Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

CT EITC stands for Connecticut Earned Income Tax Credit. It is a refundable tax credit designed to assist low-income working individuals and families in Connecticut. The credit is based on a percentage of the federal earned income tax credit and can help eligible taxpayers reduce the amount of state income tax they owe or potentially receive a refund. The exact amount of the credit depends on factors such as income level, number of qualifying children, and filing status.

Who is required to file ct eitc?

Connecticut Earned Income Tax Credit (CT EITC) is a tax credit program offered by the state of Connecticut to help low-income working individuals and families. Eligibility for CT EITC is determined based on federal EITC guidelines.

In general, you may be required to file for CT EITC if you meet the following criteria:

1. You are eligible for the federal Earned Income Tax Credit (EITC).

2. You are a Connecticut resident.

3. You have earned income from employment or self-employment during the tax year.

4. You meet the income limits set by the state.

The income limits for CT EITC vary depending on your filing status and the number of qualifying children you have. It is recommended to review the official guidelines or consult a tax professional to determine if you are required to file for CT EITC.

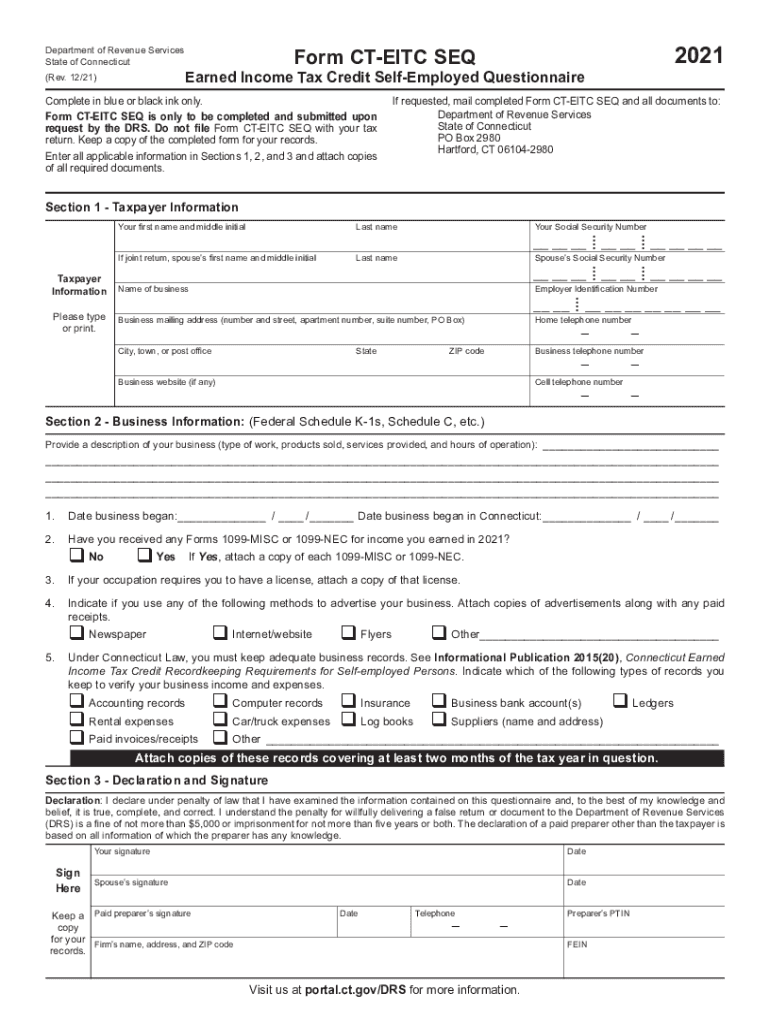

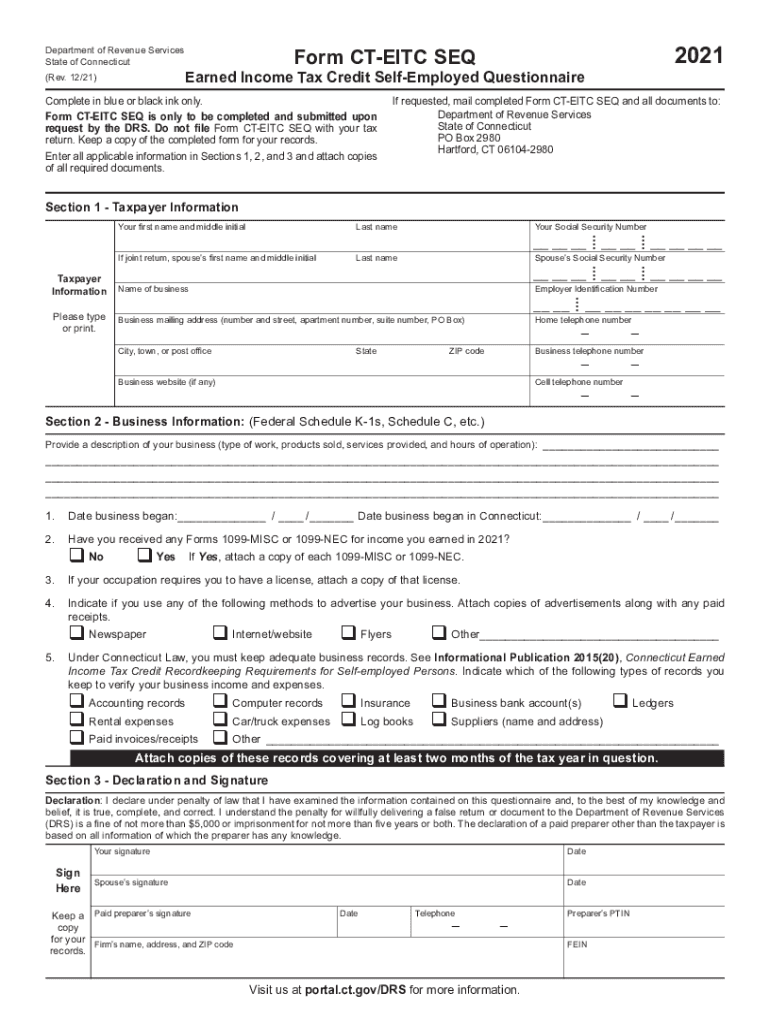

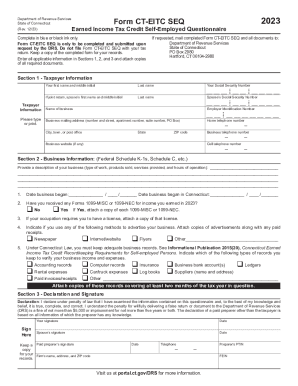

To fill out the CT EITC (Connecticut Earned Income Tax Credit) form, follow these steps:

1. Gather necessary information: Collect all documents required to complete the form, including your Social Security Number, income statements (W-2, 1099 forms), and any other relevant tax documents.

2. Download the form: Visit the official Connecticut Department of Revenue Services website and download the CT EITC form (Form CT-EITC).

3. Fill out personal information: Enter your personal details at the top of the form, such as your name, Social Security Number, and address.

4. Enter income information: Fill in your total earned income and any other income sources in the appropriate sections. Consult your W-2 and 1099 forms for accurate information.

5. Calculate credit: Use the provided worksheet to determine your CT EITC credit amount. Follow the instructions and calculate according to your income and family size.

6. Complete Form CT-1040: Once you have determined your CT EITC credit amount, transfer it to Line 32 of your CT-1040 income tax return form. Ensure you sign the form and provide any additional required information.

7. Double-check: Review all filled sections to verify accuracy and completion.

8. File the forms: Send your completed CT-1040 and CT EITC forms to the Connecticut Department of Revenue Services by mail or electronically through the DRS platform.

Remember to keep copies of all forms and supporting documents for your records. If you have any uncertainty or further questions, consider consulting a tax professional or contacting the Connecticut Department of Revenue Services for assistance.

What is the purpose of ct eitc?

