When can I expect my child tax rebate in CT?

State officials said Thursday that 2022 Connecticut Child Tax Rebate checks are going out and families should begin receiving them over the next several days. Gov. Ned Lamont held a news conference Thursday morning with Department of Revenue Services Commissioner Mark Boughton.

Can you track a rebate check?

Is there any way to track your payment? There isn't a tracking tool. The tax board does provide dates for when they expect to send out each round of payments, which give you a sense of when you'll receive a direct deposit or debit card. They expect 90% direct deposits to be issued in October 2022.

Is CT getting a rebate check?

Ned Lamont announced Thursday. Around 45,000 Connecticut residents will receive an average rebate of $540. The rebate amount is based on an income scale and the rent and utility payments made in the year before applying for a rebate.

Will we receive the Child Tax Credit in 2022?

Taxpayers can claim the child tax credit for the 2022 tax year when they file their tax returns in 2023. Determining your eligibility for the credit begins with understanding which children qualify and what other criteria you need to be mindful of.

How do I track my CT rebate?

TELEPHONE: Call our automated refund system 24 hours a day and check the status of your refund by calling 800-382-9463 (Connecticut calls outside the Greater Hartford calling area only) or 860-297-5962 (from anywhere).

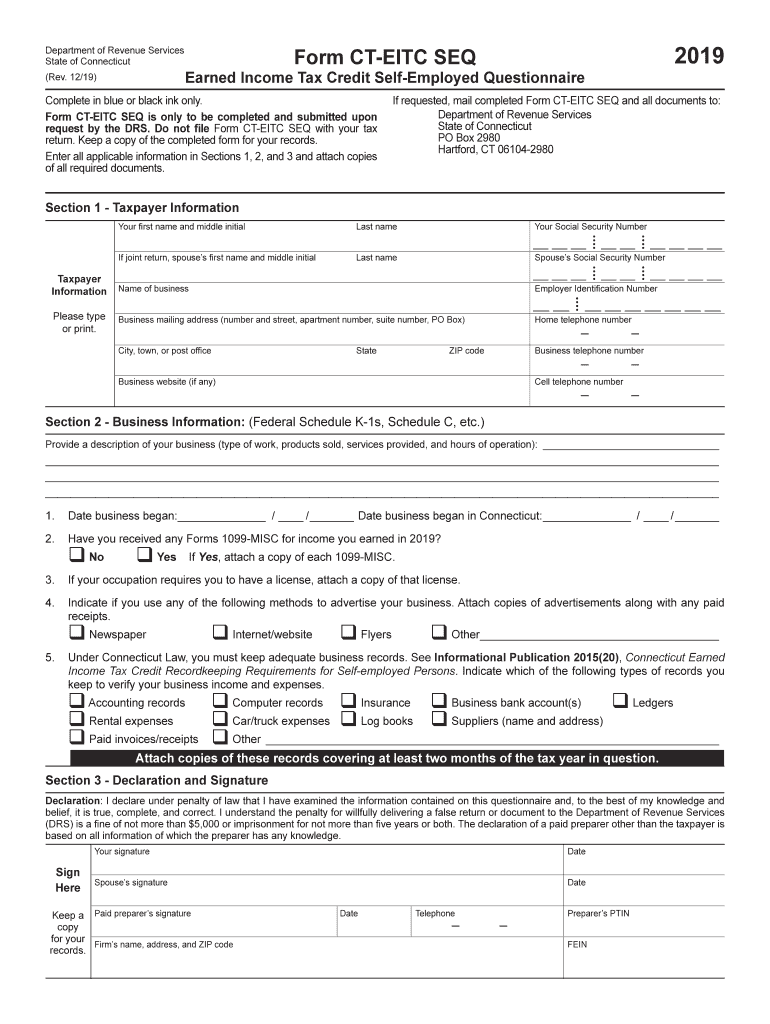

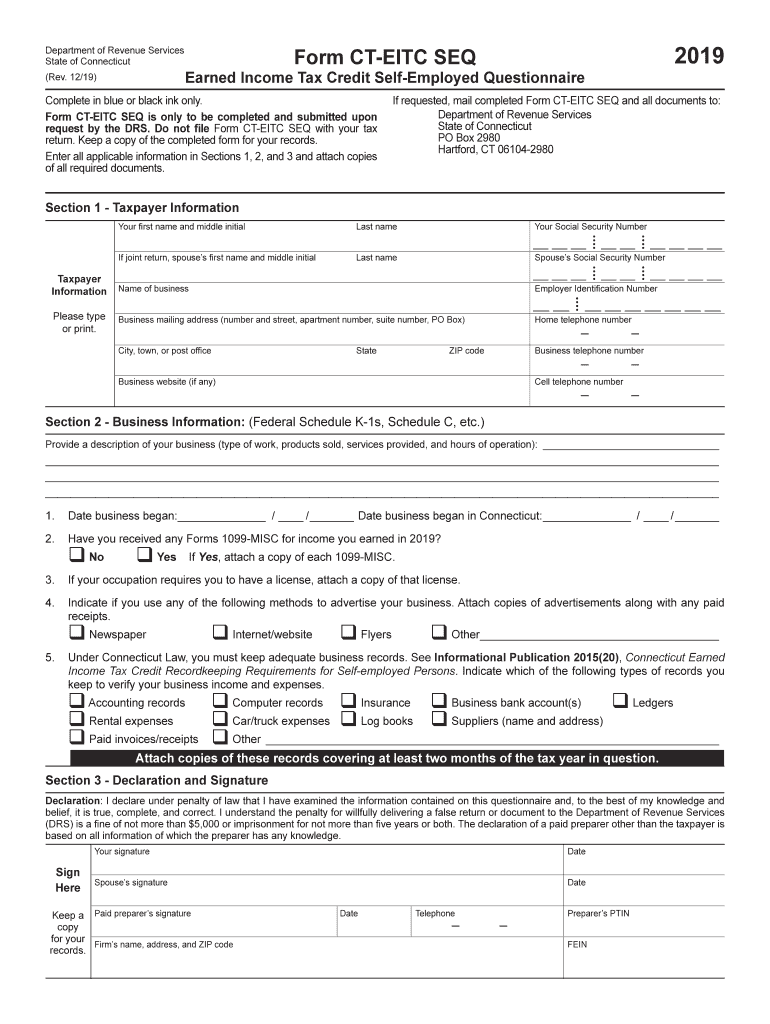

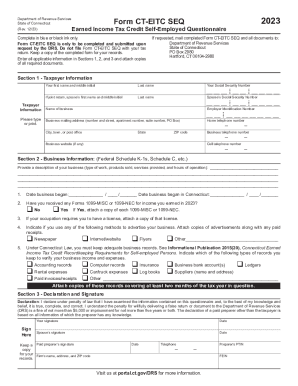

The Connecticut Earned Income Tax Credit (or CT EITC) is a refundable state income tax credit for low to moderate income working individuals and families. The state credit mirrors the federal Earned Income Tax Credit.

Where do I find the CT EITC state ID?

The employer should list that state ID on the W-2 as well as their EIN. If they did not, you will need to call their payroll department and get that number from them.

Is the IRS giving out extra money 2022?

Refunds may be smaller in 2023. Taxpayers will not receive an additional stimulus payment with a 2023 tax refund because there were no Economic Impact Payments for 2022. In addition, taxpayers who don't itemize and take the standard deduction, won't be able to deduct their charitable contributions.

How much earned income credit will I receive?

Basic Qualifying Rules Have worked and earned income under $57,414. Have investment income below $10,000 in the tax year 2021. Have a valid Social Security number by the due date of your 2021 return (including extensions) Be a U.S. citizen or a resident alien all year.

