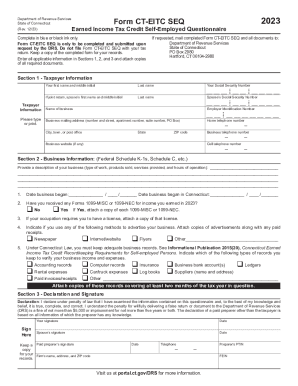

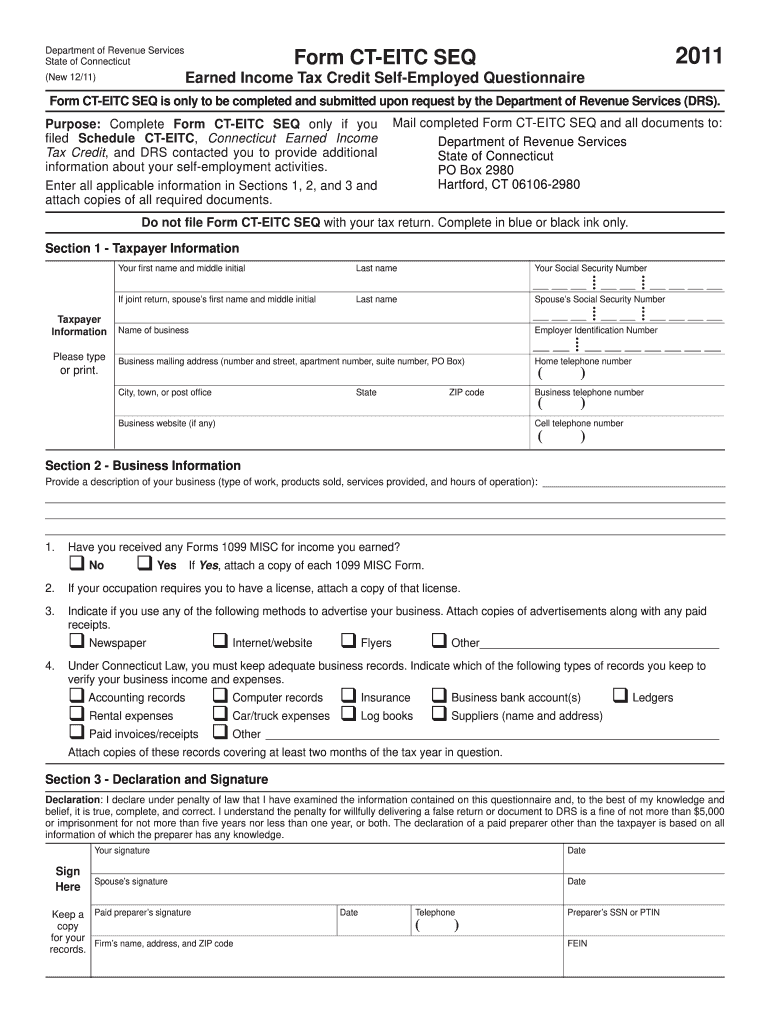

CT DRS CT-EITC SEQ 2011 free printable template

Instructions and Help about CT DRS CT-EITC SEQ

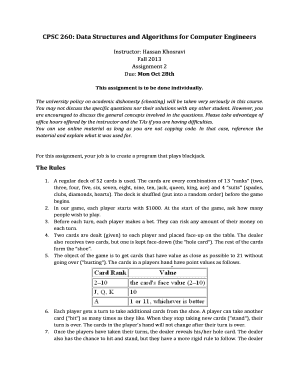

How to edit CT DRS CT-EITC SEQ

How to fill out CT DRS CT-EITC SEQ

About CT DRS CT-EITC SEQ 2011 previous version

What is CT DRS CT-EITC SEQ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

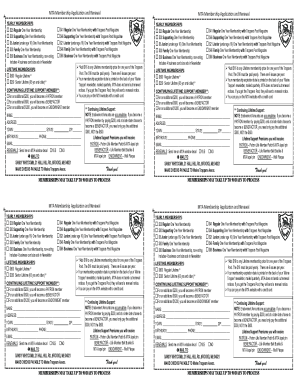

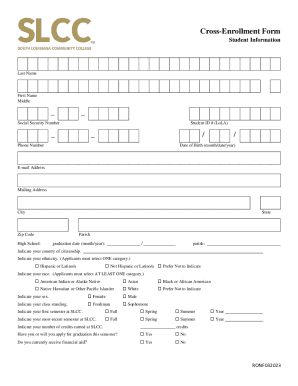

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about CT DRS CT-EITC SEQ

What should I do if I notice an error after submitting my eitc forms 2011?

If you realize there's a mistake on your submitted eitc forms 2011, you can file an amended return using Form 1040-X. Ensure you follow the specific guidelines for corrections and include any necessary documentation to support your claims. It's crucial to act promptly to prevent any potential issues with your tax situation.

How can I check the status of my submitted eitc forms 2011?

To check the status of your filed eitc forms 2011, visit the IRS website where you can access the 'Where's My Refund?' tool. This will give you updates on the processing of your return. Additionally, ensure your personal information matches what you provided when filing to avoid discrepancies.

What should I do if my e-filed eitc forms 2011 are rejected?

In the event your e-filed eitc forms 2011 are rejected, review the error codes provided by the e-filing system carefully. Address the specific issues indicated and re-submit your forms. Keep in mind that resolving these errors promptly can help avoid delays in processing your refund.

Are e-signatures acceptable when submitting the eitc forms 2011 electronically?

Yes, e-signatures are acceptable for submitting eitc forms 2011 electronically through approved e-filing software. Ensure that the software you use complies with the IRS standards for e-signature acceptance. This will streamline the filing process and help maintain the security of your submission.

How long should I keep my records after filing the eitc forms 2011?

After filing the eitc forms 2011, retain your tax records, including copies of your forms and any supporting documentation, for at least three years. This retention period aligns with the IRS guidelines for audit potential and ensures you have the necessary information should any questions arise in the future.