The purpose of the CT EITC (Connecticut Earned Income Tax Credit) is to provide tax relief for low-income working individuals and families in the state of Connecticut. It is a refundable tax credit that is designed to supplement the federal Earned Income Tax Credit (EITC), providing additional financial support to eligible individuals and families. The CT EITC aims to reduce poverty, encourage work, and enhance the economic well-being of low-income individuals and families by reducing their tax burden and helping them access funds for basic necessities and financial stability.

What information must be reported on ct eitc?

The Connecticut Earned Income Tax Credit (CT EITC) requires the following information to be reported:

1. Filing Status: Your marital status as of the last day of the tax year (e.g., single, married filing jointly, etc.).

2. Income: All sources of income, including wages, salaries, tips, self-employment income, rental income, and any other taxable income earned within the tax year.

3. Connecticut Earnings: The amount of earned income you or your spouse earned in Connecticut during the tax year.

4. Federal Earnings: The amount of earned income you or your spouse earned outside of Connecticut during the tax year.

5. CT EITC Eligibility: Determine if you qualify for the CT EITC based on income limits, filing status, and the number of qualifying children you have.

6. Qualifying Children: The name, Social Security number, and relationship of each qualifying child, as well as their residency status during the tax year (must be a Connecticut resident).

7. Child Support: Information regarding any child support paid or received during the tax year.

8. Federal EITC: Whether you claimed the federal Earned Income Tax Credit (EITC) and the amount received, if applicable.

9. Connecticut Taxes: Information regarding any Connecticut state taxes withheld from your earnings during the tax year.

10. Connecticut Property Tax Credit: If eligible, report any property taxes paid on your primary residence in Connecticut.

It is crucial to consult the official CT EITC guidelines or a tax professional for accurate information and specific requirements.

What is the penalty for the late filing of ct eitc?

The penalty for the late filing of the Connecticut Earned Income Tax Credit (CT EITC) depends on the specific circumstances. Generally, individuals who fail to timely file their CT EITC claim may be subject to a late-filing penalty. The penalty amount is typically calculated as a percentage of the EITC claimed amount.

It is advised to refer to the official Connecticut Department of Revenue Services (DRS) website or consult a tax professional for accurate and up-to-date information on CT EITC penalties, as tax laws can change over time.

How can I get earned income tax credit 2023?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ct eitc form and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete seq income online?

pdfFiller has made it simple to fill out and eSign connecticut drs ct eitc seq. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I edit ct earned self employed straight from my smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing ct eitc form, you can start right away.