How do I check my EITC status?

Simply enter your Social Security Number, filing status, and the exact refund amount. You can check the status within 24 hours after IRS has received your e-filed tax return, or 4 weeks after mailing in your paper return. This information is updated once every 24 hours, usually overnight.

How much is the Earned Income Tax Credit for 2022?

Maximum Credit Amounts No qualifying children: $560. 1 qualifying child: $3,733. 2 qualifying children: $6,164. 3 or more qualifying children: $6,935.

Is CT sending relief checks?

Gov. Ned Lamont's administration mailed out nearly 248,000 checks to low-income households this past weekend — the second time in the past two months a state tax cut delivered tens of millions of dollars to Connecticut families.

Are we getting Child Tax Credit in july 2022?

Expanded Child Tax Credit available only through the end of 2022 - CBS Los Angeles.

How do I check my child tax credit payments?

You can check the status of your payments with the IRS: For Child Tax Credit monthly payments check the Child Tax Credit Update Portal. For stimulus payments 1 and 2 check Where's My Refund.

Eligible earned income amounts # of childrenMax Federal EITCMax State EITC @ 30.5% of Federal3 or more$6,728$2,0522$5,980$1,8241$3,618$1,103None$1502$458

How much is the CT earned income credit?

In 2021, the credit is worth up to $6,728. The credit amount rises with earned income until it reaches a maximum amount, then gradually phases out. Families with more children are eligible for higher credit amounts. You cannot get the EITC if you have investment income of more than $10,000 in 2021.

How will I receive my EITC?

If you claimed the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC), you can expect to get your refund March 1 if: You file your return online. You choose to get your refund by direct deposit. We found no issues with your return.

How much is the child tax credit in CT?

You may be eligible for a child tax rebate of up to a maximum of $750 ($250 per child up to three children).

How much EITC do I qualify for?

Who qualifies for the earned income tax credit Number of childrenMinimum AGI to earn the creditCredit sizeZeroSingle: $9,820 Heads of household: $9,820 Married: $9,820$1,502OneSingle: $10,640 Heads of household: $10,640 Married: $10,640$3,618TwoSingle: $14,950 Heads of household: $14,950 Married: $14,950$5,9802 more rows • Mar 24, 2022