USE ONLY Locator Number / Due Date: Monday, May 17, 2021Property Assessed

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your kentucky tangible property tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your kentucky tangible property tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kentucky tangible property tax return 2022 excel online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tangible personal property tax form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

KY DOR 62A500-W Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kentucky tangible property tax

How to fill out Kentucky tangible property tax:

01

Gather all necessary documents, such as property records, assessment notices, and forms provided by the Kentucky Department of Revenue.

02

Determine the taxable value of your tangible property by assessing its fair cash value, which includes tangible personal property, machinery, equipment, and inventory.

03

Complete the appropriate Kentucky tangible property tax return form, such as Form 62A500 or Form 62A500(O).

04

Provide accurate and detailed information on the form, including your personal details, property description, and any exemptions or deductions you may qualify for.

05

Calculate the tax liability by multiplying the appropriate tax rate by the taxable value of the property.

06

Make sure to double-check all the information provided and review the completed form for any errors or omissions.

07

Submit the completed form, along with any required attachments or supporting documents, to the Kentucky Department of Revenue by the specified deadline.

Who needs Kentucky tangible property tax:

01

Individuals and businesses who own tangible property located in Kentucky may need to pay Kentucky tangible property tax.

02

This includes property owners who possess tangible personal property, machinery, equipment, inventory, and any other taxable assets.

03

The tax applies to both resident and non-resident property owners who own taxable property in Kentucky.

04

It is important to note that some exemptions or exclusions may apply depending on the type of property and the taxpayer's eligibility criteria.

05

It is advised to consult with a tax professional or refer to the Kentucky Department of Revenue guidelines to determine if you are specifically required to pay Kentucky tangible property tax.

Fill ky personal return : Try Risk Free

People Also Ask about kentucky tangible property tax return 2022 excel

What is the tangible personal property tax in PA?

How do you depreciate tangible personal property?

What are tangible personal property assets?

Who is required to file a Florida tangible personal property tax return?

What is the definition of tangible personal property in Florida?

Who must file dr 405 Florida?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is kentucky tangible property tax?

Kentucky tangible property tax is a tax on the value of tangible personal property owned and used in the state. This includes items such as furniture, machinery, equipment, and inventory. The tax is paid to the state and is based on the assessed value of the property.

What is the purpose of kentucky tangible property tax?

The Kentucky Tangible Property Tax is an annual tax levied on tangible personal property owned by businesses in the state. It is designed to generate revenue for local governments and to help offset the cost of providing public services such as police, fire, and educational services.

What is the penalty for the late filing of kentucky tangible property tax?

The penalty for late filing of the Kentucky Tangible Property Tax is 10% of the tax owed, plus 1.5% per month, up to a maximum of 25%.

Who is required to file kentucky tangible property tax?

In Kentucky, all individuals, businesses, and organizations that own or possess tangible personal property on January 1st of each year are typically required to file the Kentucky Tangible Property Tax Return. This includes both residents and non-residents who own or possess taxable tangible personal property located in Kentucky.

How to fill out kentucky tangible property tax?

To fill out the Kentucky tangible property tax, follow these steps:

1. Obtain the tangible property tax form: You can download the necessary form from the Kentucky Department of Revenue's website or obtain a physical copy from their local office.

2. Review the instructions: Read the instructions provided by the Kentucky Department of Revenue carefully, as they will guide you through the process and provide any specific requirements for your situation.

3. Gather necessary information: Collect all the required information and documents for the tax form. This may include details about your tangible property, such as its cost, acquisition date, description, and location.

4. Provide general information: Fill out the general information section of the form, including your name, contact information, tax account number, and any other requested identification details.

5. List the tangible property: Complete the section of the form where you need to list the tangible property you own. Include a description of each item, the year it was acquired, the original cost, and the acquisition method (purchase, lease, etc.). Provide additional details as requested.

6. Calculate the assessment: Use the designated portion of the form to calculate the total value of your tangible property. This is usually done by multiplying the original cost by the depreciation factor, as determined by the Kentucky Department of Revenue.

7. Apply any exemptions or deductions: Kentucky provides certain exemptions and deductions for tangible property tax. If applicable, appropriately claim any exemptions or deductions for your property.

8. Calculate the tax liability: Calculate the tax due by applying the appropriate tax rate to the assessed value of your tangible property. The tax rate can be obtained from the Kentucky Department of Revenue or the local taxing district.

9. Make payment: Pay the calculated tax liability by the due date specified on the form. Different payment options, such as online, mail, or in-person, may be available. Ensure you follow the provided instructions for payment submission.

10. File the form: Once complete, sign and file the tangible property tax form with the Kentucky Department of Revenue by the specified deadline. Retain a copy of the form, along with any supporting documents, for future reference.

Note: It is essential to consult the official Kentucky Department of Revenue website or contact them directly for the most accurate and up-to-date information regarding filling out the tangible property tax form in Kentucky.

What information must be reported on kentucky tangible property tax?

In Kentucky, the following information must be reported on the Tangible Property Tax return:

1. Personal Property:

- Description of each item of personal property subject to taxation.

- Original cost of each item of personal property.

- Date purchased or acquired.

- Condition of each item of personal property.

- Location of each item of personal property.

2. Business Assets:

- Description of each business asset subject to taxation.

- Original cost of each business asset.

- Date purchased or acquired.

- Condition of each business asset.

- Location of each business asset.

3. Vehicles:

- Year, make, and model of each vehicle subject to taxation.

- Vehicle identification number (VIN).

- Original cost of each vehicle.

- Date purchased or acquired.

- Condition of each vehicle.

- Location of each vehicle.

4. Leased Property:

- Description of each leased property subject to taxation.

- Name and address of the lessor.

- Original cost of each leased property.

- Date of lease agreement.

- Location of each leased property.

5. Other Required Information:

- Name, address, and contact information of the owner of the tangible property.

- Details of any exemptions or exclusions claimed.

- Any changes in ownership or use of tangible property during the reporting period.

- Any other relevant information required by the Kentucky Department of Revenue.

It is important to review the specific Kentucky Department of Revenue guidelines and forms for accurate reporting as the requirements may vary based on the type of property and other factors.

How do I edit kentucky tangible property tax return 2022 excel online?

With pdfFiller, the editing process is straightforward. Open your tangible personal property tax form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in 2021 kentucky 62a500 without leaving Chrome?

kentucky personal property tax can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I complete ky tangible property tax return on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your kentucky personal property tax return form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your kentucky tangible property tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2021 Kentucky 62A500 is not the form you're looking for?Search for another form here.

Keywords relevant to kentucky tangible personal property tax return form

Related to kentucky tangible property tax return

If you believe that this page should be taken down, please follow our DMCA take down process

here

.